NEOJAPAN (TSE:3921) Margin Expansion Reinforces Bullish Narratives After 60% Earnings Growth

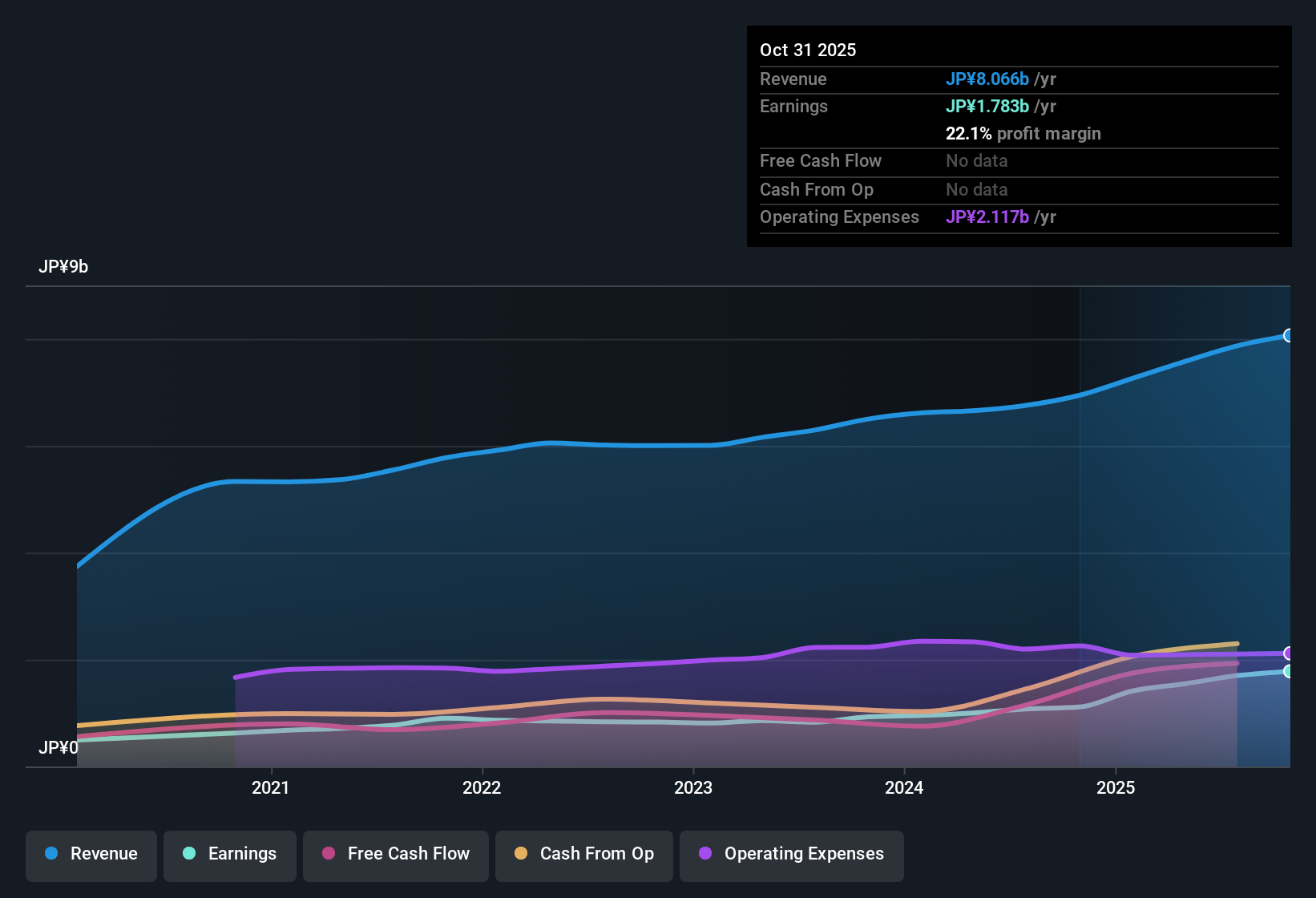

NEOJAPAN (TSE:3921) has posted another solid set of numbers for Q3 2026, with revenue of ¥2.1 billion and EPS of ¥33.05 anchoring a period that caps off 60.1% earnings growth over the past year and a trailing net profit margin of 22.1% versus 16% a year earlier. The company has seen quarterly revenue move from ¥1.68 billion in Q2 2025 to ¥2.11 billion in Q3 2026, while EPS climbed from ¥20.53 to ¥33.05 over the same stretch, setting up a story of steadily improving profitability that investors will be watching closely as margins continue to firm.

See our full analysis for NEOJAPAN.With the headline numbers on the table, the next step is to see how this earnings momentum lines up with the dominant narratives around NEOJAPAN, and where the latest margin performance might start to shift sentiment.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM earnings climb 60.1 percent

- Over the last 12 months, NEOJAPAN’s net income excluding extra items rose 60.1 percent to ¥1,782.9 million on trailing revenue of about ¥8.1 billion, versus ¥1,113.6 million on roughly ¥6.9 billion of revenue a year earlier.

- For investors taking a bullish view, what stands out is how this trailing growth lines up with a longer five year annualised earnings growth rate of 18.3 percent, which:

- Indicates that the recent 60.1 percent jump is building on an already solid multi year trend rather than a one off spike.

- Occurs alongside relatively steady quarterly basic EPS in 2026, at around ¥32 to ¥33 per share in each of the first three quarters, which supports the view that profitability has been consistently strong through the current year.

Margins expand to 22.1 percent

- Trailing net profit margin improved to 22.1 percent from 16 percent a year earlier, while quarterly net income excluding extra items has risen from ¥287 million in Q2 2025 to ¥463.3 million in Q3 2026 as revenue moved from ¥1,679 million to ¥2,114.4 million over the same period.

- Supporters of the bullish narrative point to this margin step up as a key part of the story, and the numbers illustrate that in several ways:

- The higher 22.1 percent margin on about ¥8.1 billion of trailing revenue means more of each yen of sales is dropping to profit than when the margin was 16 percent on roughly ¥6.9 billion of revenue.

- Across the last six reported quarters, basic EPS has climbed from ¥20.53 in Q2 2025 to ¥33.05 in Q3 2026, which is used to support the claim that operating leverage has been working in NEOJAPAN’s favour.

Valuation discount versus peers

- At a share price of ¥1,845, NEOJAPAN trades on a trailing P E of 14.5 times, below both the Japan software industry average of 19 times and a peer group average of 25.3 times, and also below a DCF fair value estimate of ¥3,007.40 per share.

- Analysts with a bullish tilt argue that this combination of earnings growth and a lower multiple creates an attractive set up, and they highlight the size of the gap in the figures:

- The roughly 38.7 percent discount to the DCF fair value, when set against 60.1 percent trailing earnings growth and a 22.1 percent net margin, is cited in support of the view that the current price does not fully reflect recent performance.

- The P E sitting well under both peer and industry averages despite the described earnings quality highlights a tension that bullish investors see as an opportunity for rerating if the current growth and margin profile is sustained.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on NEOJAPAN's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite rapid earnings and margin expansion, NEOJAPAN still faces uncertainty around how durable this pace will be and whether the current valuation fully compensates for that risk.

If you want ideas where robust fundamentals are already paired with clear upside potential, use our these 903 undervalued stocks based on cash flows to quickly find companies trading at more compelling valuations today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com