Trump aid, Fed rate cuts and USDA reports add to news cycle

Howdy market watchers!

It’s cold outside! Much of the United States and all of Canada are heading for a polar plunge this weekend after a recent run of moderate temperatures. Unfortunately, it doesn’t look like it is bringing much precipitation with many areas increasingly drought stressed. We have seen quite a bit of snowfall in the Midwest and Northeast recently, but it has not been broad in coverage. The Pacific Northwest has received heavy rainfall in select regions as of late.

After this cold spell, there is a dramatic shift back to warmer temperatures that look to last through Christmas. Perhaps that is the explanation behind the apocalyptic plunge in natural gas futures that from last Friday’s high at $5.496 on January futures to this Friday’s low at $4.065, has lost an incredible $1.431 in one week! They don’t call this contract the ‘widow-maker’ for nothing and this week’s trading range has reinforced this reputation.

However, EIA’s weekly natural gas storage update released every Thursday revealed that net withdrawals were larger than expected, larger than a year ago and larger than the 5-year average! All of that is bullish with LNG exports strong. Buy the rumor, sell the fact? Apparently and I would expect to see a strong rebound as demand remains on solid footing.

The warmup following this cold snap sure doesn't bode well for freezing out those New World Screwworms in Mexican cattle should the USDA reopen the border. Although it is not expected until after the first of the year, it could be announced at anytime.

One would hope that cheaper natural gas would result in lower urea prices given it is the main ingredient in urea production, but I wouldn’t expect much. The fertilizer industry is also very consolidated, which has drawn recent criticism from the Trump Administration to investigate price collusion. Having said that, the Trump Administration put tariffs on fertilizer manufacturers in Canada this week to bolster domestic production, which only tightens supplies further and giving every reason for those already producing on US soil to even increase prices in the near-term.

There is however the big nuance of which specific fertilizer product as urea is produced domestically while potash is not as the mines are all in other countries, namely Canada, Russia, Belarus, China, Germany, Israel, Jordan, Laos, Chile and then the United States as number ten in production scale. You may notice that our relations with most of these countries are iffy at best, but US agriculture production and pricing of our inputs is reliant on those suppliers. Long-term, of course it would be great to be more self sufficient in potash production, but short-term, it will increase potash input prices for US farmers. Ukraine’s bombing of Russian fertilizer plants also complicates the matter and tightens supplies and thus raises prices as well. Link to potash producer rankings: Top 10 Potash Countries by Production | Nasdaq

The Trump Administration finally released the $12 billion grain aid package for US farmers on Monday although details remain fuzzy. Contact your local FSA office for details noting a December 19th deadline. It sounds like funding will not be released until February 2026. Link to details: Trump Administration Announces $12 Billion Farmer Bridge Payments for American Farmers Impacted by Unfair Market Disruptions | USDA

The USDA released its monthly WASDE and Crop Production reports on Tuesday this week. US corn ending stocks for 2025/26 came in at 2.029 billion bushels, lower than the average trade guesses at 2.129 billion bushels, which was already a cut from last month’s 2.154 billion bushels. For US soybean ending stocks, the USDA pegged the figures at 290 million bushels, lower than the average trade expectations at 308 million bushels, but equal to prior figures. US wheat ending stocks came in above average trade guesses at 901 million bushels versus 889 million bushels expected, but equal to USDA’s prior numbers.

China continues to purchase US soybeans at a moderate pace. With the Trump Administration’s announcement this week that select Nvidia chips will now be able to be sold to China, I was expecting this to quicken the pace of China buying. However, they wanted to wait for the USDA report and slow play strategy to see if prices could ease for a better buy. They have and we will see if this chart gap below remains unfilled as it could given it is a breakaway gap.

For the South American row crops, the USDA kept Brazil’s corn and soybean production unchanged while trade expectations were for a slight increase. Argentine production of corn and soybeans were also left unchanged from last month while slight increases were expected for corn. So far, South American weather remains favorable and is adding downward pressure to soybean futures, in particular.

Globally, corn ending stocks came in below average trade guesses as did soybeans. However, wheat ending stocks came in at 274.9 million metric tons versus 273.0 million metric tons expected. While US wheat exports have been strong in recent weeks, global production is outpacing such demand with upward revisions in wheat production in the EU, Russia, Canada, Australia and Argentina.

Speaking of Argentina, grain export tariffs were permanently reduced this week by two percentage points that wasn’t well received by US futures markets given it adds further supply and reduces prices. This move will directly impact US producers already struggling to compete on the international stage with our commodity exports and applying downward pressure on prices. We saw weak closes for corn, soybeans and wheat this week and need a spark to excite buying interest as lower volume, holiday trading begins to near.

