Evommune (EVMN) Q3: Revenue Jump Reinforces Bullish Growth Narrative Despite Ongoing Losses

Q3 2025 Snapshot and Recent Trends

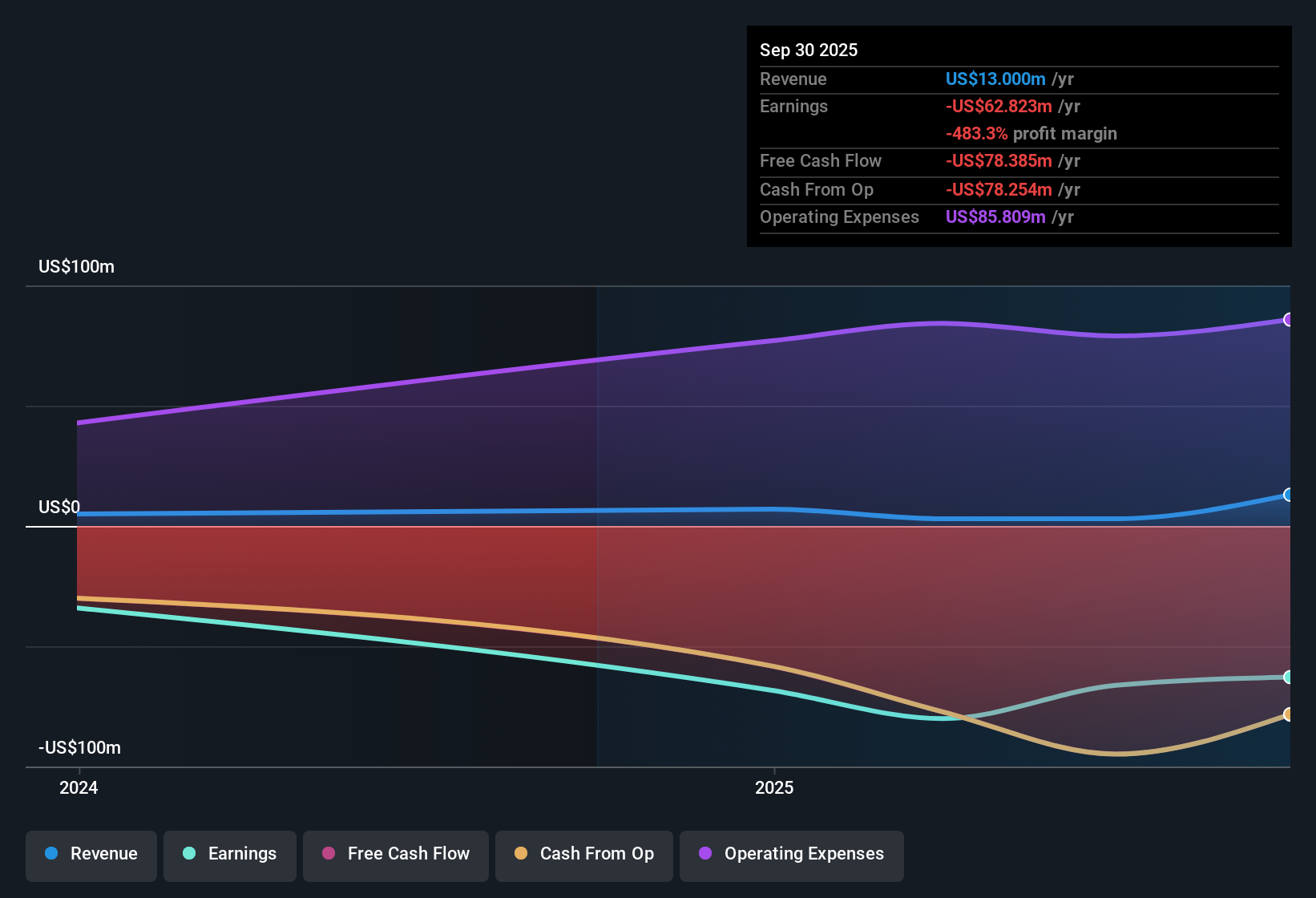

Evommune (EVMN) just posted Q3 2025 results with revenue of about $10 million and a basic EPS loss of roughly $8.07, while trailing twelve month figures show total revenue of about $13 million and basic EPS of around minus $40.87. Over recent periods the company has seen revenue move from roughly $5 million on a trailing basis in Q4 2023 to about $7 million in Q4 2024, then to around $13 million by Q3 2025, even as quarterly basic EPS remained negative between about minus $18.09 and minus $8.07. That mix of expanding top line and persistent EPS losses sets up a story where investors will be watching how quickly margins can narrow the gap between growth and ongoing cash burn.

See our full analysis for Evommune.With the headline numbers on the table, the next step is to line them up against the dominant narratives around Evommune to see which stories the latest quarter supports and which ones the data starts to undermine.

Curious how numbers become stories that shape markets? Explore Community Narratives

Triple digit revenue growth but deeper losses

- On a trailing 12 month basis, total revenue rose from about $5 million in Q4 2023 to roughly $13 million in Q3 2025, while net income over that same period moved from a loss of about $34.1 million to a deeper loss of around $62.8 million.

- Bulls often focus on that 100.1% revenue growth over the last year as a sign the pipeline is starting to show commercial traction, yet the widening trailing loss of roughly $28.8 million invites a reality check:

- The bullish angle is supported by revenue stepping up from $7 million on a trailing basis in Q4 2024 to about $13 million by Q3 2025, which is a meaningful move for a small biotech.

- At the same time, the larger net loss underscores that scaling revenue has not offset spending so far, so any bullish thesis has to be about future operating leverage rather than current profitability.

Cash runway under one year with ongoing losses

- Q3 2025 net income excluding extra items was a loss of about $12.5 million, and analysis points to less than one year of cash runway with earnings forecast to decline around 30.4 percent per year over the next three years.

- Bears argue that a combination of sustained losses and a short cash runway creates financing risk, and the numbers here line up with that concern:

- Quarterly net losses have stayed in the low to mid teen millions across 2025, from roughly $14.6 million in Q1 to about $12.5 million in Q3, which does not yet show a clear move toward break even.

- With profitability not expected in the next three years, the pattern of multi million dollar quarterly losses reinforces the bearish view that fresh capital will likely be needed if spending stays at similar levels.

Rich valuation despite forecast declines

- Evommune trades on a price to sales ratio of about 41.7 times, which is more than three times the US biotech industry average of roughly 12.3 times and substantially above the peer average of about 3.7 times, even though revenue is forecast to fall around 39.9 percent per year.

- What stands out for a bearish check is how this premium multiple sits alongside expectations for shrinking revenue and earnings:

- With trailing 12 month revenue of about $13 million and a current share price of $18.01, the high price to sales level suggests the market is paying up relative to both the sector and closer peers despite the projected declines.

- Analysts still see scope for upside to a target of $39.33, but that target has to be weighed against the combination of a rich multiple, forecast revenue contraction and the company remaining unprofitable.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Evommune's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Evommune combines rapid revenue growth with widening losses, a short cash runway, and a rich valuation, leaving investors exposed to dilution and execution risk.

If that profile feels too fragile, use our these 907 undervalued stocks based on cash flows to quickly zero in on companies where cash flows better justify the price you are paying today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com