Is It Too Late To Consider AutoZone After Its Strong Multi Year Share Price Run?

- Wondering if AutoZone is still a smart buy after such a long run up, or if the easy money has already been made, you are not alone.

- The stock is up an impressive 191.5% over 5 years and 44.8% over 3 years, but more recently it has slipped 9.9% over the last week and 9.1% over the past month, leaving year to date gains at 6.0% and 1 year returns at 2.2%.

- Recent attention has focused on AutoZone's ability to keep winning in the do it yourself and commercial repair markets, as investors weigh how resilient auto parts demand will be if the economy slows. On top of that, analysts have been talking about the company’s aggressive share repurchases and store network expansion, both of which help explain why the stock has pulled back as investors reassess how much future growth is already priced in.

- Right now, AutoZone scores a 2/6 on our valuation checks. This suggests there may be some value but also a few red flags. We are going to walk through the main valuation approaches investors use here, then finish with a more holistic way to judge what the stock is really worth.

AutoZone scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AutoZone Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting all the cash it can return to shareholders in the future, then discounting those cash flows back to today in dollar terms.

For AutoZone, the 2 Stage Free Cash Flow to Equity model starts with last twelve months free cash flow of about $2.0 billion, then applies analyst forecasts and longer term assumptions. Analyst estimates drive the next few years, with free cash flow expected to rise toward roughly $3.3 billion by 2030. The later years are extrapolated by Simply Wall St using more moderate growth rates.

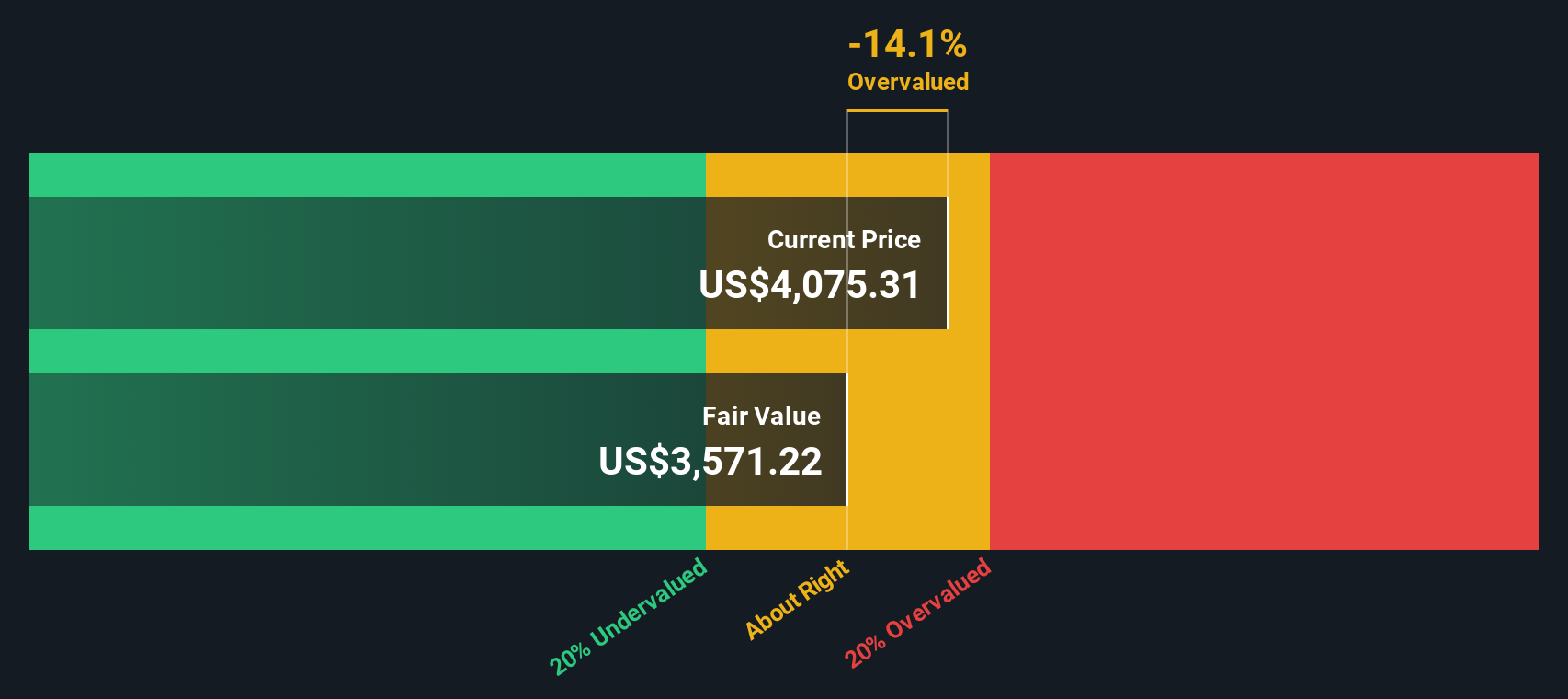

Adding up all those projected cash flows and discounting them back to today gives an estimated intrinsic value of about $3,276 per share. Compared with the current share price, that implies AutoZone is roughly 5.2% overvalued, which is a relatively small premium and within a reasonable margin of error for this kind of model.

