Cocoa Update: Index Buying Has Begun — But the Big Wave Is Still Ahead

Dual Edge Research publishes two powerful newsletters that work great individually — and even better together. The Bull Strangle Newsletter focuses on stocks and options, combining stock ownership with premium-selling strategies to generate consistent income and market-beating returns. The Smart Spreads Newsletter specializes in seasonal commodity futures spreads, offering a diversified approach with low correlation to equities. Together, they deliver a complete investment perspective — one focused on income, the other on diversification — all under one simple subscription.

Introduction

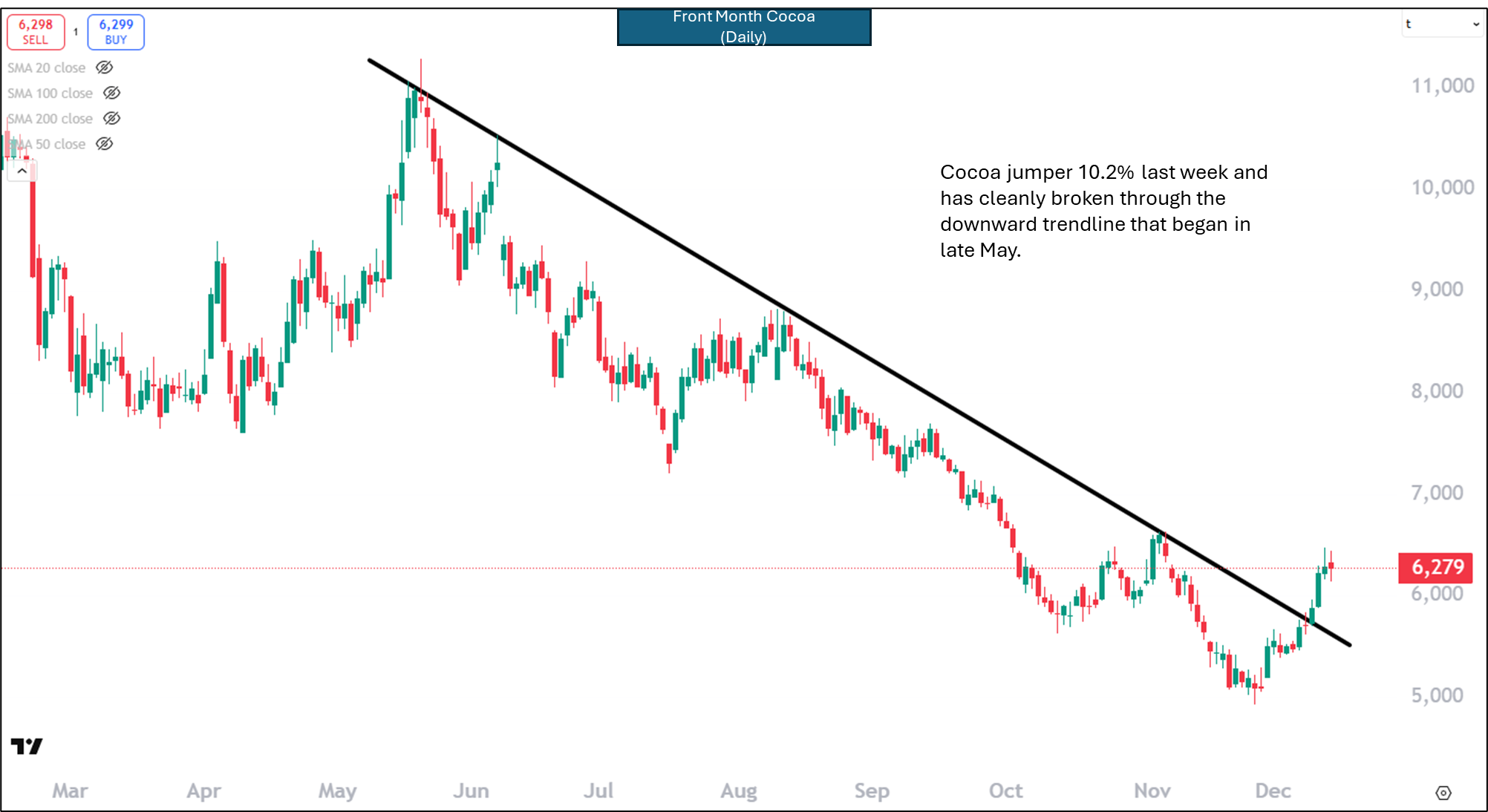

In the weeks since cocoa was added to the upcoming January rebalancing schedules for the Bloomberg Commodity Index (BCOM) and S&P GSCI, traders have been watching closely for signs that passive flows were starting to hit the market. This past week delivered clear confirmation: cocoa futures surged 10.2% in the front month, a powerful move for a market of its size and liquidity profile. But the most important takeaway is that this was only the beginning.

Index Buying Has Started — and It’s Already Moving the Market

Despite last week’s steep rally, the projected amount of passive buying still required during the January roll remains extremely large.

- Current estimate: ~36,000 cocoa futures contracts

- Previous estimate: ~41,000

- Share of open interest: ≈30% of total OI

Even after trimming, the required buying remains one of the largest percentage-of-open-interest shocks any major commodity has seen in years. This is precisely the scenario that tends to create large, front-loaded moves as traders position ahead of forced index flows. The 10.2% weekly gain suggests that this “pre-positioning” phase is now well underway.

Why the Rally May Still Be Early

The updated buying estimate is still enormous by cocoa-market standards:

- Cocoa open interest is thin relative to larger commodities.

- A required purchase equal to roughly one-third of the entire market is structurally destabilizing.

- Most index-linked buying must occur during the official January rebalance window, not beforehand.

That means last week’s rally could prove to be just the initial reaction—not the end of the move. Additionally:

- Hedge fund positioning remains light, still well below the 52-week average.

