Nareru Group (TSE:9163) Margin Decline Tests Bullish Undervaluation Narrative After FY 2025 Results

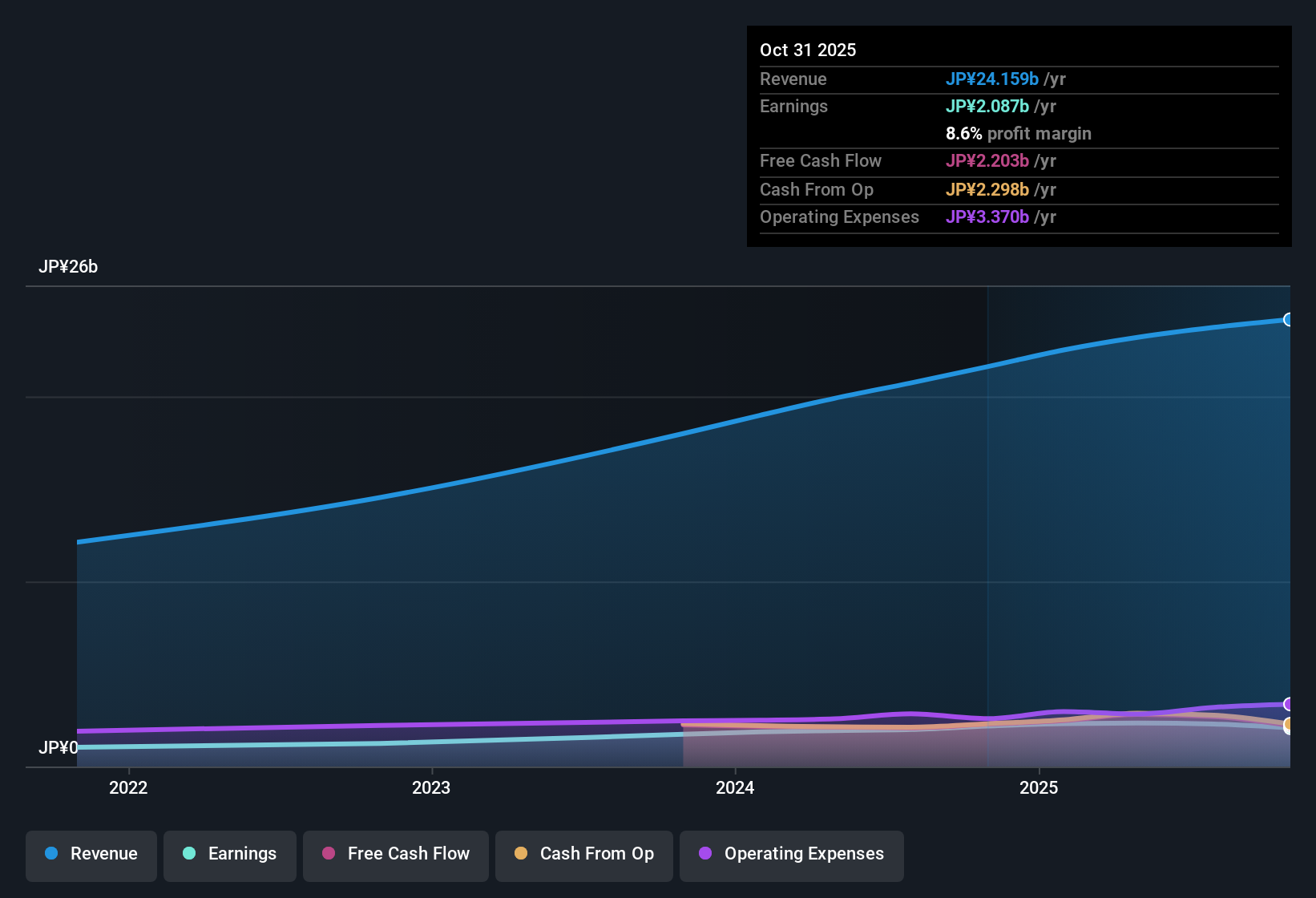

Nareru Group (TSE:9163) has wrapped up FY 2025 with fourth quarter revenue of ¥6.2 billion and basic EPS of ¥55.8, capping off a year in which trailing 12 month revenue reached ¥24.2 billion and EPS came in at ¥238.7. Over the past six reported quarters, revenue has steadily stepped up from ¥20.7 billion to ¥24.2 billion on a trailing basis, while quarterly EPS has moved around in a relatively tight band. This gives investors a clear view of the top line trajectory even as per share earnings oscillate. With net profit margins slipping from 10.1% to 8.6% over the year, the latest numbers present a picture of solid scale but tighter profitability that will shape how investors read this result.

See our full analysis for Nareru Group.With the headline figures on the table, the next step is to compare these results with the prevailing narratives around Nareru Group, highlighting where the numbers align with the story and where they start to challenge it.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM Net Income Slips To ¥2.1 Billion

- Over the last twelve months, net income excluding extra items came in at ¥2,086.9 million, down from ¥2,187 million a year earlier, even as trailing revenue increased from ¥21,608 million to ¥24,158.9 million.

- Critics highlight that this bearish turn in annual profit, with TTM EPS easing from 255.1 JPY to 238.7 JPY, contrasts with the stronger five year earnings growth of 17.7% per year and raises the question of whether the recent dip is a blip or a sign that the earlier growth tempo is getting harder to repeat.

- The move from ¥2,187 million to ¥2,086.9 million of TTM net income lines up with the reported margin compression from 10.1% to 8.6%, showing that higher sales alone have not been enough to keep profits growing.

- At the same time, quarterly net income has hovered between ¥437.0 million and ¥698.1 million over the last six reported quarters, which gives bears data points for slower momentum but also shows that profitability has not collapsed.

Margins Tighten As Revenue Scales

- The latest twelve month net profit margin of 8.6% compares with 10.1% a year ago, while quarterly revenue has stepped up from ¥5,599.3 million in FY 2024 Q3 to ¥6,232.2 million in FY 2025 Q4.

