Assessing AMP (ASX:AMP)’s Valuation as Class Action Settlement Signals Progress on Legacy Issues

AMP (ASX:AMP) has moved to settle a longstanding class action over historic adviser commissions with a proposed A$29 million agreement, aiming to draw a line under legacy conduct risks and refocus investors on its core operations.

See our latest analysis for AMP.

The announcement has landed against a backdrop of solid share price momentum, with AMP delivering a year to date share price return of 15.67 percent and a three year total shareholder return of 45.18 percent. This suggests investors see legacy risks slowly easing.

If this clean up story has you thinking about where else capital could work harder, it might be worth exploring fast growing stocks with high insider ownership as a source of fresh ideas.

With AMP trading only slightly below analyst targets after a strong three year run, but still facing shrinking revenue, is this cleanup phase giving investors a genuine value opportunity, or is the market already pricing in the turnaround?

Most Popular Narrative: 3.4% Undervalued

With AMP last closing at A$1.85 against a narrative fair value of A$1.91, the story hinges on whether shrinking revenue can coexist with rising profitability.

The company's significant progress in digital transformation including the launch of AMP Bank GO, integration of AI to improve adviser efficiency, and rollout of digital advice modules is expected to drive operational efficiency, enhance customer retention/acquisition, and improve cost to income ratios and net margins over time.

Curious how a business with falling top line can still justify a richer future earnings multiple and margin profile? The narrative leans on a powerful mix of cost transformation, capital discipline, and a profit trajectory that is bolder than current results imply. Want to see the exact earnings ramp and margin lift that underpin that A$1.91 fair value call? Read on and unpack the full playbook behind this recovery thesis.

Result: Fair Value of $1.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and lingering litigation or remediation surprises could still upset the recovery trajectory and challenge the narrative of improving margins and earnings.

Find out about the key risks to this AMP narrative.

Another View: Market Multiple Sends a Different Signal

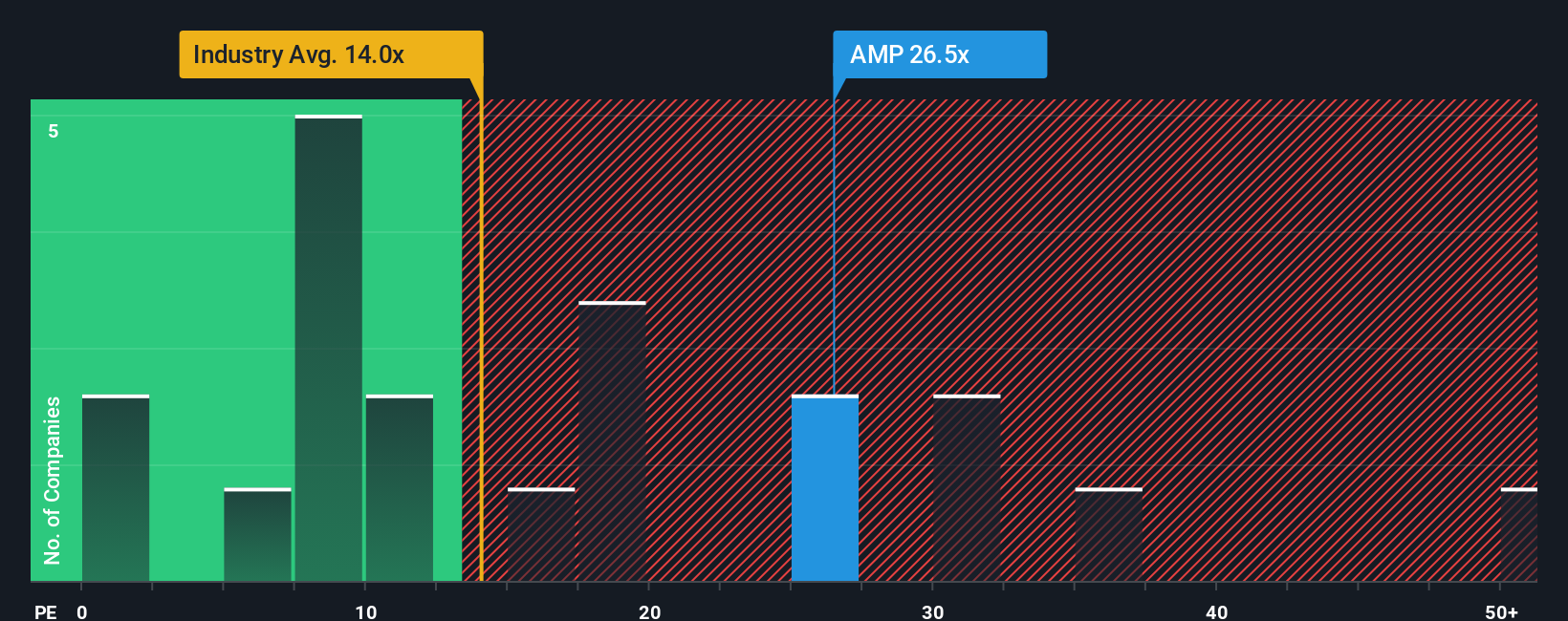

Our SWS DCF model may see upside, but the earnings multiple tells a tougher story. AMP trades on about 27 times earnings versus a fair ratio of 19.2 times, a steep premium that suggests limited margin for error if the margin recovery or buybacks slip.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AMP for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AMP Narrative

If you see the story differently or want to stress test the numbers yourself, build a personalised view of AMP in minutes with Do it your way.

A great starting point for your AMP research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take the next step in your research and put your capital to work across more opportunities using the Simply Wall St Screener before the best ideas move away from you.

- Secure steadier income by targeting companies with reliable payouts through these 13 dividend stocks with yields > 3%, and position your portfolio for consistent cash returns.

- Capture long term growth potential in transformative technologies by screening for these 26 AI penny stocks that are pushing the boundaries of automation and intelligent software.

- Position yourself early in emerging digital finance trends by using these 80 cryptocurrency and blockchain stocks to find businesses building real utility on blockchain and crypto infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com