- RSI readings remain only moderately elevated, suggesting the market is not technically overextended.

Many discretionary traders are only now beginning to appreciate the size of the required flows.

Key Variables to Watch From Here

As we approach the roll period, several factors will determine how far this move extends:

- Speed of Front-Running - Last week’s 10.2% spike suggests that more traders are now positioning ahead of the flows.

- Depth of Commercial Selling - If producers, merchants, or trade houses do not increase their offer size during the roll, the remaining 36,000 contracts of passive buying could push prices meaningfully higher.

Volatility Layered On Top - Cocoa remains fundamentally tight, with weather and disease risks still elevated. Any deterioration in supply expectations would magnify the price impact of the forced flows.

Bottom Line

The cocoa market has entered the early phase of a rare flow-driven opportunity. The sharp weekly advance confirms that discretionary buyers are stepping in ahead of the January index roll, yet the amount of remaining forced buying is still massive:

- ~36,000 contracts still need to be purchased

- ≈30% of all open interest

A narrow execution window in early January

Put simply:

- If last week’s 10.2% rally occurred before the bulk of index buying has even begun, the coming weeks could bring significantly more volatility and upward pressure. This remains one of the most compelling flow-driven setups in the commodity complex heading into year-end.

More Information

Now you can get two powerful newsletters — for one simple price!

- For stocks and options, the Bull Strangle Newsletter shows you how to combine stock ownership with dual option selling — a disciplined strategy that has consistently outperformed the S&P 500.

- For commodity futures, the Smart Spreads Newsletter focuses on seasonal commodity spreads — a proven, low-correlation approach that thrives in all types of markets.

Each newsletter is designed to deliver consistent income on its own — but when used together, they create a complete, diversified trading approach that works in any market environment.

Visit BullStrangle.com to subscribe for just $1 for the first month.

For a video overview of the Bull Strangle Newsletter

For a video overview of the Smart Spreads Newsletter

Darren Carlat

Dual Edge Research

(214) 636-3133

DualEdgeResearch@gamil.com

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.