How Nasdaq-100 Inclusion and Notable Insider Moves Will Impact Insmed (INSM) Investors

- Insmed was recently added to the Nasdaq-100 Index and has seen continued accumulation by prominent institutional investor Stanley Druckenmiller, while Director Sharoky Melvin MD sold 20,000 shares for US$4,100,000 on 5 December 2025.

- This combination of index inclusion and visible institutional positioning has brought fresh attention to Insmed’s growing pulmonary-focused biopharma franchise and revenue profile.

- We’ll now examine how Insmed’s addition to the Nasdaq-100 could influence its existing investment narrative around respiratory launches and growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Insmed Investment Narrative Recap

To own Insmed, you need to believe its respiratory portfolio, led by brensocatib and ARIKAYCE, can translate clinical traction into a sustainably larger revenue base despite ongoing losses. The Nasdaq 100 inclusion, alongside continued buying from Stanley Druckenmiller and recent insider selling, mainly affects trading attention and liquidity rather than the core catalyst of brensocatib launches or the key risk of potential FDA or payer delays.

The Nasdaq 100 addition stands out here because it can pull more benchmark and ETF capital into Insmed just as the company moves from EU approval of BRINSUPRI toward broader commercialization. While this index move does not change the scientific or regulatory profile, it could interact with expectations around brensocatib’s rollout, making any shift in timing or market access for the drug more visible in the share price.

Yet while index inclusion has helped shine a spotlight on Insmed, investors should also be aware of the risk that FDA review timelines for brensocatib could...

Read the full narrative on Insmed (it's free!)

Insmed's narrative projects $1.9 billion revenue and $293.8 million earnings by 2028.

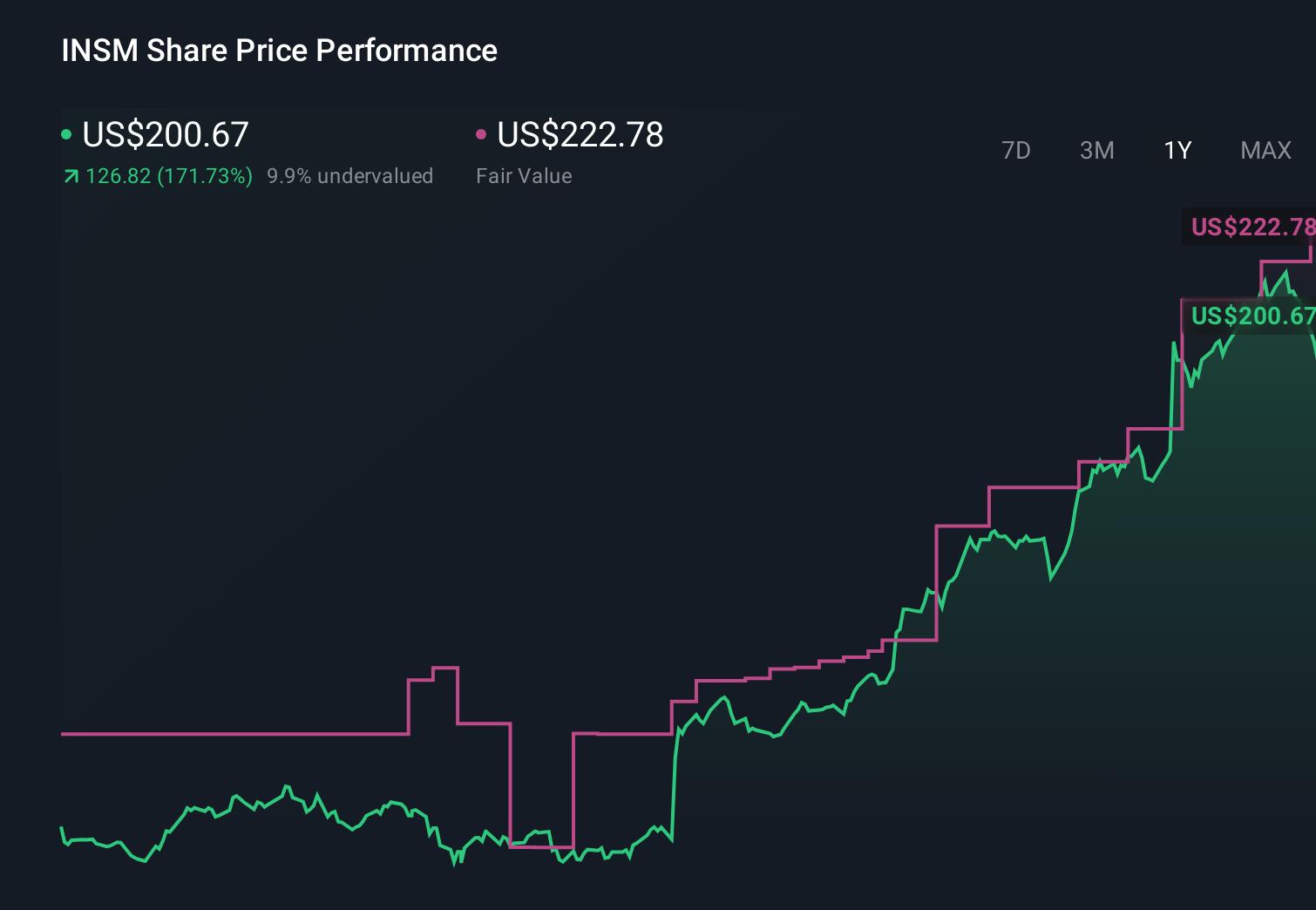

Uncover how Insmed's forecasts yield a $222.78 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$222.78 to over US$21,337.07, showing just how far apart individual views can be. When you set those against the central role of brensocatib’s global launch timing, it underlines why many investors look at several perspectives before judging what Insmed might be worth.

Explore 4 other fair value estimates on Insmed - why the stock might be worth just $222.78!

Build Your Own Insmed Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Insmed research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Insmed research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Insmed's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com