Jacobson Pharma (SEHK:2633) Margin Expansion Reinforces Bullish Narrative Despite Slower Revenue Outlook

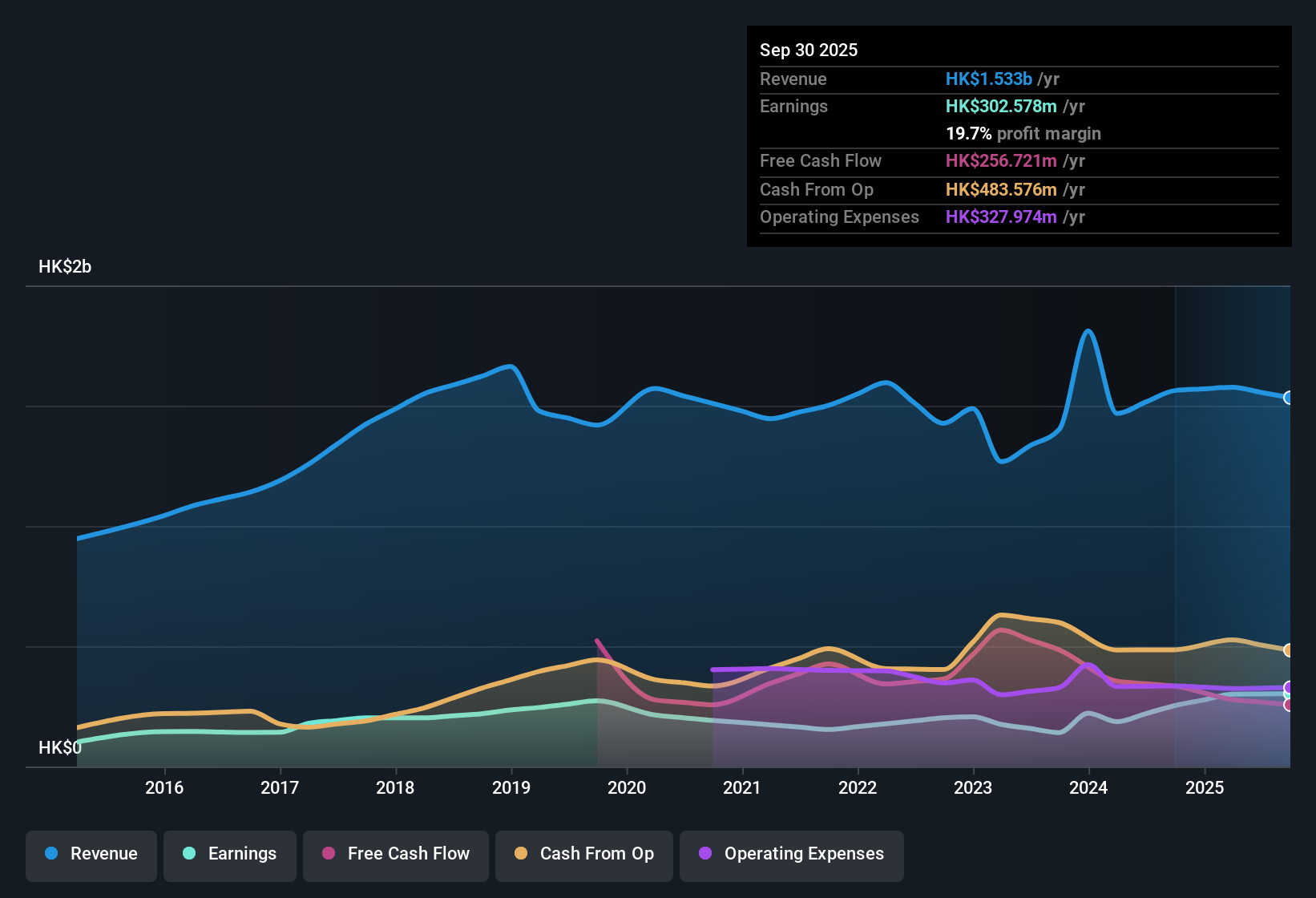

Jacobson Pharma (SEHK:2633) has posted a steady H1 2026 result, with revenue of HK$766.6 million and basic EPS of HK$0.071, supported by trailing 12 month revenue of about HK$1.5 billion and EPS of HK$0.152 that reflects solid earnings momentum over the past year. The company has seen revenue hover around the HK$1.5 billion mark over recent periods while EPS has increased from HK$0.129 to around HK$0.152 on a trailing basis, pointing to tighter execution and firmer margins that give investors a clearer view of profit quality.

See our full analysis for Jacobson Pharma.With the latest numbers now available, the next step is to see how this earnings profile compares with the dominant narratives around Jacobson Pharma, and where the data might be quietly telling a different story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Climb To 19.7 Percent

- Net profit margin over the last 12 months reached 19.7 percent, up from 16.2 percent a year ago, on trailing revenue of about HK$1,533 million and net income of roughly HK$303 million.

- What stands out for the bullish view is that profit growth is outpacing sales, with earnings up 19.5 percent year over year while revenue grew around 5.5 percent per year.

- That mix of faster profit growth and a higher margin directly supports the idea of stronger earnings quality than a simple top line snapshot would suggest.

- At the same time, the more modest revenue trend versus the wider Hong Kong market means bulls are leaning heavily on efficiency gains rather than rapid sales expansion.

TTM EPS Outpaces Half Year Pattern

- Trailing 12 month basic EPS of HK$0.1519 sits noticeably above the last three reported half year EPS prints of HK$0.0707, HK$0.0808 and HK$0.0712, showing that the combined last four quarters are stronger than any single recent half on its own.

- Supporters of a more optimistic stance point to this multi period improvement, with EPS compounding at about 12.1 percent per year over five years and net income over the latest three half years rising from HK$140.3 million to HK$160.5 million and then HK$142.0 million.

- That pattern of higher trailing EPS compared with individual half year snapshots backs the argument that the business has built a sturdier earnings base rather than relying on a one off spike.

- However, the small step down in net income from HK$160.5 million in H2 2025 to HK$142.0 million in H1 2026 is a reminder that short term swings still matter inside that longer term growth story.

Valuation Discount Versus DCF Fair Value

- At a share price of HK$1.29 and a trailing P E of 8.5 times, the stock trades at a notable gap to the stated DCF fair value of about HK$2.55 and below both peer and industry averages, with peers on roughly 8.9 times and the wider Hong Kong pharmaceuticals space nearer 13.5 times.

- From a bullish angle, this valuation setup is seen as an opportunity because the combination of nearly 19.5 percent earnings growth and a 19.7 percent net margin is being priced at a discount.

- That contrast between improving profitability and a roughly 49.5 percent gap to the DCF estimate is exactly what value focused investors look for when margins and earnings have strengthened.

- Yet the forecast that revenue may grow slower than the broader Hong Kong market and an unstable dividend history explain why some investors are less willing to close that discount quickly.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Jacobson Pharma's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite firmer margins and earnings, Jacobson Pharma still faces slower revenue growth than the broader market and an inconsistent dividend profile that tempers bullish conviction.

If that mix of patchy income and uncertain payouts makes you uneasy, use our these 1910 dividend stocks with yields > 3% to quickly refocus on companies delivering stronger, more reliable yields today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com