FIT EASY (TSE:212A) Net Margin Slip Tests Bullish Growth Narrative After FY 2025 Results

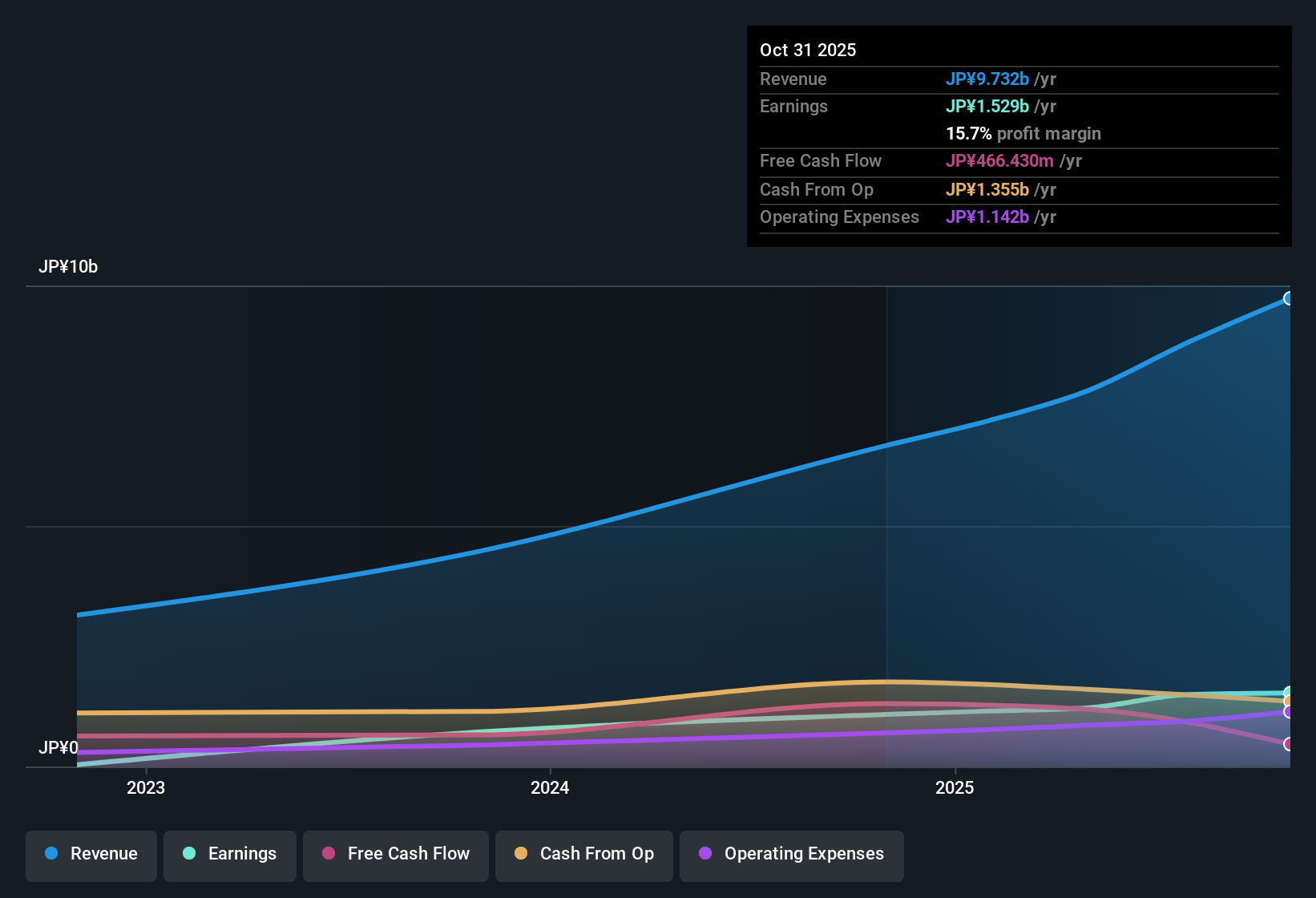

FIT EASY (TSE:212A) has just wrapped up FY 2025 with fourth quarter revenue of ¥2.8 billion and EPS of ¥21.5, capping off a year where trailing twelve month revenue reached ¥9.7 billion and EPS came in at ¥96.1. The company has seen revenue climb from ¥4.5 billion and EPS of ¥48.4 in FY 2023 to ¥6.7 billion and EPS of ¥71.2 in FY 2024, and now to ¥9.7 billion and EPS of ¥96.1 on a trailing basis. This sets the stage for investors to focus on how durable those margins really are as growth expectations build into the latest print.

See our full analysis for FIT EASY.With the headline numbers on the table, the next step is to see how this pace of revenue and EPS growth compares with the main narratives around FIT EASY, and where the latest margin trends might reinforce or challenge what investors expect from here.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM Net Margin Slips To 15.7%

- On a trailing basis, FIT EASY generated ¥1,528.8 million of net income on ¥9,731.5 million of revenue, which translates into a 15.7% net margin versus 16.2% a year earlier.

- What stands out for a bullish take is that revenue is forecast to grow about 10.6% per year and earnings about 11.9% per year. This sits alongside the slightly lower margin and a 41.3% year on year earnings increase, which means:

- The strong growth profile is backed by both the historic jump in reported earnings and above market revenue forecasts, even though margins have eased a little from last year.

- Supporters can still point to the combination of double digit growth expectations and mid teens profitability as evidence that the business is scaling rather than just growing the top line.

Revenue Track Moves Toward ¥10 Billion

- Trailing twelve month revenue has risen from ¥4,481.3 million in FY 2023 to ¥6,673.5 million in FY 2024 and now ¥9,731.5 million, while net income over the same windows moved from ¥722.4 million to ¥1,082.1 million and then to ¥1,528.8 million.

- Consensus narrative style growth expectations are that revenue will keep expanding at roughly 10.6% per year and earnings at about 11.9% per year. When these expectations are set against this multi year step up in revenue and net income:

- The pattern of steadily higher trailing revenue and profits gives numerical backing to the idea that the business has been building scale rather than relying on one off gains.

- At the same time, the modest dip in net margin from 16.2% to 15.7% shows that part of that growth has come with some pressure on profitability even as overall earnings climb.

High Growth Expectations Meet Premium Valuation

- At a share price of ¥2,361, FIT EASY trades on a 25.5x P E multiple versus a peer average of 17.5x and industry average of 23.6x, and well above a DCF fair value of ¥382.27.

- Critics highlight the major risk of high non cash earnings alongside this premium valuation, and that tension shows up clearly in the numbers:

- The gap between the current price and DCF fair value, together with a trailing margin that is slightly below last year, underlines why some see limited room for disappointment despite the 41.3% reported earnings growth.

- Recent share price volatility over the past three months adds another concrete data point for bearish investors who question how firmly this valuation is supported by cash based performance.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on FIT EASY's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

FIT EASY combines fast headline growth with a slipping net margin and a share price that screens as significantly above discounted cash flow fair value.

If stretched valuation and limited margin headroom concern you, use our these 901 undervalued stocks based on cash flows to quickly find companies where pricing looks more reasonable against their underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com