Is Coeur Mining’s Surging 2025 Share Price Justified by Its Cash Flow Outlook?

- Wondering if Coeur Mining is still a bargain after its big run, or if you are late to the party? This breakdown will help you decide whether the current share price makes sense or is getting ahead of itself.

- The stock has rocketed, with shares up 8.8% over the last week, 10.4% over the past month, and 178.2% year to date, on top of a 163.0% gain over the last year and a 427.5% rise over three years.

- Recent moves have been closely tied to shifting sentiment around precious metals, as investors rotate back into gold and silver exposed names. Coeur has also been in the headlines for operational updates and strategy moves that aim to position it as a higher quality, growth leaning producer in a stronger metals price environment.

- Despite the rally, Coeur Mining only scores a 3/6 valuation check score. Below we walk through what different valuation methods say about the stock, then finish by looking at a way to think about value beyond simple models.

Approach 1: Coeur Mining Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in dollar terms. For Coeur Mining, the 2 Stage Free Cash Flow to Equity model starts with last twelve months Free Cash Flow of about $175.0 million and then builds forward using analyst forecasts and longer term extrapolations.

Analysts currently see Coeur’s Free Cash Flow rising toward roughly $1.11 billion by 2029. The interim path includes projected annual FCF in the $1.0 billion to $1.2 billion range between 2026 and 2035, reflecting expectations that the business will scale meaningfully as its assets mature and metals prices remain supportive. Simply Wall St extends analyst estimates beyond the usual five year window to create a full 10 year cash flow curve, and then discounts those cash flows back to today.

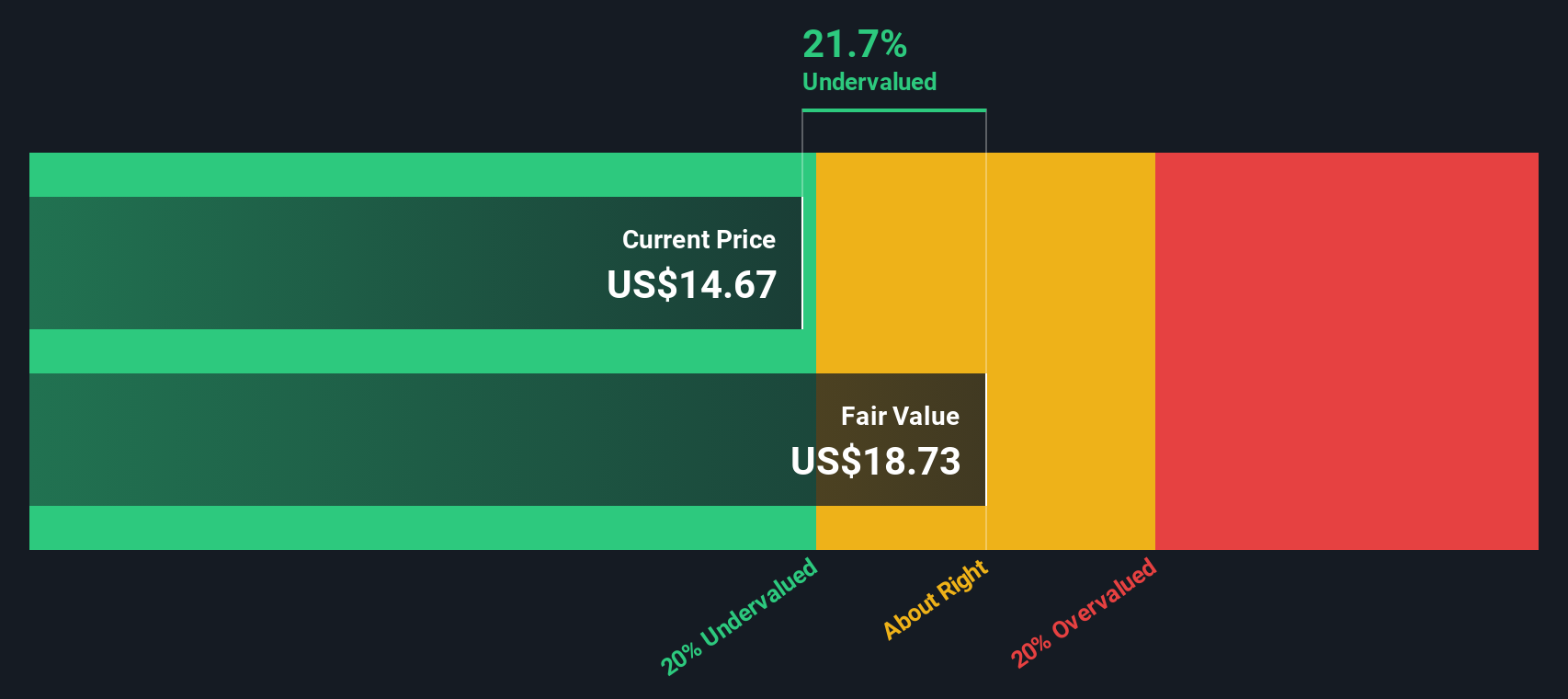

On this basis, the model arrives at an intrinsic value of about $29.93 per share. Compared to the current market price, this implies Coeur Mining is trading at roughly a 42.4% discount, suggesting potential upside if these cash flow assumptions prove accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coeur Mining is undervalued by 42.4%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Coeur Mining Price vs Earnings

