Does BioCryst’s DCF and Sales Multiple Suggest a Bargain After Recent HAE Progress?

- If you have been wondering whether BioCryst Pharmaceuticals at around $7.57 is a bargain or a value trap, you are not alone. This article is aimed squarely at that question.

- Despite a choppy few years, the stock has edged up about 5.4% over the last month, while still roughly flat over the past year and well below levels from three years ago. That hints that sentiment might be cautiously shifting, but the long term story is still being debated.

- Recent headlines have focused on BioCryst's progress with its hereditary angioedema treatment and its broader pipeline of rare disease therapies, drawing fresh attention from both specialists and generalist investors. At the same time, discussions around the company often highlight its funding position and commercial ramp, which helps explain why the share price has been oscillating rather than moving in a straight line.

- On our framework, BioCryst scores a solid 5 out of 6 on valuation checks. Next we will unpack what that actually means across different valuation approaches, before closing with a more intuitive way to judge whether the current price really makes sense.

Find out why BioCryst Pharmaceuticals's 0.5% return over the last year is lagging behind its peers.

Approach 1: BioCryst Pharmaceuticals Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those amounts back to today. For BioCryst Pharmaceuticals, the model starts with last twelve month Free Cash Flow of about $47.7 million and uses analyst forecasts for the next few years, then extends those trends further out to 2035.

On this basis, Simply Wall St expects BioCryst’s Free Cash Flow to rise to roughly $392.3 million by 2029, with longer term projections reaching over $900 million by 2035. These future cash flows are then discounted to today’s dollars using a 2 Stage Free Cash Flow to Equity approach. This reflects higher uncertainty further out.

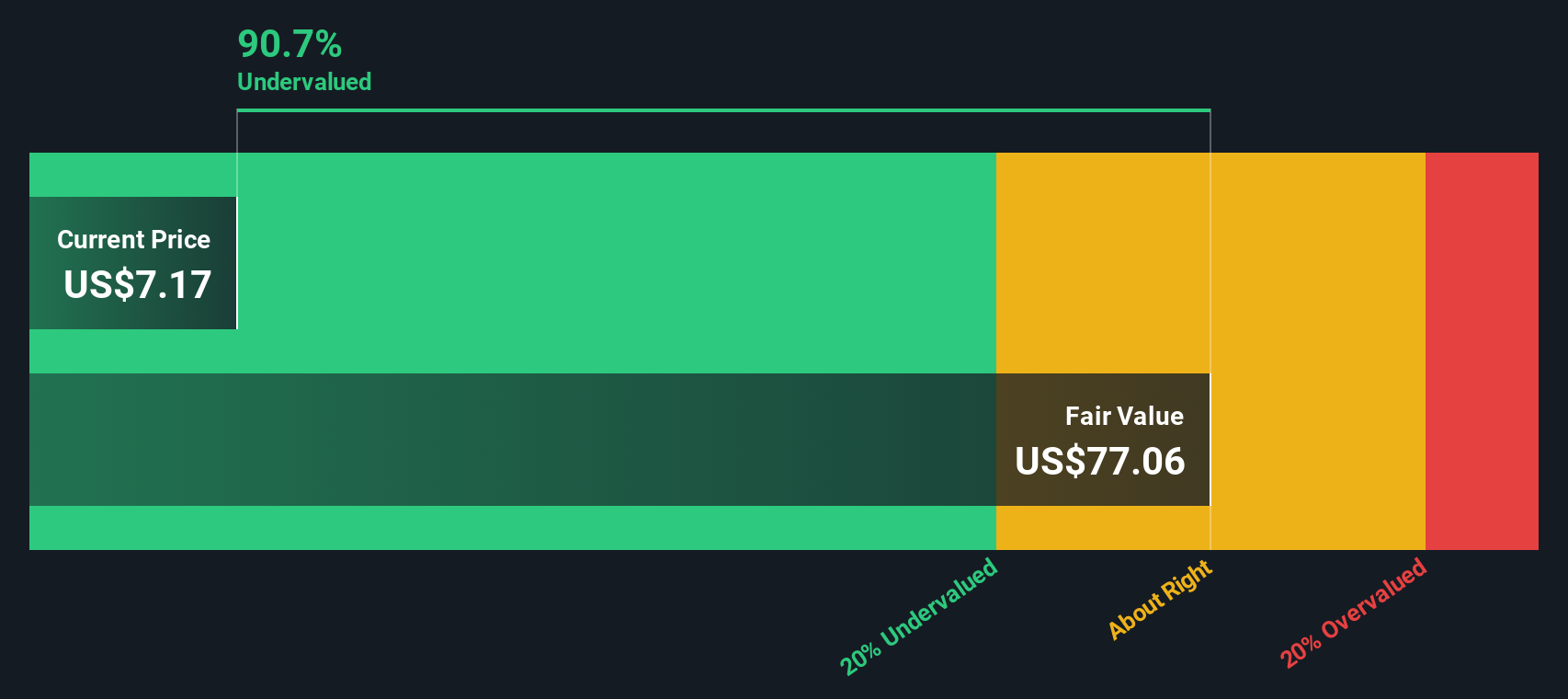

Putting all of this together, the model arrives at an intrinsic value of about $62.45 per share. Compared with the recent share price around $7.57, the DCF suggests the stock is roughly 87.9% undervalued. This implies very substantial potential upside if the cash flow trajectory is achieved.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BioCryst Pharmaceuticals is undervalued by 87.9%. Track this in your watchlist or portfolio, or discover 901 more undervalued stocks based on cash flows.

