Wells Fargo (WFC) Valuation Check as Prime Rate Cut and AI-Driven Job Cuts Reshape Its Outlook

Wells Fargo (WFC) just cut its prime lending rate to 6.75% and outlined fresh job cuts tied to new AI driven efficiency plans, moves that speak directly to its earnings power and stock valuation.

See our latest analysis for Wells Fargo.

Those moves land against a backdrop of strong momentum, with the share price at $92.76 and a year to date share price return above 30 percent. The five year total shareholder return above 250 percent shows how much sentiment has already swung in Wells Fargo’s favor.

If this kind of turnaround story has your attention, it could be worth seeing what other major banks are doing with their balance sheets by exploring solid balance sheet and fundamentals stocks screener (None results).

With Wells Fargo trading just shy of analyst targets but at a meaningful intrinsic discount, investors face a key question: is this rally still leaving upside on the table, or is the market already baking in the next leg of growth?

Most Popular Narrative: 1% Undervalued

With Wells Fargo last closing at $92.76 versus a narrative fair value near $93.71, the story leans toward modest upside driven by improving profitability.

The analysts have a consensus price target of $87.0 for Wells Fargo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $95.0, and the most bearish reporting a price target of $72.0.

Curious how steady growth, richer margins, and a higher future earnings multiple can still point to only slight upside? See which assumptions really move that fair value line.

Result: Fair Value of $93.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks remain. Tougher digital competition and lingering regulatory obligations are both capable of undermining margin gains and restraining growth.

Find out about the key risks to this Wells Fargo narrative.

Another Angle on Valuation

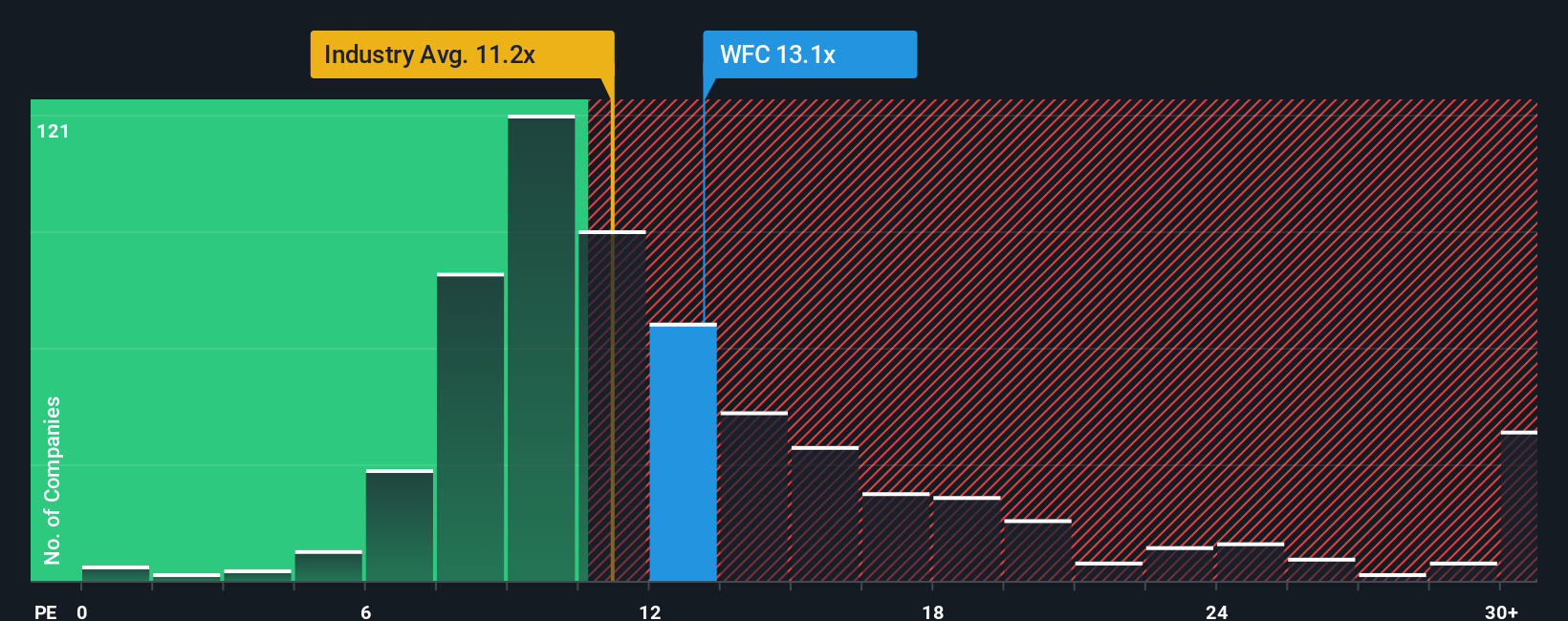

On earnings based metrics Wells Fargo looks less forgiving. It trades on a price to earnings ratio of about 14.6 times, richer than both peers at 13.7 times and the wider US banks group at 11.9 times, even though our fair ratio sits higher at 15.6 times. Is the market already pricing in a lot of the clean up and growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wells Fargo Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Wells Fargo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at Wells Fargo, you could miss out on other standout opportunities, so put Simply Wall Street’s powerful Screener to work for your portfolio today.

- Lock in potential income by reviewing these 13 dividend stocks with yields > 3% that aim to deliver reliable cash flows with yields that can support your long term goals.

- Ride structural growth trends by targeting these 26 AI penny stocks that harness artificial intelligence to strengthen competitive advantages and earnings power.

- Act early on mispriced opportunities by scanning these 907 undervalued stocks based on cash flows where strong cash flows are not yet fully reflected in market prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com