Is SouthState Bank a Regional Standout After Recent Share Price Rebound?

- If you have been wondering whether SouthState Bank at around $96 a share is quietly turning into a value opportunity, you are not alone. This is exactly what we are going to unpack.

- The stock has climbed 4.3% over the last week and 7.2% over the past month, even though it is still down 0.9% year to date and 9.4% over the last year. This hints at shifting expectations after a tougher stretch, despite a solid 39.3% 3 year and 46.9% 5 year run.

- Recent headlines around regional banks, including SouthState, have focused on how well capitalized lenders are navigating a higher for longer interest rate backdrop and sticky funding costs. Investors are watching closely to see which franchises can grow profitably without taking on excess risk. SouthState has been mentioned in that context as a conservatively run bank with room to keep expanding in attractive Southeastern markets. This helps explain why sentiment has started to thaw even while the longer term share price picture looks mixed.

- On our checks, SouthState scores a 3/6 valuation score, suggesting it screens as undervalued on several, but not all, of the metrics we track. Next we will walk through those different valuation lenses before finishing with a more holistic way to judge whether the market is still underpricing the story.

Find out why SouthState Bank's -9.4% return over the last year is lagging behind its peers.

Approach 1: SouthState Bank Excess Returns Analysis

The Excess Returns model asks a simple question: how much profit can SouthState Bank generate above the minimum return that shareholders require on their equity, and for how long can it sustain that gap.

SouthState is modeled with a Book Value of $89.14 per share and a Stable EPS of $9.84 per share, based on weighted future Return on Equity estimates from 9 analysts. That implies an Average Return on Equity of about 10.04%, comfortably above the estimated Cost of Equity of $8.03 per share. The difference between these, the Excess Return, is $1.81 per share, which is what drives long term value creation in this framework.

As Book Value compounds toward a Stable Book Value of $98.04 per share, the model assumes SouthState can keep earning attractive returns on this growing equity base. Discounting those excess returns back to today yields an intrinsic value of roughly $134.71 per share, suggesting the stock may be about 28.7% undervalued versus the current price near $96.

Result: UNDERVALUED

Our Excess Returns analysis suggests SouthState Bank is undervalued by 28.7%. Track this in your watchlist or portfolio, or discover 901 more undervalued stocks based on cash flows.

Approach 2: SouthState Bank Price vs Earnings

For a consistently profitable bank like SouthState, the price to earnings ratio is a useful yardstick because it ties the share price directly to the cash generating power of the business. Investors typically accept a higher or lower PE depending on how quickly they expect earnings to grow, how volatile those earnings might be, and how risky the balance sheet looks through a full credit cycle.

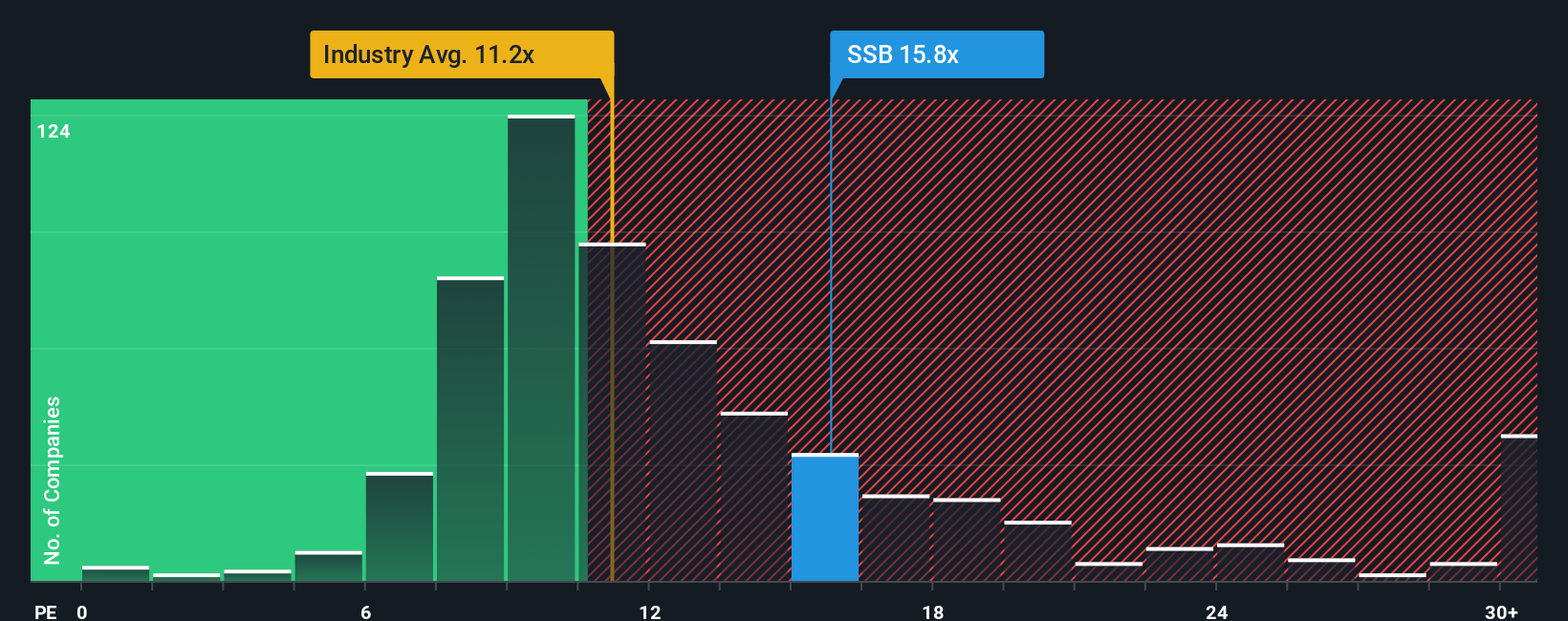

SouthState currently trades on about 13.9x earnings, slightly above the 11.9x average for the wider Banks industry and just above its peer group at roughly 13.4x. On the surface that suggests investors are already paying a small premium for its quality and growth profile. To refine that view, Simply Wall St uses a Fair Ratio, which estimates what a justified PE should be once you factor in company specific metrics like earnings growth, profitability, risk, market cap and industry positioning.

For SouthState, the Fair Ratio comes out at around 14.9x, which is meaningfully higher than the current 13.9x multiple. That points to the market still applying a modest discount to what looks like a higher quality regional bank franchise.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SouthState Bank Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company connected to a set of numbers like expected revenue growth, future margins, earnings and a fair value estimate.

A Narrative on Simply Wall St links what you believe about SouthState Bank, or any company, to a structured forecast and then to a fair value, so you can directly compare that fair value with today’s share price to decide whether it looks like a buy, hold or sell.

Narratives are easy to create and explore on Simply Wall St’s Community page, where millions of investors share their views, and they are automatically refreshed when new data, news or earnings are released so your conclusions stay current without you having to rebuild your model from scratch.

For example, one SouthState Narrative on the platform might see high loan growth, rising margins and solid fee income supporting a fair value near $120 per share. A more cautious Narrative that emphasizes margin pressure, funding costs and regional risk might land closer to $110, giving you a clear, numbers backed range to weigh against the current price.

Do you think there's more to the story for SouthState Bank? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com