Is It Too Late To Consider Nextpower After Its 2025 Rally And Solar Expansion Deals?

- If you are wondering whether Nextpower is still a smart buy after its huge run up, or if you have already missed the sweet spot, this article will walk through what the current price really implies.

- Despite pulling back around 4.2% over the last week and 10.1% over the past month, the stock is still up about 119.6% year to date and 144.6% over the last year. This naturally raises questions about whether the market has gotten ahead of itself.

- Recent headlines have focused on Nextpower expanding its footprint in utility scale solar projects and securing new long term supply partnerships, which investors often read as a sign of rising growth potential. At the same time, broader clean energy sentiment and shifting expectations around interest rates have added extra volatility, helping to explain the sharp moves in the share price.

- On our framework, Nextpower currently scores a 4 out of 6 valuation checks. This suggests it still looks undervalued on several fronts, and we will unpack those methods in detail before finishing with a more complete way to think about its true long term value.

Approach 1: Nextpower Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those cash flows back to the present.

For Nextpower, the latest twelve month Free Cash Flow is about $620.8 Million. Analysts and internal estimates project this to rise steadily, reaching around $911.8 Million by 2030, with further growth assumptions extending out to 2035 based on Simply Wall St’s two stage Free Cash Flow to Equity model. These forecasts blend explicit analyst estimates for the next few years with moderated growth projections thereafter.

When all those future cash flows are discounted back, the model arrives at an intrinsic value of roughly $100.53 per share. Compared with the current share price, this implies the stock is about 13.7% undervalued, indicating the market may not be fully pricing in Nextpower’s expected cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nextpower is undervalued by 13.7%. Track this in your watchlist or portfolio, or discover 902 more undervalued stocks based on cash flows.

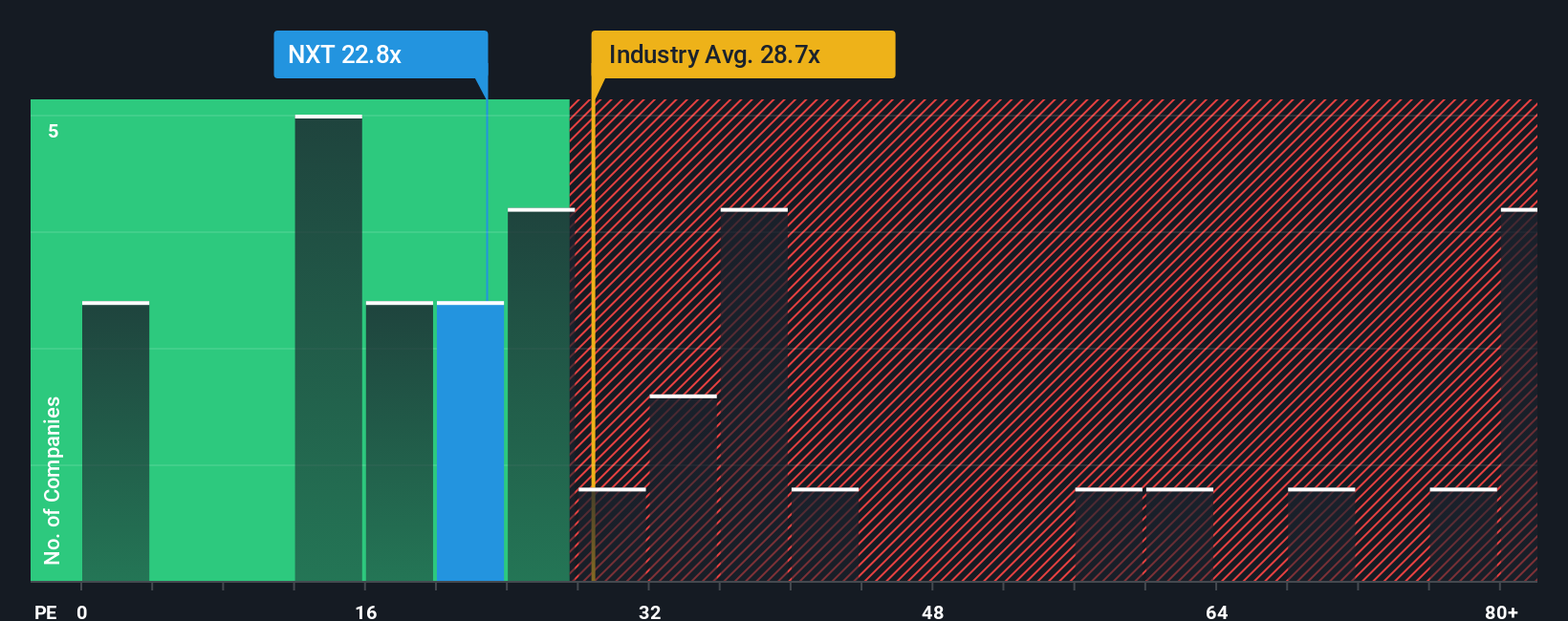

Approach 2: Nextpower Price vs Earnings

For profitable companies like Nextpower, the Price to Earnings, or PE, ratio is a useful way to gauge value because it directly links what investors are paying for each dollar of current earnings. In practice, higher growth and lower perceived risk tend to justify a higher normal PE, while slower growth or elevated risk usually warrant a lower one.

Nextpower currently trades on a PE of about 22.34x. That is noticeably below both the Electrical industry average of roughly 31.62x and the broader peer group average of about 38.07x, suggesting the market is applying a discount relative to similar businesses. Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE multiple Nextpower should trade on, given its earnings growth outlook, profitability, industry, market cap and risk profile. This proprietary Fair Ratio for Nextpower is 31.07x, which is more tailored than a simple comparison with peers or industry averages because it adjusts for the company’s specific strengths and risks.

With the stock trading at 22.34x versus a Fair Ratio of 31.07x, the multiple analysis points to Nextpower being undervalued on earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nextpower Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple stories that explain your view on a company and connect it to a set of numbers like future revenue, earnings, margins and ultimately a fair value estimate. A Narrative on Simply Wall St’s Community page starts with your perspective on the business, links that story to a clear financial forecast, and then turns it into a fair value that you can compare to the current share price to decide whether to buy, hold or sell. Narratives are easy to create and follow, are used by millions of investors on the platform, and they automatically update as new information such as company news, guidance changes or earnings results come in, so your view never goes stale. For example, one Nextpower Narrative might lean into its global expansion and innovation to justify a fair value well above the current price. In contrast, a more cautious Narrative could focus on margin pressure, geographic concentration risk and regulatory uncertainty to arrive at a much lower fair value instead.

Do you think there's more to the story for Nextpower? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com