Is Metallium (ASX:MTM) Quietly Reframing Its Tech Licensing Strategy With This Flash Joule Deal?

- Earlier this week, Metallium Limited, via its wholly owned subsidiary Flash Metals USA Inc., signed a binding Letter of Intent with ElementUSA to deploy its Flash Joule Heating technology for recovering gallium and scandium from red mud at a planned demonstration facility in Gramercy, Louisiana, backed by up to US$10.10 million in non-dilutive funding.

- The agreement not only secures a commercial framework of license fees, royalties and revenue sharing, but also preserves Metallium’s full ownership of its Flash Joule Heating intellectual property while opening the door to future work on additional materials such as aluminum, titanium and sodium.

- We’ll now examine how the non-dilutive funding for Flash Joule Heating deployment may influence Metallium’s investment narrative and long-term positioning.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Metallium's Investment Narrative?

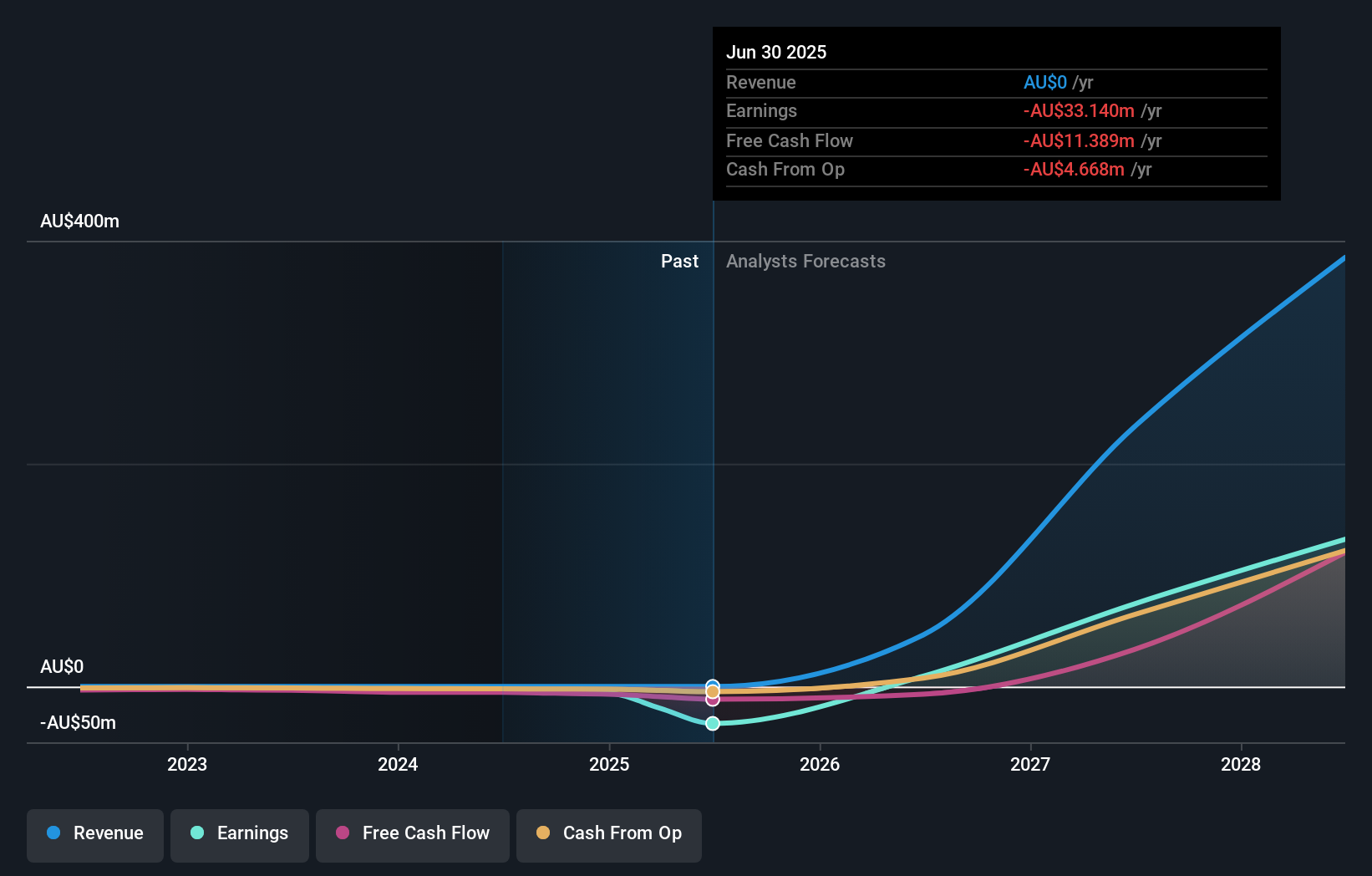

To own Metallium, you need to believe Flash Joule Heating can become a commercially relevant processing platform across critical metals, not just a clever lab technology. That belief sits alongside a very early-stage financial profile, with no meaningful revenue, widening losses of A$33.1 million and a history of dilution to fund development. In that context, the ElementUSA LOI looks material in the short term: up to US$10.10 million of non-dilutive funding helps relieve immediate cash runway pressure and could shift near-term catalysts toward execution milestones at the Gramercy demonstration facility and follow-on licensing deals. It also strengthens the licensing and royalty narrative that many shareholders are already banking on. The flip side is execution and timing risk if development and licensing agreements slip or performance underwhelms expectations.

However, investors should be aware of how quickly further capital might still be needed. Despite retreating, Metallium's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 5 other fair value estimates on Metallium - why the stock might be worth just A$1.82!

Build Your Own Metallium Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Metallium research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Metallium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Metallium's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com