Result: ABOUT RIGHT

AutoZone is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: AutoZone Price vs Earnings

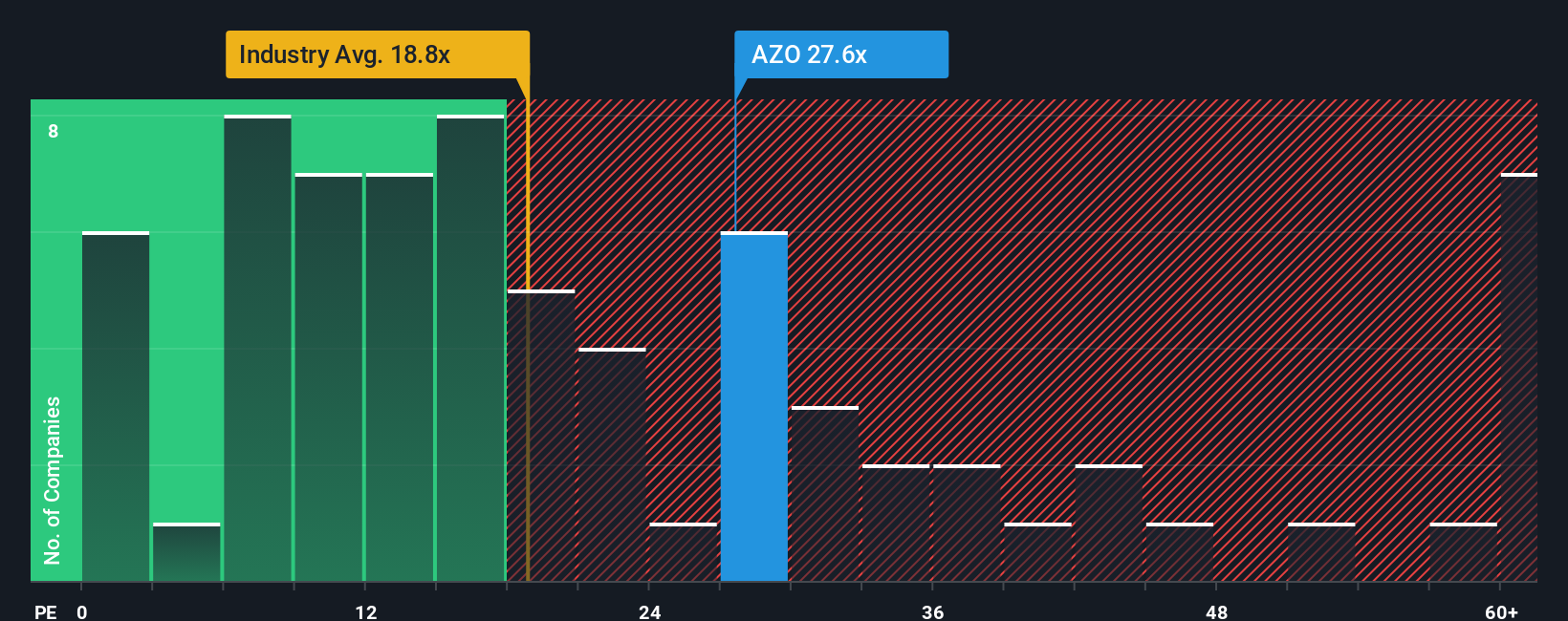

For profitable companies like AutoZone, the price to earnings, or PE, ratio is often the go to valuation gauge because it directly links what investors pay to what the business earns per share. In general, faster earnings growth and lower perceived risk justify a higher PE, while slower growth or higher risk should mean a lower, more conservative multiple.

AutoZone currently trades on a PE of about 23.2x. That is slightly above the Specialty Retail industry average of roughly 20.3x, but well below the peer group average of about 39.4x. This suggests the market is not giving it a premium growth stock valuation. Simply Wall St’s Fair Ratio framework estimates what PE the company should trade on, given its growth outlook, profitability, size and risk profile, and arrives at a Fair Ratio of around 19.9x.

This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for AutoZone’s specific fundamentals rather than assuming all retailers deserve the same multiple. With the actual PE at 23.2x versus a Fair Ratio near 19.9x, the shares look somewhat expensive on an earnings basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AutoZone Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your story about AutoZone to the numbers by linking your assumptions for future revenue, earnings, margins and fair value to a clear investment case. A Narrative on Simply Wall St, available to millions of investors on the Community page, connects three things in one place: what you believe will happen in the business, how that translates into a financial forecast, and the fair value you get from those forecasts, which you can then compare with the current share price to decide whether AutoZone looks like a buy, a hold, or a sell. Because Narratives update dynamically when new information like results, news or guidance comes in, your fair value view evolves in real time instead of staying stuck on an old spreadsheet. For example, one AutoZone Narrative might lean bullish, assuming margin pressures ease, store expansion pays off and justify a fair value near the top of recent targets around $4,900. A more cautious Narrative might focus on persistent cost headwinds and slower demand and land closer to $2,900, and both perspectives are visible and comparable in the same framework.

Do you think there's more to the story for AutoZone? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com