Mitsui High-tec (TSE:6966) Margin Compression Tests Bullish Earnings Growth Narrative After Q3 2026 Results

Mitsui High-tec (TSE:6966) has just posted another steady quarter, with Q3 2026 revenue of ¥54.6 billion and basic EPS of ¥17.64 off net income of ¥3.2 billion, setting the tone for how investors read the latest move in margins. The company has seen quarterly revenue hover in a tight band between roughly ¥53.5 billion and ¥56.7 billion over the past six periods, while basic EPS has moved from around ¥12.43 to ¥17.64 as net income climbed from about ¥2.3 billion to ¥3.2 billion, teeing up this result as part of a gradual earnings build rather than a one off spike. All in, the release puts the spotlight squarely on how sustainably Mitsui High tec can defend its profitability into the next leg of growth.

See our full analysis for Mitsui High-tec.With the headline numbers on the table, the next step is to weigh these results against the dominant narratives around Mitsui High tec, testing where the data backs the story and where the numbers push back.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM earnings growth but margin slippage

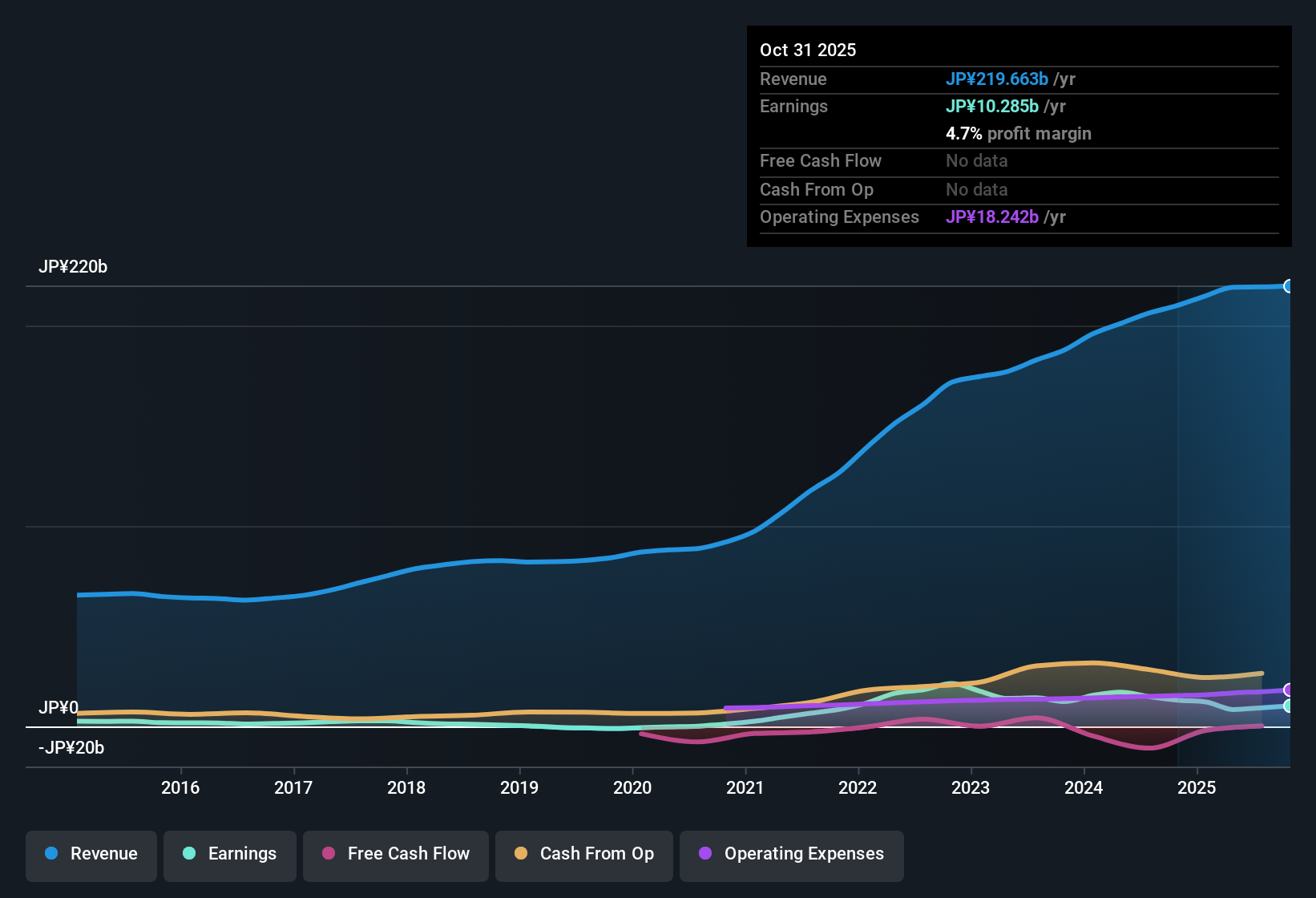

- On a trailing 12 month basis, net income is ¥10,285 million on revenue of ¥219,663 million, which works out to a 4.7 percent net profit margin compared with 6.3 percent a year earlier.

- Bulls point to earnings growing about 10.4 percent per year over five years and forecasts of roughly 21.2 percent annual earnings growth. However, the step down in trailing margin from 6.3 percent to 4.7 percent shows profitability has come under pressure even as revenue over the last year sits at about ¥219,663 million.

- That tension means the growth story relies on forecast acceleration rather than recent margin trends, which have moved the wrong way despite higher trailing revenue.

- Supporters who focus on the long term will highlight the five year earnings compounding, but the current 4.7 percent margin makes it clear that execution from here needs to improve to match those optimistic growth forecasts.

Short term profits, long term forecasts

- Quarterly net income has moved from ¥2,271 million in Q3 2025 to ¥3,223 million in Q3 2026, while analysts are expecting revenue to grow around 11.7 percent per year and earnings about 21.2 percent per year over the next three years.

- What stands out for a bullish angle is that this steady climb in quarterly net income lines up with those double digit growth forecasts, even though trailing 12 month earnings growth over the past year was negative compared with the prior period.

- The contrast between rising quarterly net income and negative recent annual earnings growth suggests the business may be emerging from a softer patch rather than stuck in decline.

- At the same time, the ambitious 21.2 percent earnings growth outlook will need this kind of quarterly consistency, since the latest annual data alone does not yet show that pace.

Low P E versus peers but DCF gap

- The shares trade on about 13.9 times trailing earnings versus 37.6 times for peers and 20.9 times for the broader semiconductor industry, yet the DCF fair value of ¥203.84 sits well below the current ¥782 share price.

- Bears focus on that DCF fair value gap and the drop in trailing margin from 6.3 percent to 4.7 percent, arguing that even a seemingly cheap P E multiple might not offer much downside protection if profitability stays under pressure.

- The combination of a 2.3 percent dividend that is not well covered by free cash flow and a share price far above the ¥203.84 DCF fair value reinforces the cautious view on valuation quality.

- However, the discount to peer and industry P E multiples means skeptics are effectively saying that the margin compression and cash flow strain more than justify Mitsui High tec trading at a substantial multiple gap.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Mitsui High-tec's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Mitsui High tec faces pressure from shrinking margins, a stretched valuation versus its DCF estimate, and a dividend not well covered by free cash flow.

If you are uneasy about paying up for a stock with weakening profitability and valuation risk, use our these 903 undervalued stocks based on cash flows to quickly focus on companies where discounted cash flows still point to genuine upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com