Precision Tsugami China (SEHK:1651) Margin Gain Reinforces Bullish Earnings Narrative in H1 2026

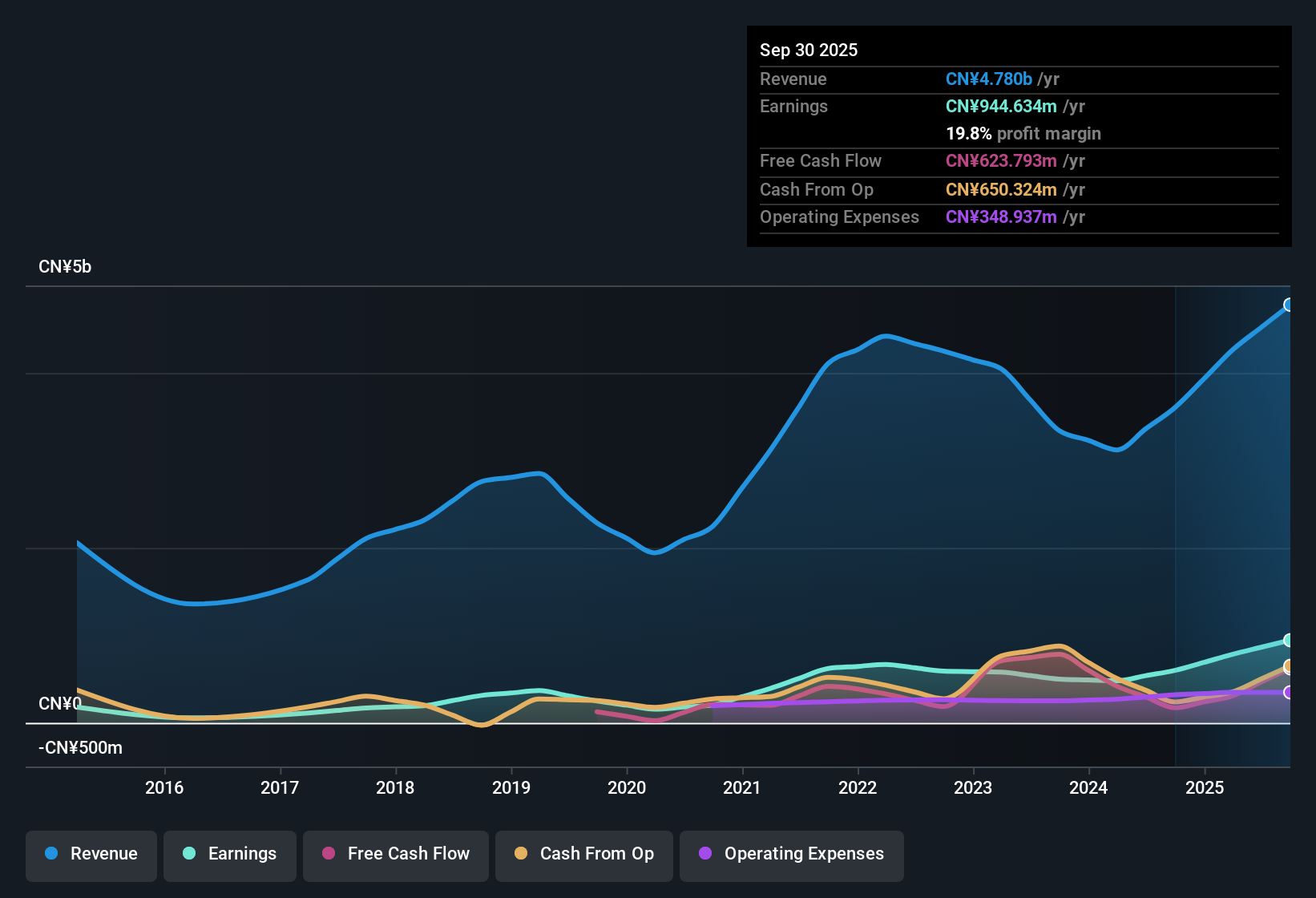

Precision Tsugami China (SEHK:1651) has posted another busy half, with H1 2026 revenue coming in at about CNY 2.5 billion and basic EPS at CNY 1.36, setting the tone for a solid first leg of the fiscal year. The company has seen revenue climb from CNY 2,283.5 million in H2 2025 and CNY 1,978.1 million in H1 2025 to CNY 2,496.9 million in H1 2026, while basic EPS moved from CNY 0.90 in H1 2025 and CNY 1.18 in H2 2025 to CNY 1.36 in the latest half, with trailing twelve month net income excluding extra items at CNY 944.6 million helping to underpin healthier profitability. All in, margins look more resilient than a year ago and this gives investors a firmer base for the growth story.

See our full analysis for Precision Tsugami (China).With the headline numbers on the table, the next step is to see how this earnings momentum lines up against the dominant narratives around Precision Tsugami China, and where the data might push investors to rethink the story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Climbs To 19.8%

- Trailing net income excluding extra items reached CNY 944.6 million on CNY 4,780.4 million of revenue, giving a 19.8 percent net margin versus 16.6 percent a year earlier.

- What is striking for a bullish view is how this margin lift lines up with faster earnings growth, as net income excluding extra items rose from CNY 598.7 million to CNY 944.6 million over the trailing twelve months while basic EPS moved from 1.58 CNY to 2.54 CNY, suggesting profitability improved even as the business scaled.

- Supporters of the growth story can point to this combination of higher margin and higher profit as evidence that the current uptrend is grounded in operating performance rather than just cost cutting.

- At the same time, anyone cautious on cyclicals can see that a move from a mid teens to high teens margin leaves less room for further easy gains if end market demand softens from here.

Revenue Forecast At 17.3 Percent A Year

- Forward looking estimates call for revenue to grow about 17.3 percent per year, ahead of the broader Hong Kong market forecast of 8.5 percent, following an actual rise in half year revenue from CNY 1,978.1 million in H1 2025 to CNY 2,496.9 million in H1 2026.

