Did ThaiBev’s (SGX:Y92) Steady Dividend Amid Spirits Slowdown Redefine Its Risk‑Reward Tradeoff?

- Thai Beverage Public Company Limited has released its FY2025 results, revealing profit pressure as softer spirits demand offset resilient gross profit and improved beer profitability, while confirming a full-year dividend of THB 0.62 per share.

- An interesting angle for investors is management’s decision to maintain the dividend and reaffirm long-term investment plans in Vietnam despite macroeconomic and regulatory challenges.

- We’ll now examine how the maintained dividend amid spirits weakness could influence Thai Beverage’s existing investment narrative and risk profile.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Thai Beverage Investment Narrative Recap

To own Thai Beverage, you need to be comfortable with a business anchored in Thai and regional alcohol consumption, with beer and non-alcoholic growth offsetting softer spirits. The latest results add near term earnings pressure but do not fundamentally change the main catalyst around beer margin improvement or the key risk from regulatory uncertainty in core markets such as Vietnam and Thailand.

The reaffirmed full year dividend of THB 0.62 per share, despite weaker spirits profits, is the most relevant new development here, because it keeps income visibility intact while the beer business benefits from better profitability. For investors focused on upcoming catalysts such as a potential BeerCo IPO, the combination of maintained payouts and beer margin progress is an important context for assessing how much risk they are willing to accept for that potential upside.

Yet despite the steady dividend, investors should be aware that potential changes to spirits licensing laws in Thailand could...

Read the full narrative on Thai Beverage (it's free!)

Thai Beverage's narrative projects THB428.4 billion revenue and THB39.0 billion earnings by 2028. This requires 7.6% yearly revenue growth and an earnings increase of about THB12.3 billion from THB26.7 billion today.

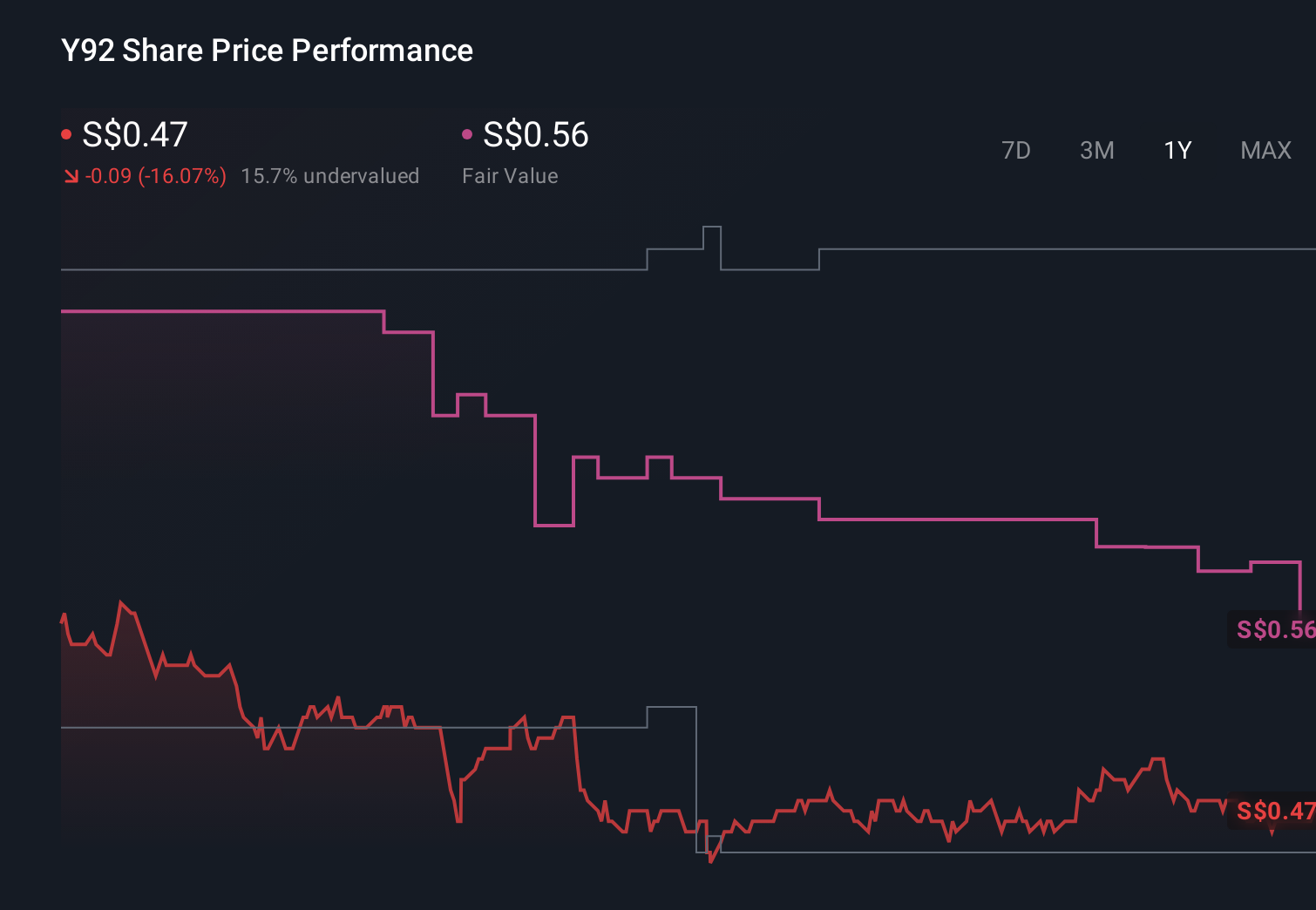

Uncover how Thai Beverage's forecasts yield a SGD0.558 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community currently see Thai Beverage’s fair value between S$0.39 and S$1.20, reflecting very different expectations. When you set those views against profit pressure from softer spirits demand, it becomes even more important to weigh how regulatory and earnings risks might shape the company’s future performance before forming your own stance.

Explore 9 other fair value estimates on Thai Beverage - why the stock might be worth 18% less than the current price!

Build Your Own Thai Beverage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thai Beverage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Thai Beverage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thai Beverage's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com