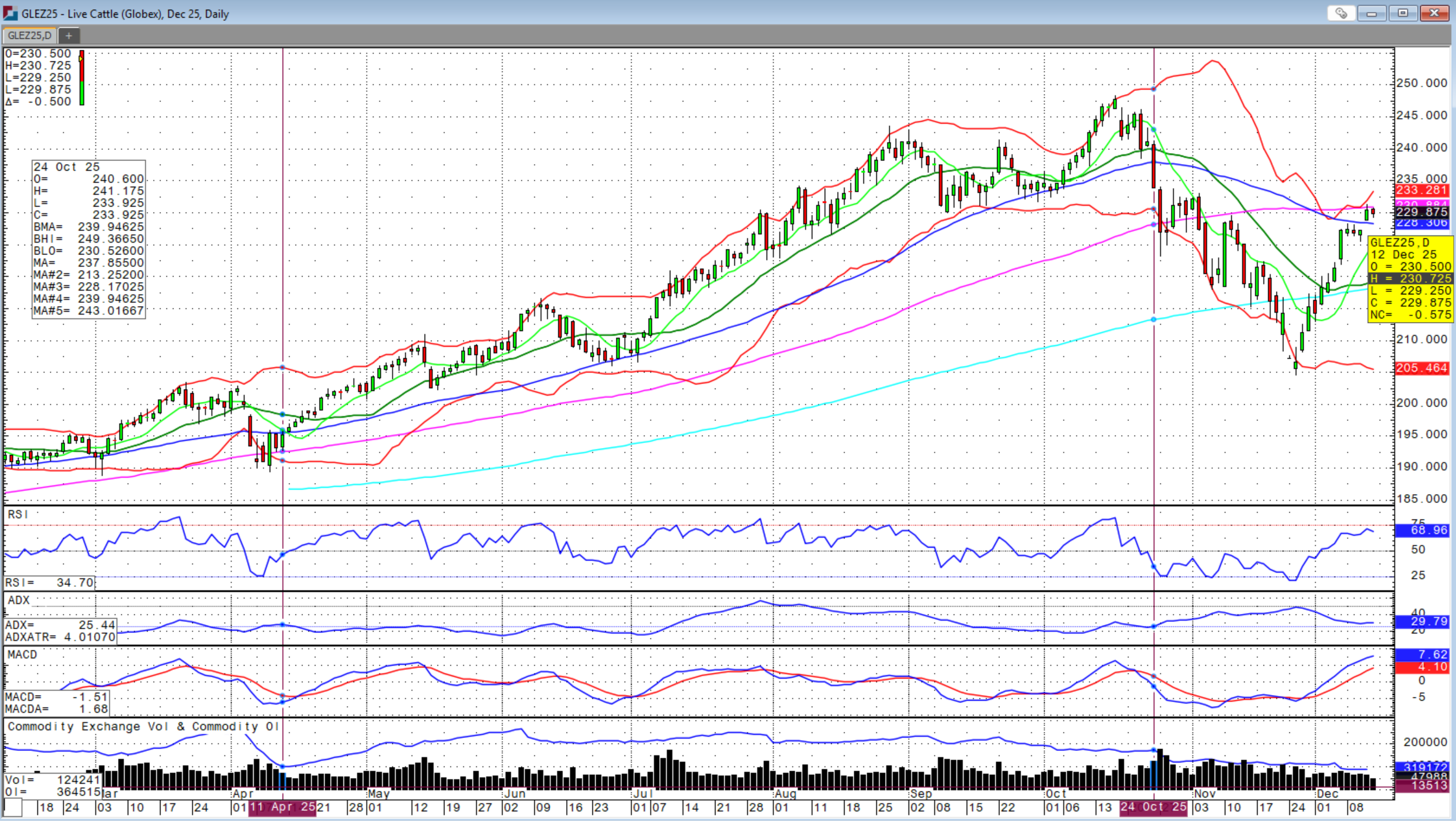

We are also beginning to see Argentine beef on US grocery store shelves this week at prices below US prices. While the cattle fundamentals are historically tight on the backdrop of strong consumer demand and driving prices higher, imports can be a necessary evil to bring some balance back so that retail prices don’t get too high. However, we just need to ensure it is a level playing field and we are not getting cheap, subsidized beef being dumped in the US market that will come at the expense of rebuilding our own herd.

