RH (RH) Q3 2026: Margin Rebound Reinforces Bullish Earnings Recovery Narrative

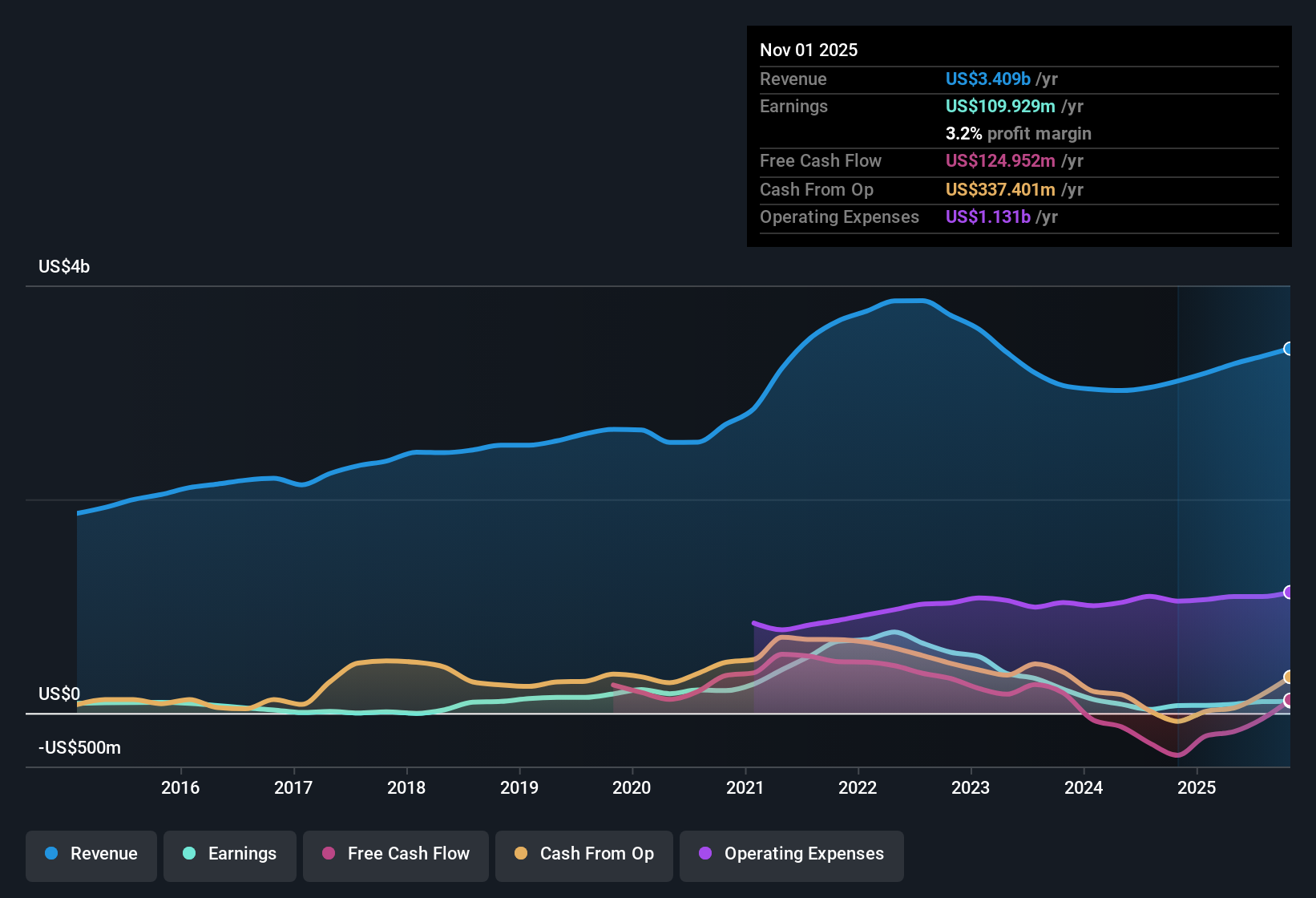

RH (RH) has just posted its Q3 2026 numbers, with revenue at $883.8 million and basic EPS of $1.93, giving investors another data point in its ongoing earnings recovery story. The company has seen revenue move from $811.7 million in Q3 2025 to $883.8 million in Q3 2026, while basic EPS has shifted from $1.79 to $1.93 over the same period, alongside a trailing net margin that has stepped up from 2.2% to 3.2%. Taken together, the latest quarter points to a business that is squeezing more profit out of each dollar of sales, even as the market debates how durable that margin profile really is.

See our full analysis for RH.With the headline numbers on the table, the next step is to see how this margin story lines up with the dominant narratives around RH, and where the latest quarter might be forcing investors to rethink their assumptions.

See what the community is saying about RH

58 percent earnings rebound shifts the story

- Over the last year, net income on a trailing basis climbed from $69.9 million to $109.9 million, a 58.2 percent jump that contrasts with the 32.2 percent average annual decline over the past five years.

- Consensus narrative highlights platform expansion and new galleries as future growth drivers, yet

- trailing 12 month revenue has only moved from about $3.1 billion to $3.4 billion while earnings have rebounded far faster, so most of the recent progress is coming from profitability rather than top line acceleration so far,

- and analysts still rely on forecast earnings growth of about 39.7 percent per year to keep that rebound going, which means the recent improvement needs to be repeated rather than treated as a one off win.

Margins improve to 3.2 percent but debt bites

- Net margin on a trailing 12 month basis has risen from 2.2 percent to 3.2 percent even though Q3 2026 revenue of $883.8 million was slightly below Q2 2026 revenue of $899.2 million.

- Bears point to financing risk, and the data backs that concern because

- the major flagged risk is that interest payments are not well covered by earnings, so even with higher margins RH has limited room for error if operating trends soften,

- and earnings forecasts assume margins continue to expand from this 3.2 percent base, so any pressure from interest costs could slow the path toward the much higher profitability analysts are baking in.

Premium P E with big DCF gap

- RH trades at a trailing P E of 27.6 times versus peers at 18.8 times and the broader industry at 20.2 times, yet the $162.01 share price still sits 54.5 percent below a DCF fair value of about $356.07 per share.

- Bullish investors argue the valuation gap is justified by growth potential, and the numbers give them some support because

- earnings are forecast to grow roughly 39.7 percent per year while revenue is expected to grow about 8.1 percent per year, implying continued margin expansion on top of the recent move from 2.2 percent to 3.2 percent,

- and trailing 12 month EPS has climbed from $3.8 to $5.9, so the current premium P E multiple is being placed on a base of earnings that is already higher than a year ago rather than purely on distant projections.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for RH on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle and want to test that view fast? Use the latest figures to shape your own narrative in minutes: Do it your way.

A great starting point for your RH research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite the earnings rebound, RH still faces stretched valuation metrics and heavy interest burdens that leave little room for disappointment if margins stall or costs rise.

If that trade off feels uncomfortable, use our solid balance sheet and fundamentals stocks screener (1944 results) to quickly focus on businesses with stronger financial cushions that can better withstand higher rates and economic slowdowns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com