- Bullish analysis leans heavily on this above market growth profile, arguing it fits a “picks and shovels” role in advanced manufacturing, yet the numbers also show that the trailing twelve month revenue step up from CNY 3,603.3 million to CNY 4,780.4 million needs to be repeated to keep that narrative intact.

- On one hand, the 57.8 percent earnings growth over the past year alongside this double digit revenue trajectory strengthens the case that demand across automotive, electronics and automation customers has been supportive.

- On the other hand, the same high bar means any slowdown from the current 17.3 percent revenue growth pace would quickly test how much investors are willing to pay for the story at a time when the share price sits at HKD 34.46.

DCF Fair Value Far Above HKD 34.46

- The shares trade at about HKD 34.46 with a trailing P E of 12.3 times, roughly in line with the Hong Kong machinery industry at 12.2 times, while a DCF fair value of roughly HKD 95.34 points to the stock changing hands at a large discount on that model.

- What stands out for a more cautious, quasi bearish angle is the tension between this apparent valuation gap and the cash flow profile, because a 3.48 percent dividend yield is flagged as not well covered by free cash flow, raising questions about how quickly that DCF value can be realized if distributions or reinvestment choices have to be adjusted.

- Supporters can argue that with trailing net income excluding extra items at CNY 944.6 million and EPS at 2.54 CNY, the current P E and discount to DCF fair value leave room for re rating if growth and margins hold.

- Skeptics will focus on the fact that a P E only slightly cheaper than peers and an uncovered dividend mean the market may be baking in some risk that future cash generation does not fully match the optimistic DCF path.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Precision Tsugami (China)'s growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite rapid earnings and margin expansion, Precision Tsugami China faces questions over the sustainability of its uncovered dividend and the reliability of future cash generation.

If that payout risk makes you uneasy, use our these 1908 dividend stocks with yields > 3% to quickly shift your focus toward companies offering stronger, more sustainable income streams backed by healthier cash coverage.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com