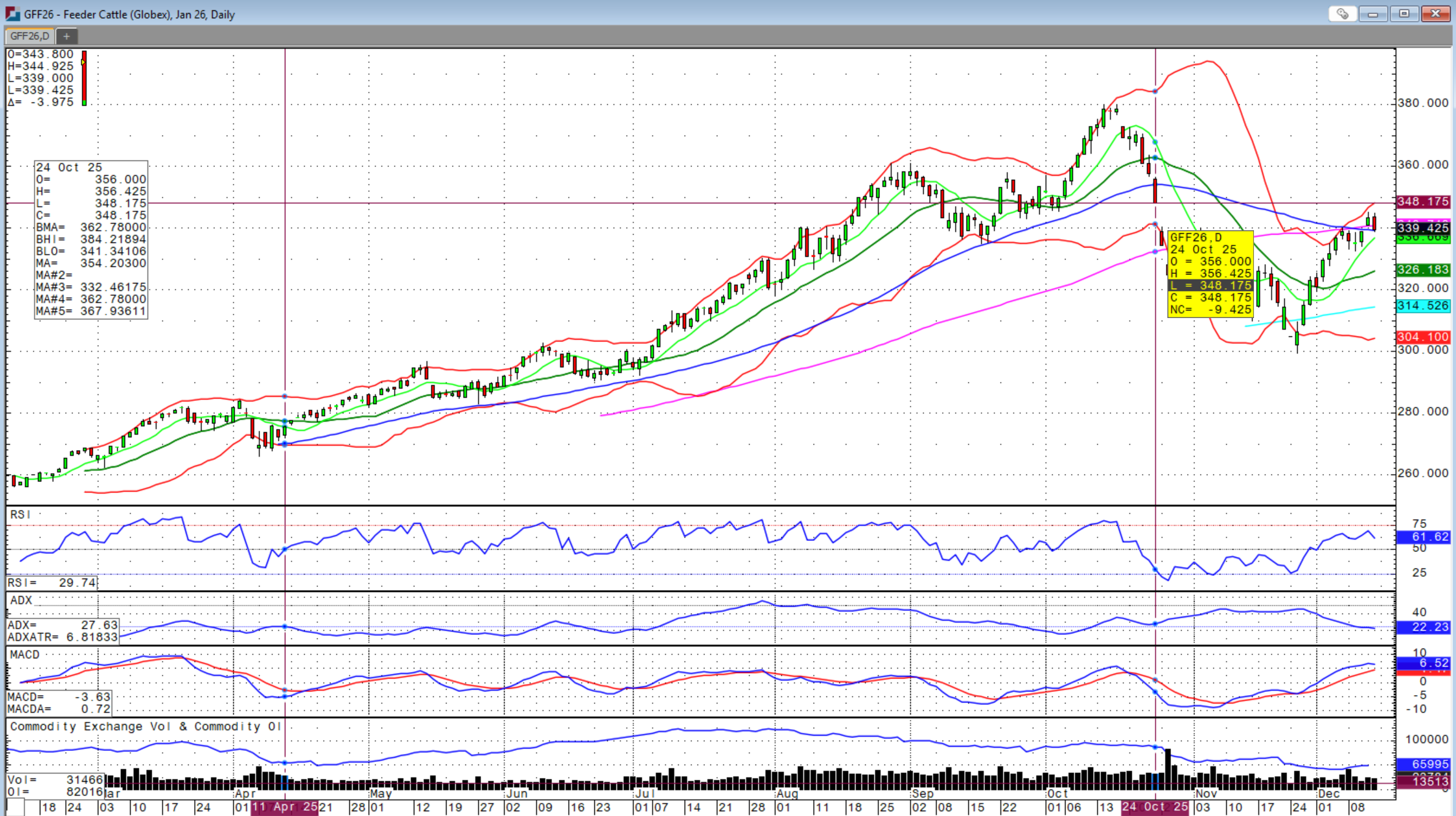

If the Trump Administration is after investment in US production and manufacturing, there is no better group to back than the American cattleman and cattlewomen! The cattle market has managed an incredible rebound from the November 25th lows with both futures and especially cash markets on fire.

We did see some profit taking on Friday with feeder and live cattle futures closing right at their 50-day moving averages. However, this was only the 3rd session with a lower close in the last 13 consecutive sessions since that pre-Thanksgiving low. Cash, sale barn prices for weaned calves is back near the records as buyers return in droves to increase numbers before year-end. While it was a disappointing close on Friday with some contracts making a higher high and lower low versus Thursday’s trade, the gap below that some are calling an island gap, may not fill and we see a return of buyers on Monday to chase the CME Feeder Cattle Cash Index that is around $345.00 versus January feeder futures now sub-$340.00. The big chart gap above on January feeders will fill when the market reaches $348.175. Then, there is another chart gap at $356.875. And then, the final gap at $376.750 from October 16th, the same day as the high was made at $380.200.

Cash Fed Cattle trade topped out at $230.00, but that traded on Thursday all the way down in Texas as well as negotiated trade at $230.00 on Friday in Texas. December Live cattle futures closed Friday just below $230.00, that are now in delivery mode, that is $7.00 higher versus last week!

The Federal Reserve FOMC lowered interest rates this week by 25 basis points with three dissenting votes. With inflation still a concern, further rate cuts are far from certain. The Fed will continue to watch the magnitude of weakening employment figures versus stubborn inflation in the coming months to determine if further loosening is warranted. The Federal Reserve is also resuming purchases of US Treasury securities beginning Friday that will boost bank liquidity.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.