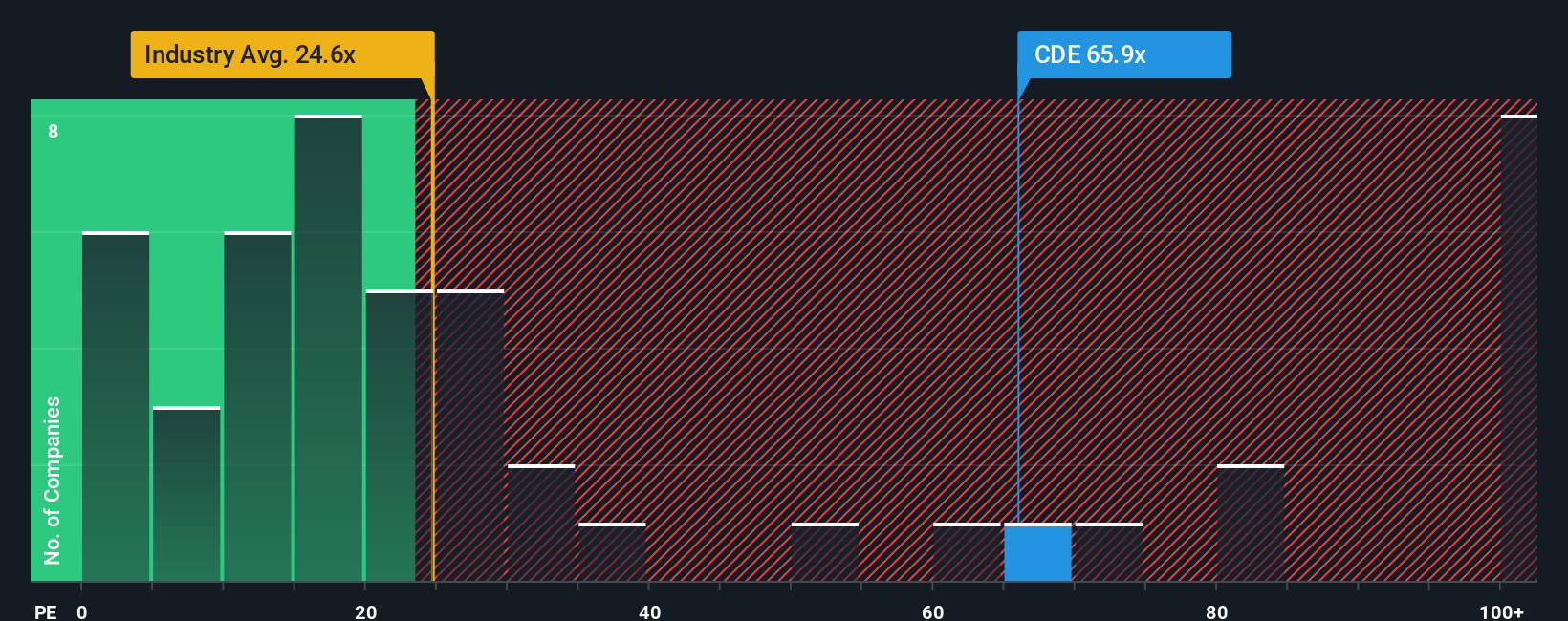

For a company that is generating positive earnings, the price to earnings, or PE, ratio is a straightforward way to judge whether the market price looks reasonable relative to current profitability. In general, faster growing and lower risk businesses can justify a higher PE ratio, while slower growth or higher risk names tend to trade on lower multiples.

Coeur Mining currently trades on a PE of about 27.1x, which is a premium to both the broader Metals and Mining industry average of roughly 22.9x and the peer group at around 23.5x. To refine this comparison, Simply Wall St uses a proprietary Fair Ratio, which estimates what PE you would expect for Coeur, given its earnings growth outlook, margins, industry, market cap and specific risk profile. For Coeur, this Fair Ratio comes out at about 26.3x.

Because the Fair Ratio is tailored to the company, it offers a more nuanced benchmark than simple peer or industry averages, which can mask important differences in growth and risk. With Coeur’s actual PE only slightly above its Fair Ratio, the share price looks broadly aligned with what its fundamentals warrant.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coeur Mining Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your own story about Coeur Mining to the numbers by linking what you believe about its future revenue, earnings and margins to a financial forecast, a fair value estimate and, ultimately, an investment decision.

On Simply Wall St’s Community page, Narratives are easy to create and compare, and they update dynamically as new news or earnings arrive, so your fair value is always grounded in the latest information rather than a static model.

Once you have a Narrative, you can quickly compare its Fair Value to today’s share price to decide how Coeur looks in your portfolio, and you can see how your view stacks up next to others on the platform, which is used by millions of investors.

For example, one optimistic Coeur Mining Narrative might lean into strong silver demand, margin expansion and successful exploration to justify a fair value closer to $21 per share, while a more cautious Narrative could focus on operational and regulatory risks to support a fair value nearer $12, showing how different stories lead to different but clearly quantified views.

Do you think there's more to the story for Coeur Mining? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com