Approach 2: BioCryst Pharmaceuticals Price vs Sales

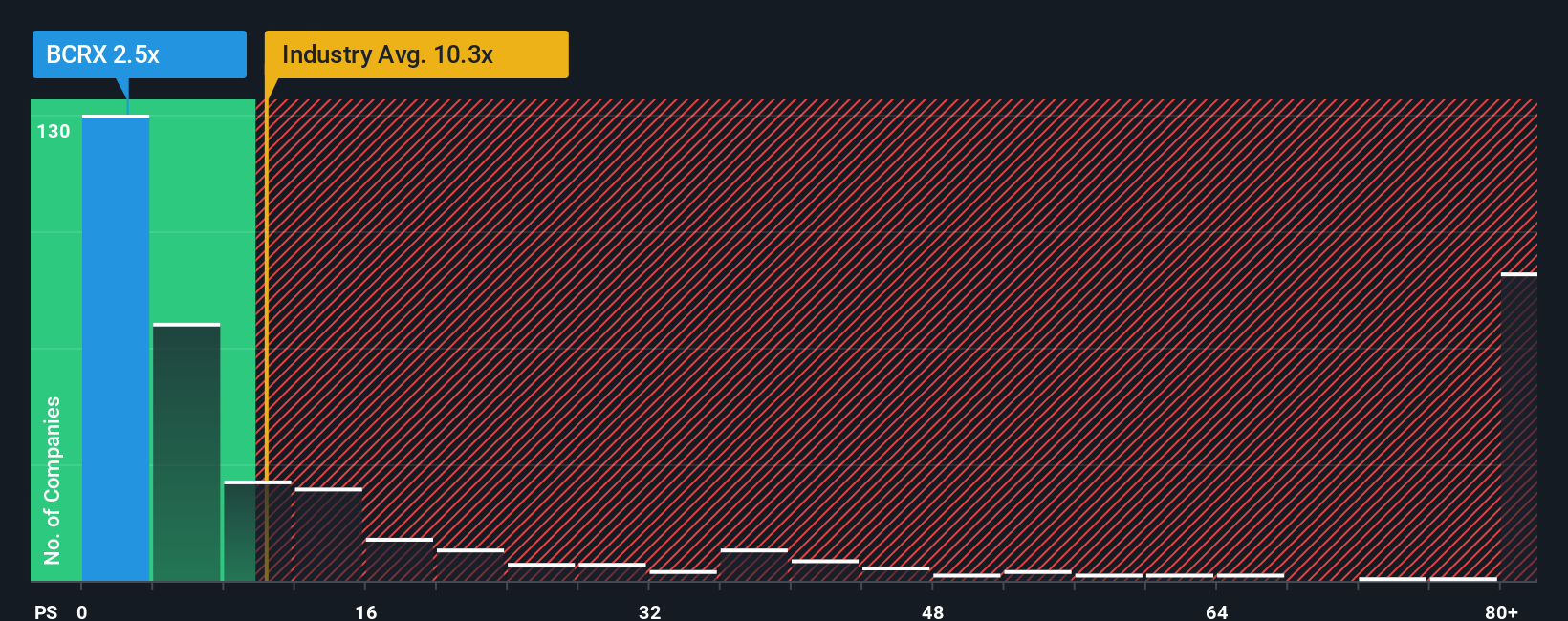

For a company like BioCryst that is still loss making but generating meaningful revenue, the Price to Sales ratio is a practical way to gauge valuation because it focuses on what investors are paying for each dollar of current sales rather than profits that are not yet steady.

In general, faster growing and less risky businesses can justify a higher Price to Sales multiple, while slower or riskier names typically warrant a lower one. BioCryst currently trades on about 2.66x sales, which is well below the broader Biotechs industry average of around 12.08x and also below the peer group average of roughly 13.52x. Simply Wall St’s proprietary Fair Ratio for BioCryst is 4.51x. This reflects expectations for its growth, profitability potential, industry dynamics, market cap and specific risk profile.

This Fair Ratio is more tailored than a simple comparison with peers or the industry because it adjusts for BioCryst’s own growth runway, margins and risk, rather than assuming it should trade like a typical biotech. Comparing the Fair Ratio of 4.51x with the current 2.66x suggests the shares are trading at a meaningful discount on this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BioCryst Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply the stories investors tell about a company, backed by their own assumptions for future revenue, earnings, margins and fair value. A Narrative connects three things in a straight line: what you believe about the business, how that belief translates into a financial forecast, and the fair value that drops out of those numbers, making it much easier to see whether today’s price looks cheap or expensive. Narratives on Simply Wall St, available to everyone on the Community page used by millions of investors, then help you decide whether to buy, hold or sell by comparing each Narrative’s Fair Value against the live share price, updating automatically as new news, earnings or guidance arrives. For BioCryst, for example, one investor might focus on ORLADEYO momentum, pipeline optionality and the Astria deal and land on a fair value above $20 per share, while a more cautious investor, worried about HAE competition, single product risk and execution on the acquisition, might set fair value closer to $11.

Do you think there's more to the story for BioCryst Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com