Kumiai Chemical Industry (TSE:4996) One‑Off Loss Drives Q4 EPS Slump, Testing Margin‑Recovery Story

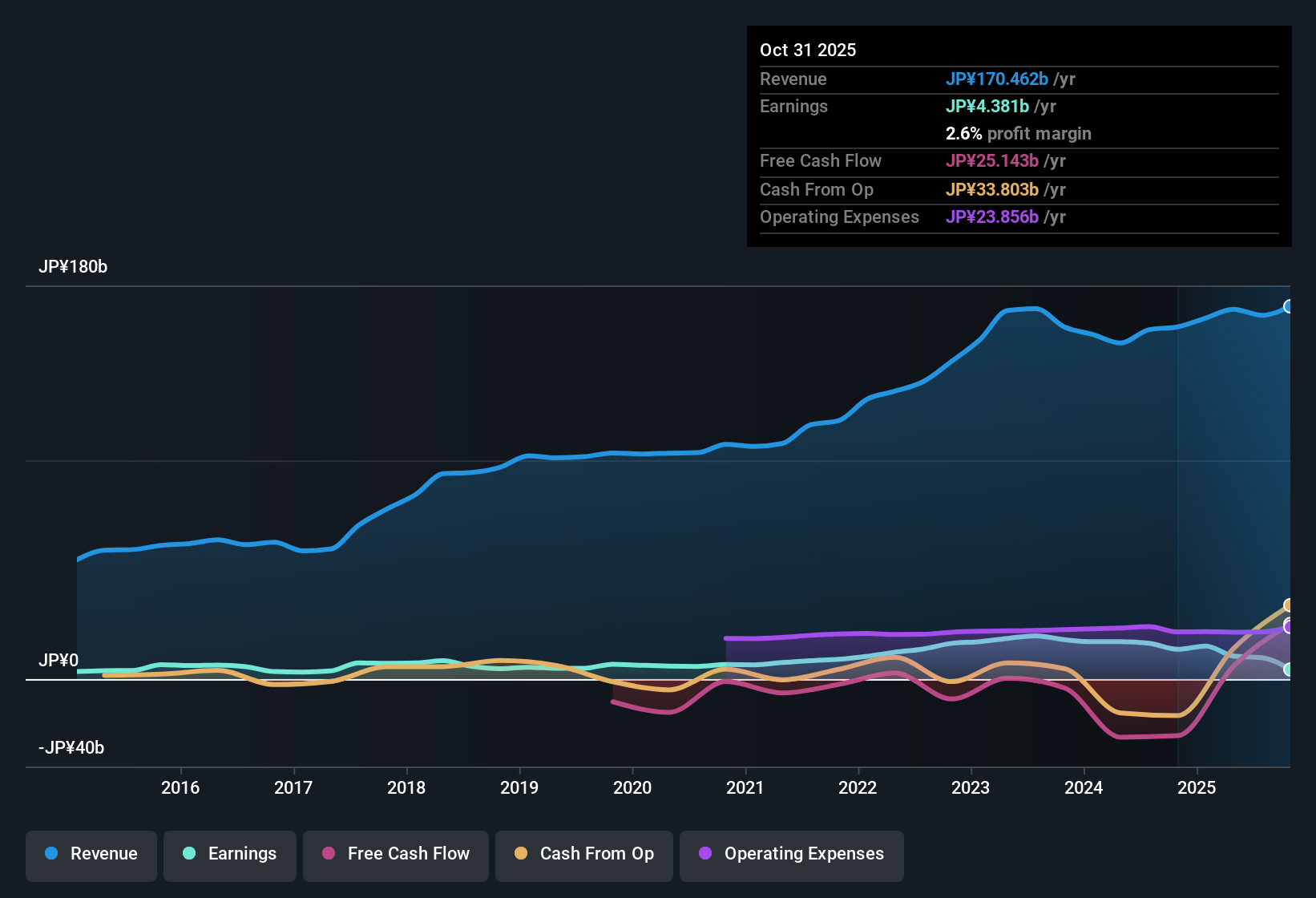

Kumiai Chemical Industry (TSE:4996) just posted its FY 2025 fourth quarter numbers with revenue of ¥35.98 billion and a basic EPS of roughly ¥‑38.75, capping off a year where trailing 12 month revenue came in at about ¥170.46 billion and EPS of around ¥36.38. The company has seen quarterly revenue move from ¥31.85 billion in Q4 FY 2024 to ¥35.98 billion in Q4 FY 2025, while basic EPS swung from about ¥6.34 to roughly ¥‑38.75 over the same period. This is likely to lead investors to focus squarely on how margins are holding up through this volatile patch.

See our full analysis for Kumiai Chemical Industry.With the latest scorecard on the table, the next step is to line these results up against the prevailing narratives to see which stories still hold water and which ones the numbers start to challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

One off loss pulls net margin down to 2.6 percent

- Over the last 12 months, Kumiai generated revenue of about ¥170,462 million and net income of roughly ¥4,381 million, which works out to a net margin of 2.6 percent compared with 8.4 percent a year earlier.

- Bears focus on this margin compression, and the data partly backs them up, but the presence of a large ¥4,300 million one off loss means:

- The 2.6 percent margin reflects that single hit as well as normal operations, so it is not a clean read on ongoing profitability.

- Trailing basic EPS on a last 12 month basis, at about ¥36.38, still remains positive despite the negative ¥38.75 EPS in Q4 FY 2025, which challenges the idea that profitability has structurally broken.

Fast EPS swings alongside modest revenue shifts

- Within FY 2025, quarterly revenue moved between about ¥35,977 million and ¥52,796 million, while basic EPS ranged from approximately ¥33.25 in Q1 to around negative ¥38.75 in Q4, showing that profits were far more volatile than sales.

- Critics highlight this volatility as a bearish point, and the quarterly patterns support that view, yet also show nuances:

- Three of the four FY 2025 quarters reported positive net income, including roughly ¥4,003 million in Q1 and ¥2,774 million in Q3, indicating that the loss is concentrated rather than spread evenly across the year.

- On a trailing basis, net income of about ¥4,381 million and positive EPS contrast sharply with the single quarter loss of roughly ¥4,667 million, suggesting the period is better described as mixed rather than consistently weak.

Premium P E, yet below DCF fair value

- The shares trade around ¥670, implying a trailing P E of 18.4 times versus roughly 11.2 times for peers and 12.6 times for the broader Japan chemicals industry. A DCF fair value of about ¥790.48 points to the stock sitting near a 15 percent discount to that valuation.

- Supporters lean on the bullish idea of strong forecast earnings growth, and the numbers give that argument some grounding but also clear trade offs:

- Analysts expect earnings to grow about 44.11 percent per year over the next three years even though revenue is only forecast to edge down by roughly 0.9 percent per year, implying a story driven by margin recovery rather than top line expansion.

- The combination of a valuation premium versus peers on current earnings and a discount to the ¥790.48 DCF fair value means the bullish case rests heavily on those earnings forecasts actually lifting margins from the recent 2.6 percent level.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kumiai Chemical Industry's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Kumiai Chemical Industry is wrestling with shrinking margins, lumpy earnings and a sharp one off loss that undercut confidence in its profit resilience.

If that kind of volatility makes you uneasy, use our stable growth stocks screener (2103 results) to quickly focus on businesses with steadier revenue and earnings paths designed for more predictable compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com