KION GROUP (XTRA:KGX) Valuation Check After a 98.7% One-Year Share Price Rebound

Why KION GROUP Is Back on Investors Radar

KION GROUP (XTRA:KGX) has quietly staged a powerful comeback, with the share price more than doubling over the past year while earnings and revenue growth have started to catch up.

See our latest analysis for KION GROUP.

That backdrop helps explain why, even after a small recent pullback, the 90 day share price return of 13.09 percent and one year total shareholder return of 98.69 percent suggest momentum is still firmly building.

If KION's run has you thinking about what else might be gearing up for a strong cycle, this is a good moment to explore auto manufacturers as potential next ideas.

With earnings rebounding, revenue ticking higher, and the share price now sitting almost level with analyst targets yet still well below some intrinsic value estimates, is KION a late-cycle buy, or has the market already priced in its recovery?

Most Popular Narrative Narrative: 0% Overvalued

With KION GROUP's fair value estimate of €64.45 sitting almost level with the last close at €64.80, the leading narrative sees only modest upside baked in.

The marked increase in modernization and upgrade projects (up 57% YoY in H1), together with high e commerce activity, serves as a leading indicator that other verticals are likely to reactivate investment as macroeconomic uncertainty eases, potentially resulting in a broader upswing in order intake and revenues across additional customer segments.

Want to see what kind of revenue runway and margin lift this scenario is built on? The narrative leans on surprisingly ambitious profitability and growth assumptions. Curious which moving parts matter most to that fair value call?

Result: Fair Value of €64.45 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on e commerce and intensifying competition in warehouse automation could quickly challenge the upbeat growth and margin assumptions behind this narrative.

Find out about the key risks to this KION GROUP narrative.

Another Lens on Value

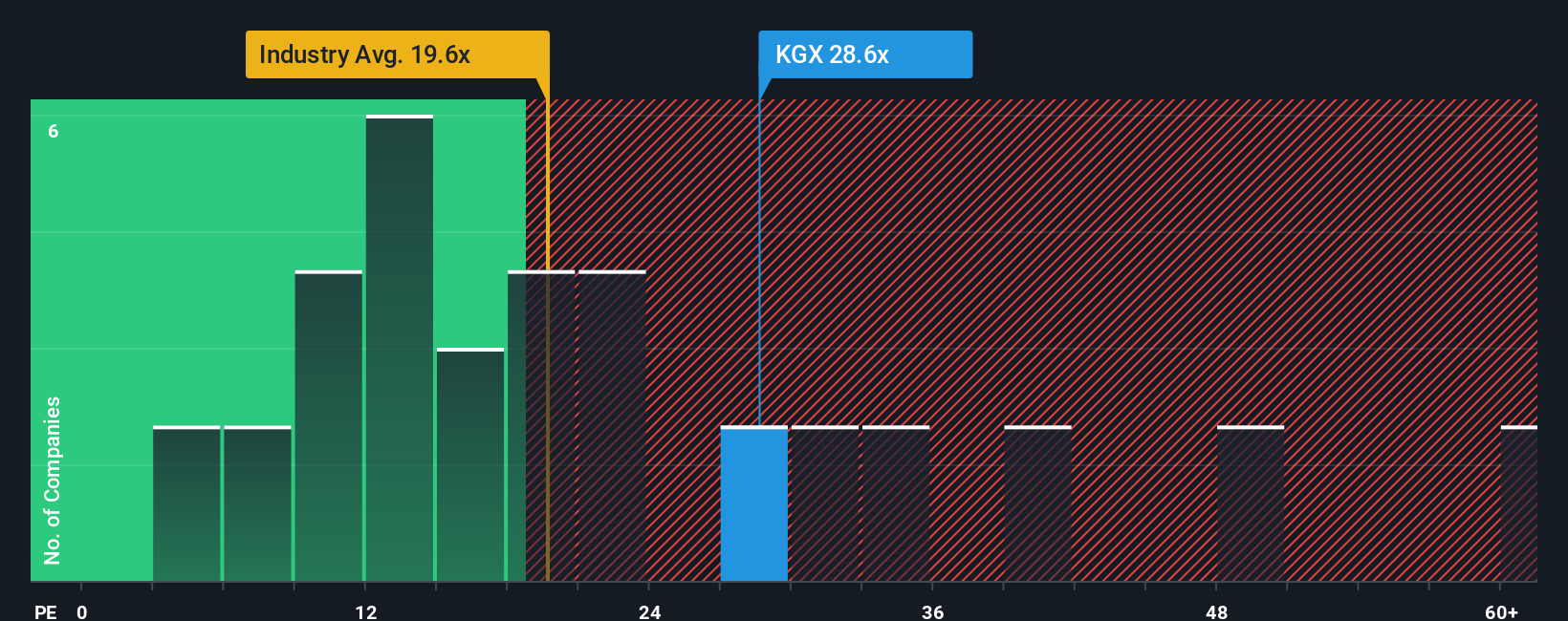

While the fair value narrative pegs KION at roughly fairly priced, a different angle using its earnings ratio paints a sharper picture. The shares trade on a 31.3x price to earnings multiple, versus a 21.3x industry average and a 30.1x peer average, yet below a 39.1x fair ratio.

This gap suggests the market already prices in a premium story, but still leaves room for sentiment to swing higher or lower if expectations shift. This raises the question: is this a margin of safety or a valuation trap if growth underdelivers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KION GROUP Narrative

If this perspective does not quite fit your view, or you prefer to dig into the numbers yourself, you can build a tailored narrative in just a few minutes: Do it your way.

A great starting point for your KION GROUP research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about staying ahead of the crowd, let Simply Wall St's powerful Screener show you where the next compelling opportunities could be hiding.

- Capture potential multi baggers early by scanning these 3610 penny stocks with strong financials that already back their promise with stronger financials than most tiny names ever achieve.

- Position your portfolio for the next productivity revolution by targeting these 26 AI penny stocks at the forefront of real world artificial intelligence adoption, not just hype.

- Identify possible value opportunities by pinpointing these 903 undervalued stocks based on cash flows that trade at discounts to their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com