- What is striking for a bearish narrative is that even with this margin squeeze, EPS across the last four reported quarters has stayed in a relatively narrow band of about 50 to 75 JPY per quarter, suggesting the business is absorbing higher costs without wild swings in per share profitability.

- FY 2025 quarterly EPS moved between 49.98 JPY and 74.50 JPY, versus 65.65 JPY and 80.34 JPY in the comparable FY 2024 quarters, which supports the view of softer profitability while still reflecting consistent earnings generation.

- Trailing revenue rising by roughly ¥2,550.9 million year on year, from ¥21,608 million to ¥24,158.9 million, underlines that demand is holding up even as margins come under pressure.

P/E 9.7x Versus DCF Fair Value Gap

- Nareru shares trade on a trailing P/E of 9.7 times, below both the 15.6 times peer average and the 13.7 times JP Professional Services average, while the current price of ¥2,315 sits about 54.1% below a DCF fair value of ¥5,042.44.

- Supporters of a more bullish stance argue that this combination of a discounted multiple and a wide gap to DCF fair value is hard to square with the description of past earnings as high quality, especially when TTM EPS of 238.7 JPY is still underpinned by over ¥24,158.9 million of revenue.

- The roughly ¥2,927 discount between the share price and the ¥5,042.44 DCF fair value points to a sizeable valuation cushion if margins stabilise around the current 8.6% level.

- With five year earnings compounding at 17.7% annually despite the latest setback, the relatively low 9.7 times P/E is often cited in arguments that the market may be undervaluing that longer term record.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nareru Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Nareru Group’s recent margin compression and modest dip in TTM earnings, despite rising revenue, suggest that profitability momentum may be cooling from its earlier pace.

If you want businesses where earnings trends look more dependable, use our stable growth stocks screener (2103 results) to quickly focus on companies delivering steadier revenue and profit expansion across cycles before conditions change again.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com