How Investors May Respond To ACI Worldwide (ACIW) Winning New Payments Deals With BanKo and LLP

- Recently, BPI Direct BanKo and LLP Exotic Auto Finance each announced new partnerships with ACI Worldwide to overhaul their payment infrastructures, adopting ACI’s issuing, acquiring and Speedpay platforms to support real-time, omnichannel and digital wallet–enabled transactions.

- These wins highlight how ACI’s modular, cloud-ready payment solutions are being used across very different customer segments, from microfinance in the Philippines to US luxury auto finance, to cut costs, ease compliance and improve digital customer experiences.

- We’ll now examine how ACI’s expanded role powering BanKo’s microfinance payments and LLP’s digital bill pay could influence its broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

ACI Worldwide Investment Narrative Recap

To own ACI Worldwide, you need to believe it can convert its established payments footprint and growing recurring software base into steadier growth, despite competition and ongoing platform investment needs. The BanKo and LLP wins support the near term catalyst of expanding ARR and cross sell into banks and billers, but they do not materially change the key risk that heavier spend on cloud native and AI capabilities could pressure margins if revenue growth slows.

The BanKo deal is particularly relevant, because it showcases ACI’s issuing and acquiring platform as a core infrastructure upgrade for a fast growing microfinance bank, aligning with the catalyst around Connetic and real time payments. If ACI can replicate this type of infrastructure replacement across more banks and emerging market institutions, it could deepen switching costs and help smooth out the contract timing volatility that has made Payment Software results uneven.

Yet while these contract wins sound encouraging, investors still need to weigh the risk that rising spend on next generation platforms could compress profits just as...

Read the full narrative on ACI Worldwide (it's free!)

ACI Worldwide's narrative projects $2.0 billion revenue and $277.3 million earnings by 2028.

Uncover how ACI Worldwide's forecasts yield a $64.60 fair value, a 36% upside to its current price.

Exploring Other Perspectives

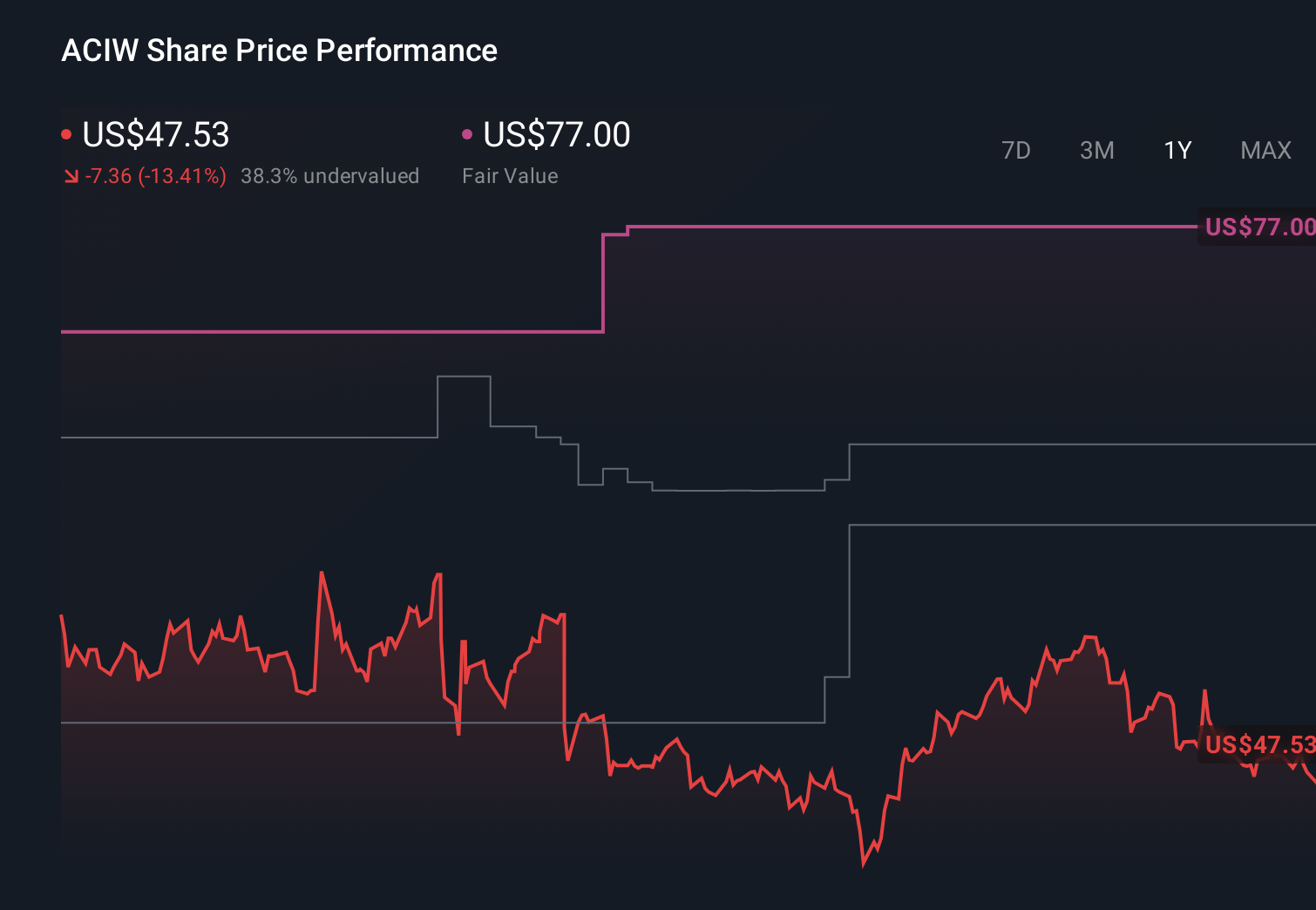

Eight fair value estimates from the Simply Wall St Community span about US$37.66 to US$77 per share, underscoring how far apart individual views can be. As you weigh those opinions against ACI’s need for continued heavy investment in next generation platforms, it is worth exploring several alternative viewpoints on how that spending might shape future performance.

Explore 8 other fair value estimates on ACI Worldwide - why the stock might be worth 21% less than the current price!

Build Your Own ACI Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ACI Worldwide research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ACI Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ACI Worldwide's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com