Leonardo DRS (DRS): Valuation Check After New Defense Deals in Thailand, Saudi Arabia and AI Counter‑UAS Partnership

Leonardo DRS (DRS) is back on investor screens after a flurry of international defense deals, including fresh agreements in Thailand and Saudi Arabia, as well as a new AI driven Counter UAS partnership with Axon Vision.

See our latest analysis for Leonardo DRS.

Despite this string of international wins, the share price, now at $34.46, has pulled back with a 90 day share price return of minus 18.1 percent. Even though the year to date share price return is still positive and the three year total shareholder return of 188.4 percent points to strong long term wealth creation, this suggests that recent weakness reflects shifting risk perceptions more than a broken growth story.

If these defense deals have you thinking more broadly about the sector, it could be a good time to scan other opportunities across aerospace and defense stocks and see what else fits your strategy.

With revenue and earnings still growing and the stock trading at a sizeable discount to analyst targets, are investors overlooking Leonardo DRS’s expanding AI and international pipeline, or is the market already pricing in the next leg of growth?

Most Popular Narrative Narrative: 27.1% Undervalued

With the narrative fair value sitting at $47.30 against a last close of $34.46, the story points to meaningful upside if its assumptions hold.

The company's strategic alignment with national priorities, including investments in naval modernization, next generation air and missile defense (such as the Golden Dome initiative), and counter UAS capabilities, sets the stage for premium contract awards and program expansions, benefiting both revenue and net margins over the next several years. Global increases in digitization and modernization of military forces are benefiting DRS's proprietary solutions in network computing, electronic warfare, and electric propulsion, supporting higher average selling prices and expanded platform content, which is expected to enhance net margins and drive operational leverage.

Curious how steady but unspectacular growth, rising margins, and a richer future earnings multiple combine to justify that higher fair value? Want the full blueprint behind those projections?

Result: Fair Value of $47.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened raw material constraints and heavy reliance on large U.S. government contracts could squeeze margins and derail those optimistic growth expectations.

Find out about the key risks to this Leonardo DRS narrative.

Another View: Ratio Based Valuation Looks Less Generous

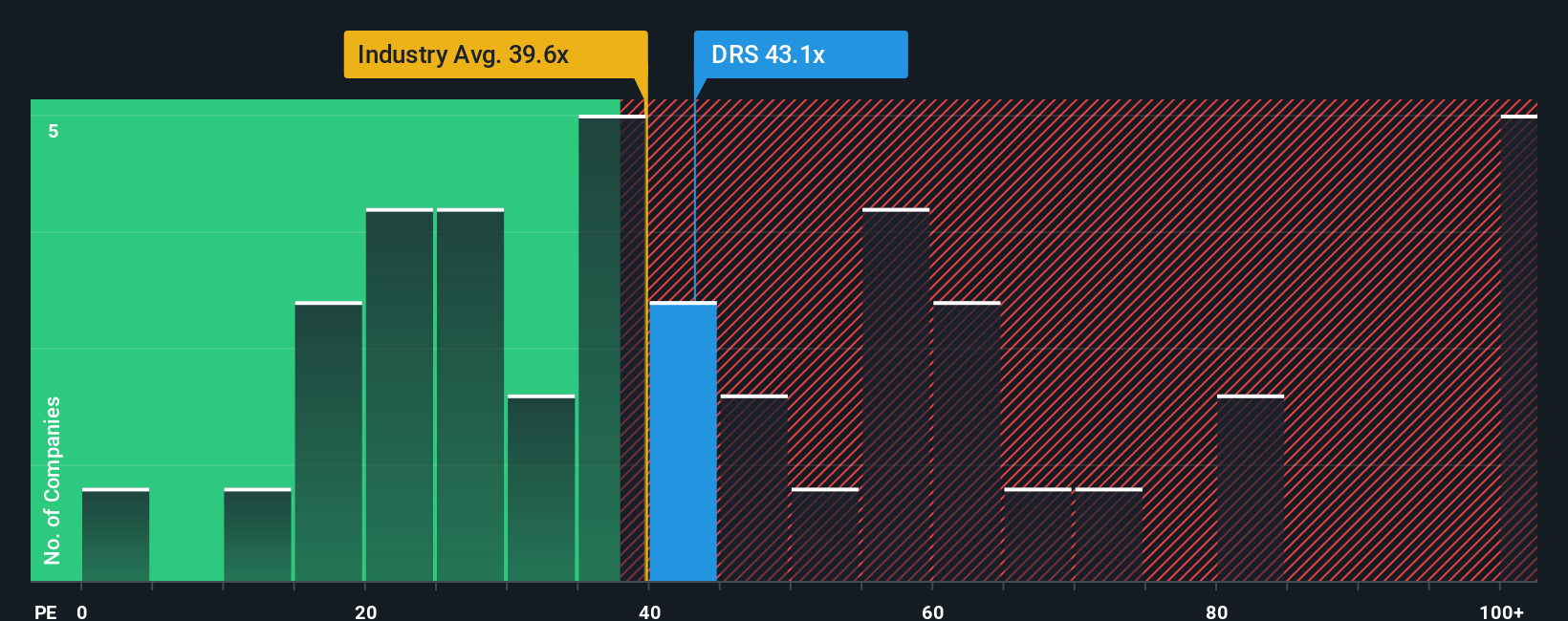

On a simple price to earnings lens, DRS looks less forgiving. Its current P E of 34.6 times screens as expensive against a fair ratio of 26.4 times, implying the market already bakes in a lot of growth. Is this a margin of safety, or a margin of error?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Leonardo DRS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Leonardo DRS Narrative

If you see the story differently or prefer to test the numbers yourself, you can build a tailored view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Leonardo DRS.

Ready for your next investing move?

Do not stop at one opportunity; use the Simply Wall St Screener now to pinpoint stocks that match your strategy before the crowd catches on.

- Capture potential bargains early by scanning these 907 undervalued stocks based on cash flows that markets may be mispricing despite solid cash flow outlooks.

- Tap into powerful secular themes by targeting these 26 AI penny stocks positioned to benefit from advances in artificial intelligence.

- Focus on these 13 dividend stocks with yields > 3% that can help strengthen portfolio income when markets are unpredictable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com