Imperial Petroleum (IMPP) Q3: 93.8% Net Margin Strengthens Bullish Profitability Narrative

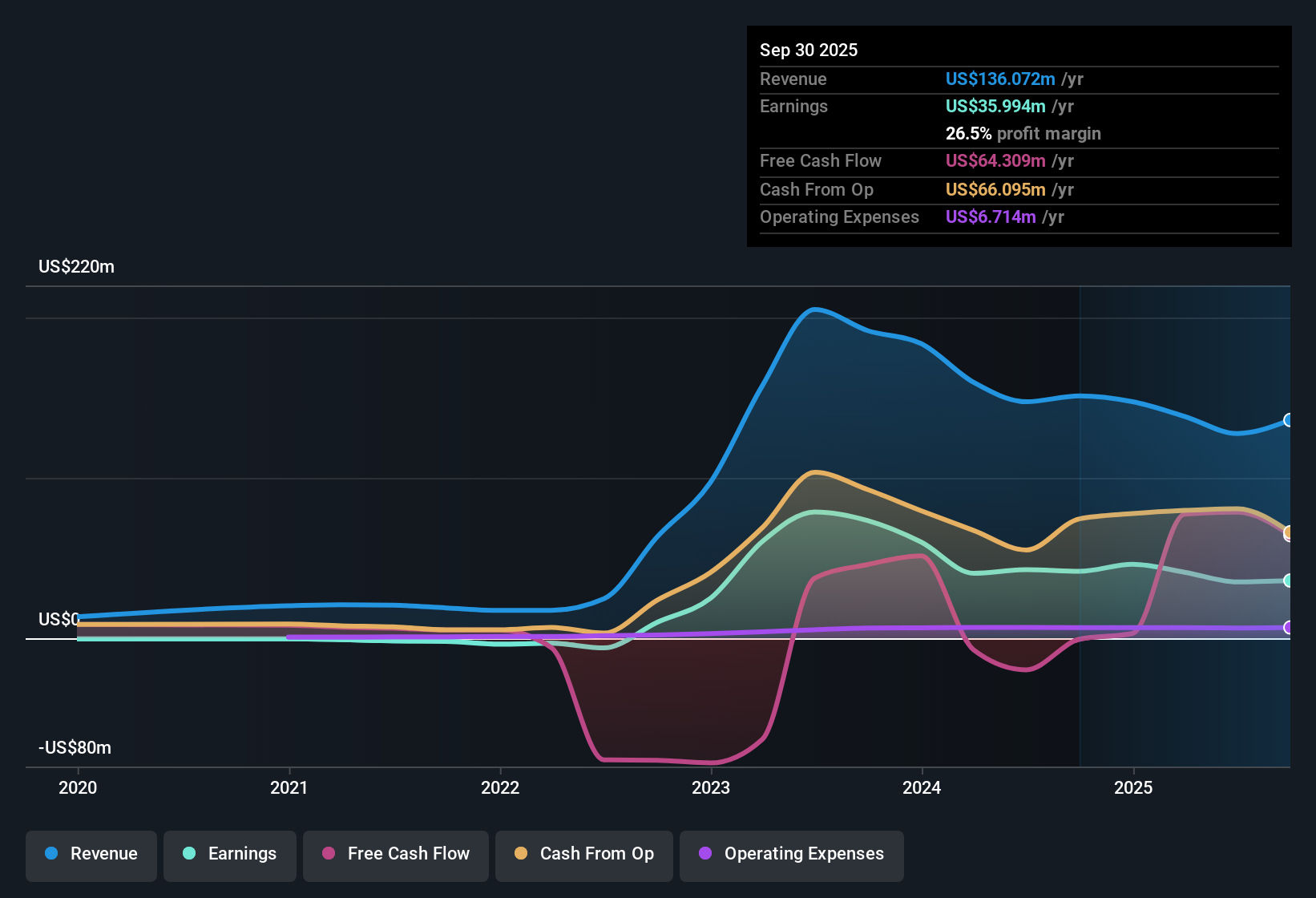

Imperial Petroleum (IMPP) has just posted Q3 2025 results, with revenue of about $41.4 million and basic EPS of $0.33, keeping both the top and bottom line firmly in focus for investors tracking the story. The company has seen revenue move from roughly $33.0 million in Q3 2024 to $41.4 million this quarter, while basic EPS shifted from $0.29 to $0.33 over the same period, giving a clear sense of how the income statement has evolved year on year. With a trailing twelve month net profit margin close to the mid 90% range, the latest release underscores how central margin dynamics are to the Imperial Petroleum investment case.

See our full analysis for Imperial Petroleum.With the numbers on the table, the next step is to see how this earnings print lines up with the key storylines investors have been following and where it pushes back against the prevailing narratives.

See what the community is saying about Imperial Petroleum

93.8 percent margin stands out

- Over the last 12 months, Imperial Petroleum reported a net profit margin of 93.8 percent, compared with 27.6 percent in the prior year, while net income over that trailing period was about 34.9 million dollars.

- Supporters of the bullish view point to this very high reported margin and multi year earnings growth of 41.6 percent per year as evidence that the fleet mix and charter strategy can sustain strong profitability, yet

- the sharp jump in margin versus the prior year invites questions about how much of this level can be maintained if freight rates or utilization normalizes.

- forecasts that profit margins could reach 43.6 percent in three years sit well below the current 93.8 percent figure, which means even bulls are implicitly assuming some moderation from the recent trailing peak.

Revenue growth accelerates despite Q2 softness

- After falling to 36.3 million dollars in Q2 2025 from 47.0 million dollars in Q2 2024, quarterly revenue has rebounded to 41.4 million dollars in Q3 2025, and analysts now forecast revenue to grow about 96.1 percent per year over the coming years.

- Critics in the bearish camp focus on that earlier 22.8 percent year on year revenue decline and weaker charter rates as signs that growth is sensitive to softer freight markets, especially because

- new drybulk vessels delivered late in recent periods are on short term contracts, so if rates pull back, the high growth forecasts could be harder to achieve.

- the company is leaning more on short term exposure in drybulk, which bears argue could translate swings in global trade or rates into more volatile revenue from one period to the next.

Low 4.2x P E versus targets

- The shares trade on a trailing P E of about 4.2 times, well below the US oil and gas industry average of 13.3 times and peer average of 27.3 times, while a DCF fair value of roughly 46.93 dollars and an analyst price target of 6.00 dollars both sit well above the current 4.22 dollar share price.

- What stands out for the bullish narrative is how these valuation markers line up with growth expectations, because

- earnings are projected to increase about 80.6 percent per year, with forecasts for earnings to reach 177.8 million dollars and EPS of 4.5 dollars around 2028, implying the market is paying a low multiple today for a much larger profit base.

- analysts would only need the stock to trade on roughly 1.8 times those 2028 earnings to justify the 6.00 dollar target, a multiple still far below the 12.6 times P E currently used for the wider US oil and gas industry.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Imperial Petroleum on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers through a different lens and turn that view into a concise, personalized storyline in just a few minutes, Do it your way.

A great starting point for your Imperial Petroleum research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Imperial Petroleum’s ultra high margins, volatile revenue path and dependence on favorable shipping cycles raise doubts about how durable its current earnings power really is.

If you want more predictable compounding instead of cyclical swings, use our stable growth stocks screener (2103 results) to focus on businesses delivering steadier revenue and earnings through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com