Timee (TSE:215A) Margin Expansion Reinforces Bullish High-Growth Narrative After FY 2025 Results

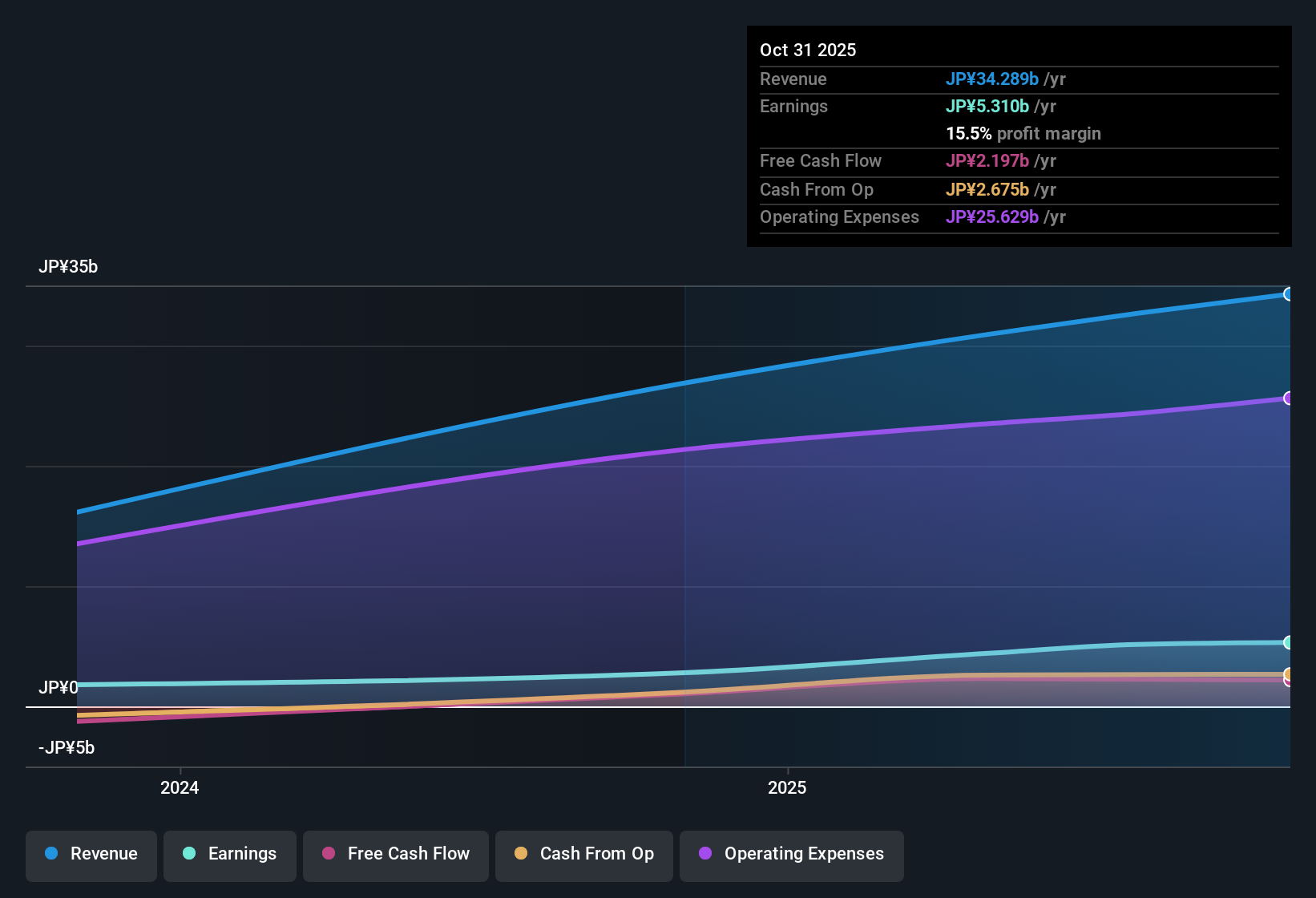

Timee (TSE:215A) has just posted its FY 2025 results, with fourth quarter revenue of ¥9.5 billion and basic EPS of ¥14.9, capping off a trailing twelve month run that saw revenue reach ¥34.3 billion and EPS of ¥53.5. Over the past few quarters the company has seen revenue move from ¥7.9 billion in Q4 FY 2024 to ¥9.5 billion in Q4 FY 2025, while quarterly EPS shifted from ¥13.8 to ¥14.9. This points to a business that is scaling on a wider profit base as margins trend higher.

See our full analysis for Timee.With the headline numbers on the table, the next step is to see how this momentum lines up with the dominant narratives around Timee and where the latest margins story might confirm or contradict what investors think they know.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Income Doubles Year on Year

- Over the last 12 months, net income rose from about ¥2,797 million to ¥5,310 million, while trailing EPS climbed from ¥29.3 to ¥53.5.

- What stands out for a bullish view is how this 102 percent earnings jump lines up with forecasts of roughly 23 percent annual earnings growth.

- Trailing revenue also expanded from about ¥26.9 billion to ¥34.3 billion, so higher profit is backed by a larger business rather than just one off cost shifts.

- Analysts looking for around 20 percent yearly revenue growth can point to this trailing step up as evidence that the platform has been scaling beyond its earlier base.

Strong post listing profit growth like this often makes investors ask whether the current trajectory can hold as the company matures.

📊 Read the full Timee Consensus Narrative.Margins Push Up To 15.8 Percent

- Trailing net margin improved from 10.5 percent to 15.8 percent, meaning more of each yen of the roughly ¥34.3 billion in sales is translating into profit.

- From a bullish angle, this margin expansion heavily supports the idea that the model gets more efficient at scale.

- Quarterly net income stayed above ¥1,250 million in every FY 2025 quarter, suggesting the higher margin level was not dependent on a single spike.

- With all four FY 2025 quarters posting EPS above ¥12, the earnings base looks more evenly spread than in FY 2024, when one quarter delivered only about ¥5.3 of EPS.

For a beginner investor, rising margins like this usually signal that fixed costs are being spread across a bigger revenue base.

Premium P E Versus Growth Outlook

- At a share price of ¥1,345, Timee trades on about 26.1 times trailing earnings, compared with roughly 13.5 times for the wider professional services group and 15.9 times for peers.

- Critics highlight that this premium valuation leans heavily on the growth story.

- Earnings and revenue are both forecast to grow a bit above 20 percent per year, which is well ahead of the 4.6 percent market revenue pace but still needs to justify paying more than industry multiples.

- The implied upside to the ¥1,762.50 analyst price target is meaningful from today’s level, so the bearish focus on a high multiple sits alongside a market that still models higher future value.

Paying up for growth like this is normal in fast expanding names, but it does leave less room if the growth path slows.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Timee's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternative Opportunities

Despite impressive margin gains and earnings growth, Timee carries a valuation premium that leaves little room for disappointment if forecasts or sentiment cool.

If paying up for this trajectory makes you uneasy, use our these 901 undervalued stocks based on cash flows to quickly focus on companies where solid fundamentals come with more conservative price tags.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com