Tractor Supply (TSCO): Reassessing Valuation After Trump’s Comments on Farming Costs and Environmental Regulations

Tractor Supply (TSCO) has been back in the headlines after President Trump publicly criticized high farming equipment costs and pledged to roll back certain environmental regulations, a shift that could eventually reshape margins and investor sentiment.

See our latest analysis for Tractor Supply.

Against that backdrop, Tractor Supply’s share price has slipped in recent months, with a 30 day share price return of minus 7.49 percent and a 90 day share price return of minus 14.26 percent. Even so, its five year total shareholder return of 91.7 percent still signals solid long term wealth creation and suggests the latest pullback reflects shifting sentiment more than a broken business model.

If these regulatory headlines have you rethinking your portfolio mix, it could be a good moment to scan other retail exposed names and discover fast growing stocks with high insider ownership.

With earnings still growing and analysts seeing double digit upside from here, investors now face a key question: Is Tractor Supply trading at a meaningful discount to its prospects, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 18.5% Undervalued

With Tractor Supply last closing at 51.97 dollars against a narrative fair value of about 63.74 dollars, the valuation story leans clearly optimistic.

Analysts expect earnings to reach 1.4 billion dollars (and earnings per share of 2.76 dollars) by about September 2028, up from 1.1 billion dollars today.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.2x on those 2028 earnings, up from 28.8x today.

Curious why a mature rural retailer is being valued with a profit multiple more often seen in faster growth sectors, and which precise margin and revenue upgrades try to back that up? Dig into the full narrative to see exactly how those future earnings are being mapped out.

Result: Fair Value of $63.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer comparable sales and pressure on big ticket categories could quickly challenge those upbeat margin assumptions and rein in the multiple.

Find out about the key risks to this Tractor Supply narrative.

Another Lens on Valuation

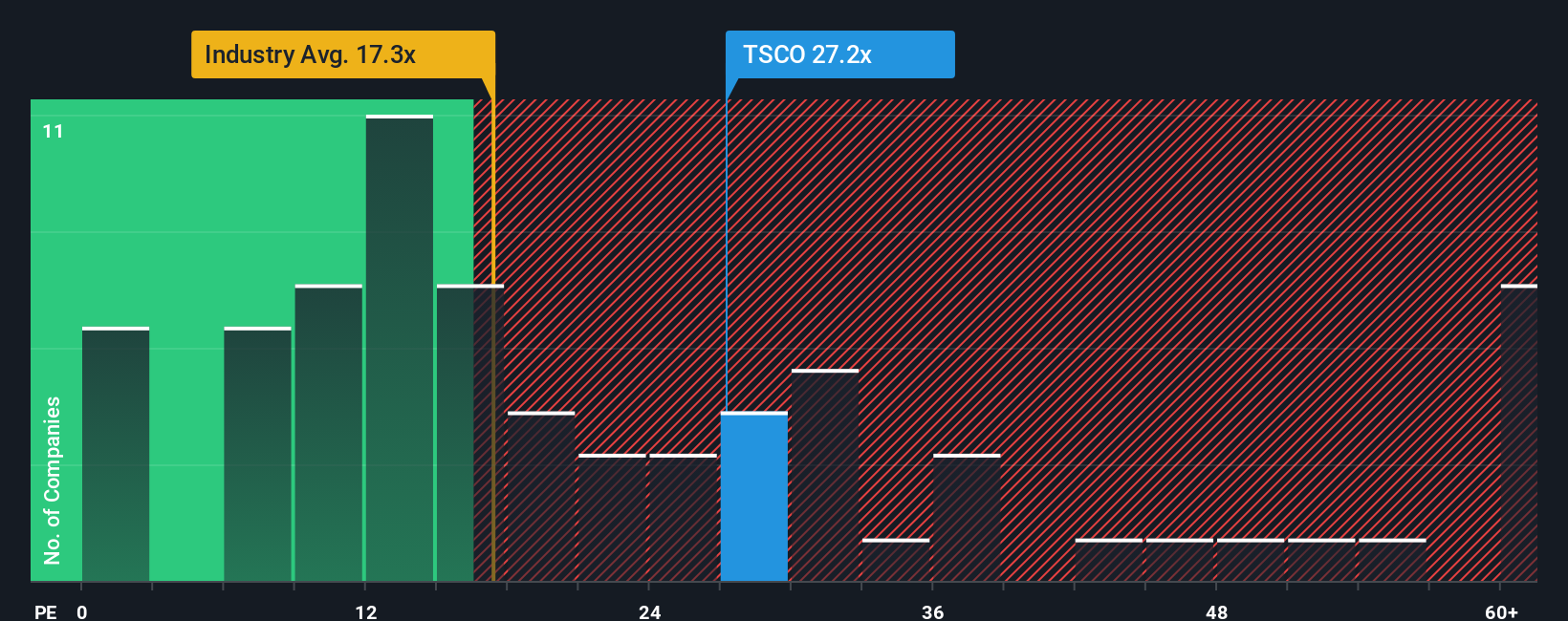

Step away from the narrative fair value and the picture shifts. On earnings, Tractor Supply trades at about 24.8 times profits, versus a 20.2 times average for US specialty retail and a fair ratio of 18.7 times. That richer multiple points to valuation risk if growth expectations slip, not a clear bargain. Is the story strong enough to keep investors paying up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tractor Supply Narrative

If you see the numbers differently or want to stress test your own thesis from the ground up, you can build a full custom view in just a few minutes, Do it your way.

A great starting point for your Tractor Supply research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity with targeted stock ideas from the Simply Wall St screener, built to match your strategy.

- Capture early growth stories by reviewing these 3606 penny stocks with strong financials that already show stronger balance sheets and improving fundamentals.

- Position your portfolio for the next productivity boom by scanning these 26 AI penny stocks powering real world applications of artificial intelligence.

- Strengthen your income stream with these 13 dividend stocks with yields > 3% that have the potential to keep paying you even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com