Northern Star Resources (ASX:NST): Valuation Check as Exploration, Renewables and Capital Discipline Drive Long-Term Story

Northern Star Resources (ASX:NST) is drawing fresh attention as its recent share gains line up with a bigger strategic story, a heavy exploration program, renewable energy rollout and disciplined capital management.

See our latest analysis for Northern Star Resources.

The recent 90 day share price return of 28.9 percent, and a 12 month total shareholder return of 71.2 percent, suggest momentum is firmly building as investors reprice Northern Star’s growth pipeline and lower risk profile.

If Northern Star’s run has you thinking about where else strong narratives are forming, it could be worth exploring fast growing stocks with high insider ownership as a source of the next wave of potential ideas.

Yet with Northern Star trading close to broker targets but still showing a hefty implied intrinsic discount, the real question is whether today’s price marks a fresh buying opportunity or if future growth is already fully priced in.

Most Popular Narrative Narrative: 24.2% Overvalued

According to Robbo, the narrative fair value of A$22.00 sits meaningfully below Northern Star’s last close at A$27.33, creating a valuation gap that demands closer inspection.

Northern Star’s existing operations are mature and should provide the financial and operational foundation to support the development of the Hemi and Mt Roe projects. At a current share price of just over $25, Northern Star is not cheap by historical standards.

Want to see how robust mine reserves, ambitious production targets and expanding margins combine into a punchy valuation call? The underlying growth curve might surprise you.

Result: Fair Value of $22.0 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sharp falls in gold prices or delays and cost overruns at Hemi and Mt Roe could quickly undermine the growth and valuation case.

Find out about the key risks to this Northern Star Resources narrative.

Another View: DCF Signals Deep Value

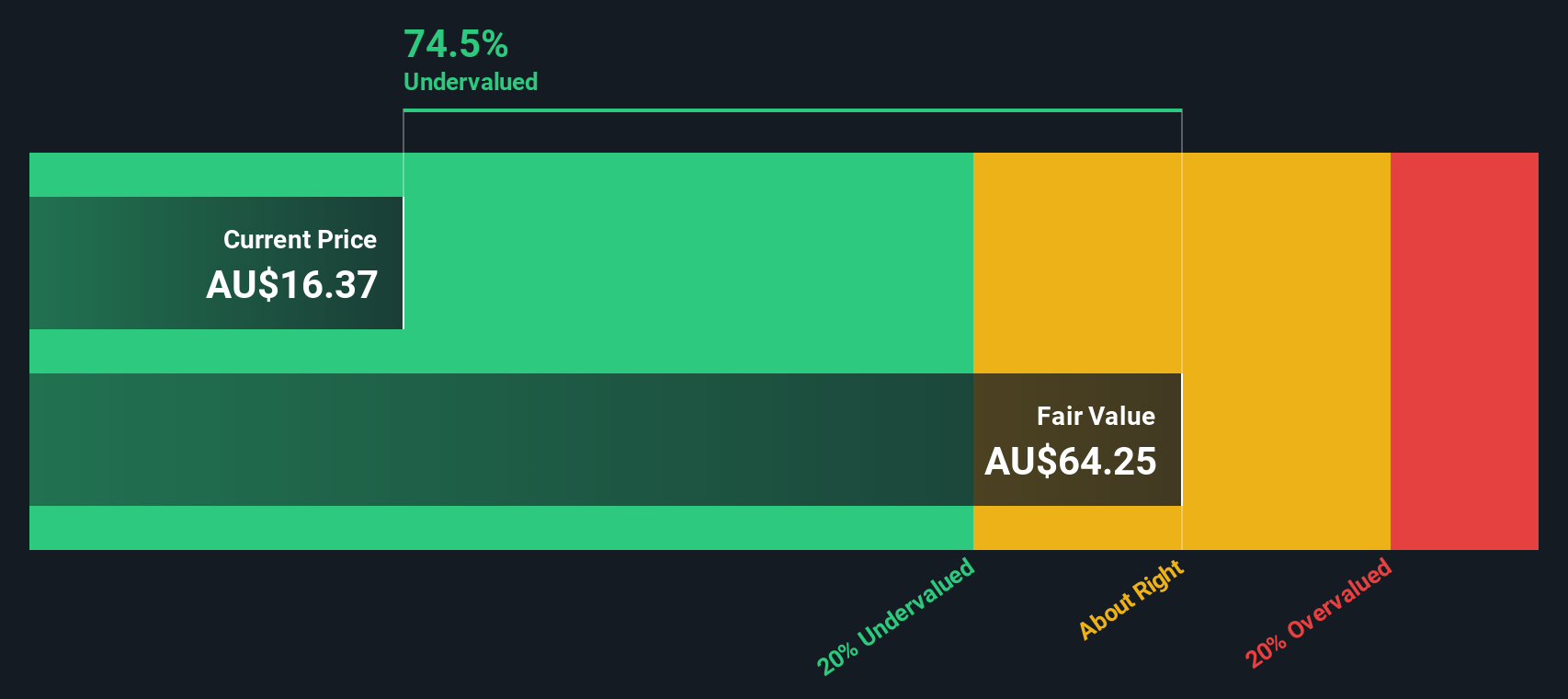

Robbo’s narrative sees Northern Star as 24.2 percent overvalued, but our DCF model tells a very different story. With the shares at A$27.33 versus an estimated fair value of A$57.38, Northern Star screens as significantly undervalued on cash flows. Which story will the market eventually believe?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Northern Star Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Northern Star Resources Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a fresh narrative in just minutes: Do it your way.

A great starting point for your Northern Star Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more compelling investment ideas?

Before the market races ahead again, use the Simply Wall St Screener to uncover fresh opportunities across themes, sectors and strategies that could sharpen your portfolio edge.

- Capture potential mispricing by targeting quality companies trading below intrinsic value through these 903 undervalued stocks based on cash flows that highlight strong cash flow support.

- Supercharge your growth watchlist with forward looking innovators at the intersection of medicine and machine learning using these 30 healthcare AI stocks.

- Position yourself early in the evolving digital asset ecosystem with companies enabling blockchain infrastructure and payment rails identified via these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com