Banc of California (BANC): Reassessing Valuation After Strong Q3 2025 Beat, Dividend Boost and Buybacks

The latest leg higher in Banc of California (BANC) stock came right after its third quarter 2025 earnings beat, a fresh cash dividend declaration, and management leaning in with share buybacks.

See our latest analysis for Banc of California.

Those fundamentals seem to be showing up in the tape too, with Banc of California’s share price up roughly 30 percent on a year to date basis and about 22 percent total shareholder return over the past year. This suggests momentum is building as investors reassess its earnings power and risk profile.

If this mix of improving fundamentals and returning capital has your attention, it could be a good time to explore fast growing stocks with high insider ownership as potential next wave candidates.

Yet with the stock near 52 week highs, trading only modestly below analyst targets despite double digit revenue and earnings growth, the key question now is whether Banc of California still offers upside or if the market is already discounting that future growth.

Most Popular Narrative Narrative: 2.8% Undervalued

With Banc of California last closing at $19.83 against a narrative fair value of about $20.41, the story leans slightly in favor of further upside.

The analysts have a consensus price target of $17.773 for Banc of California based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $15.0.

Curious how steady double digit growth, rising margins, and a lower future earnings multiple can still argue for upside from here? The narrative explains the full math in detail.

Result: Fair Value of $20.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on the Pacific Western integration, or a sharper than expected downturn in Southern California commercial real estate, could quickly undermine this upside case.

Find out about the key risks to this Banc of California narrative.

Another Take On Valuation

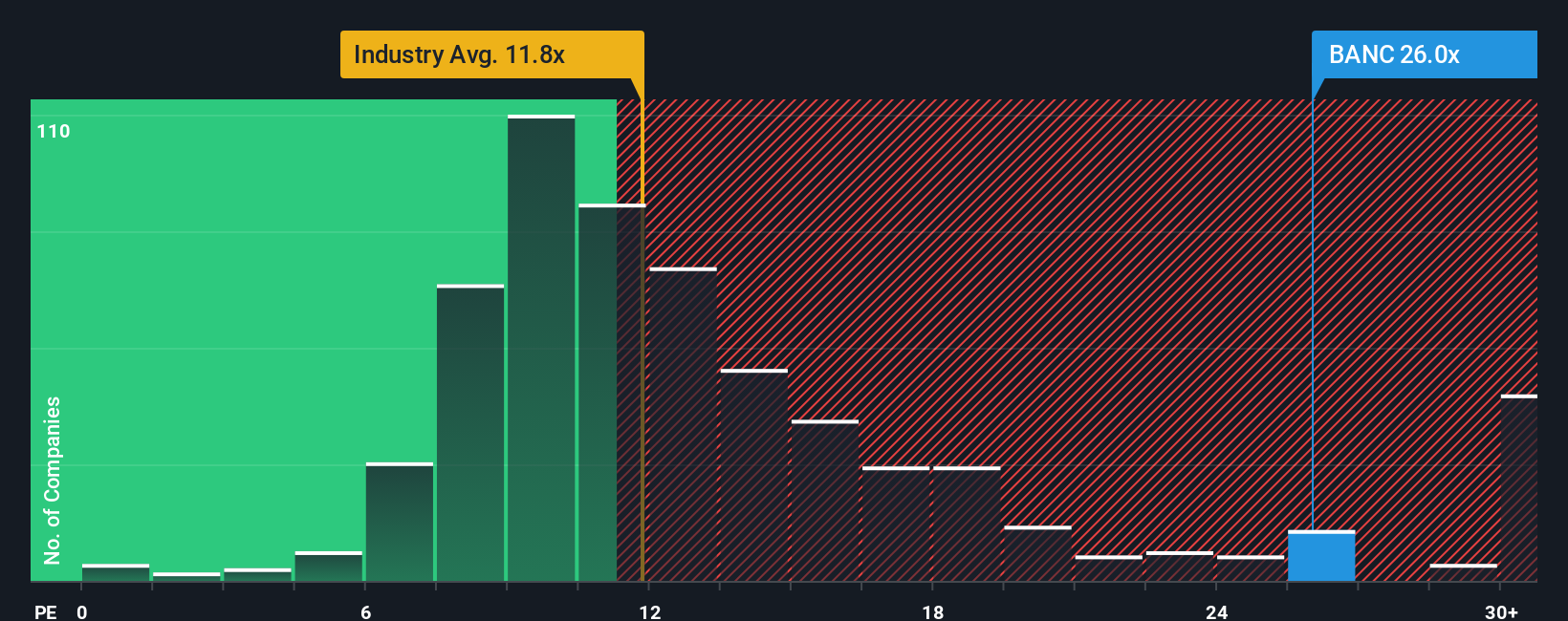

Our fair value work points to Banc of California being around 7.6 percent below intrinsic value, but its price to earnings ratio of 18.3 times sits above both the US banks industry at 12 times and a fair ratio of 16.6 times, which hints at less margin for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Banc of California Narrative

If you would rather examine the numbers yourself and challenge this view, you can build a personalized Banc of California storyline in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Banc of California.

Ready for your next investing edge?

Before the market moves on without you, put the Simply Wall Street Screener to work and line up your next high conviction opportunities in minutes.

- Capitalize on mispriced quality by targeting companies trading below intrinsic value through these 907 undervalued stocks based on cash flows and position yourself ahead of a potential rerating.

- Ride structural tailwinds in digital assets by tracking innovators linked to blockchain infrastructure with these 80 cryptocurrency and blockchain stocks, before sentiment swings back in their favor.

- Lock in potential income streams by reviewing businesses that consistently pay attractive yields via these 13 dividend stocks with yields > 3%, so your portfolio keeps working even when prices stall.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com