Is Booking Still Attractively Priced After Its 178% Three Year Surge?

- Wondering if Booking Holdings is still a smart buy after its massive run, or if the easy money has already been made? This breakdown will help you figure out what the stock is really worth today.

- The share price recently closed around $5,301.64, with returns of about 2.0% over the last week, 2.4% over the past month, 7.6% year to date, and 178.0% over three years. This points to strong long term momentum but also rising expectations.

- Recent headlines have focused on resilient global travel demand, expanding alternative accommodation offerings, and continued investment in payments and marketing platforms. These factors help explain why investors have been willing to pay more for the stock. At the same time, debate has been growing around competition from rivals and regulatory scrutiny in key markets, adding nuance to the bullish narrative.

- On our valuation framework, Booking Holdings currently scores 3 out of 6 on undervaluation checks. This means some metrics flag it as attractive while others look more fully priced. Next, we will unpack the main valuation approaches investors use, and then finish with another way to think about what this business might be worth.

Approach 1: Booking Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today. For Booking Holdings, the model used is a 2 Stage Free Cash Flow to Equity approach, which accounts for a faster growth phase followed by a more mature period.

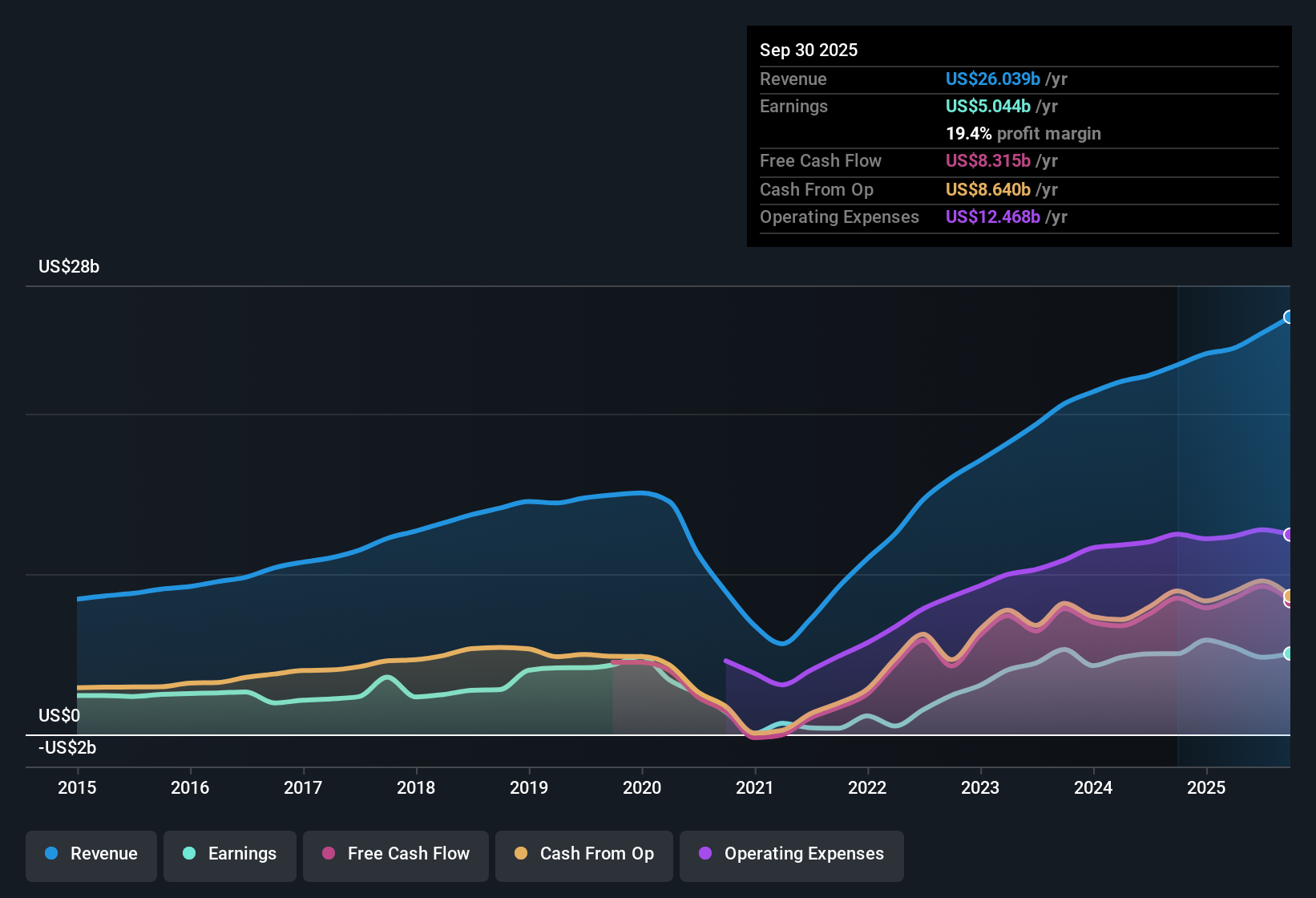

Booking generated trailing twelve month Free Cash Flow of about $8.2 billion, a strong base that analysts expect to keep growing. Projections used in this DCF see Free Cash Flow rising to roughly $17.9 billion by 2035, with the first few years anchored in analyst forecasts and the later years extrapolated by Simply Wall St.

When these future cash flows are discounted back to today, the model arrives at an intrinsic value of roughly $7,558 per share, compared with a recent share price around $5,302. That implies the stock is about 29.9% undervalued on this basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Booking Holdings is undervalued by 29.9%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

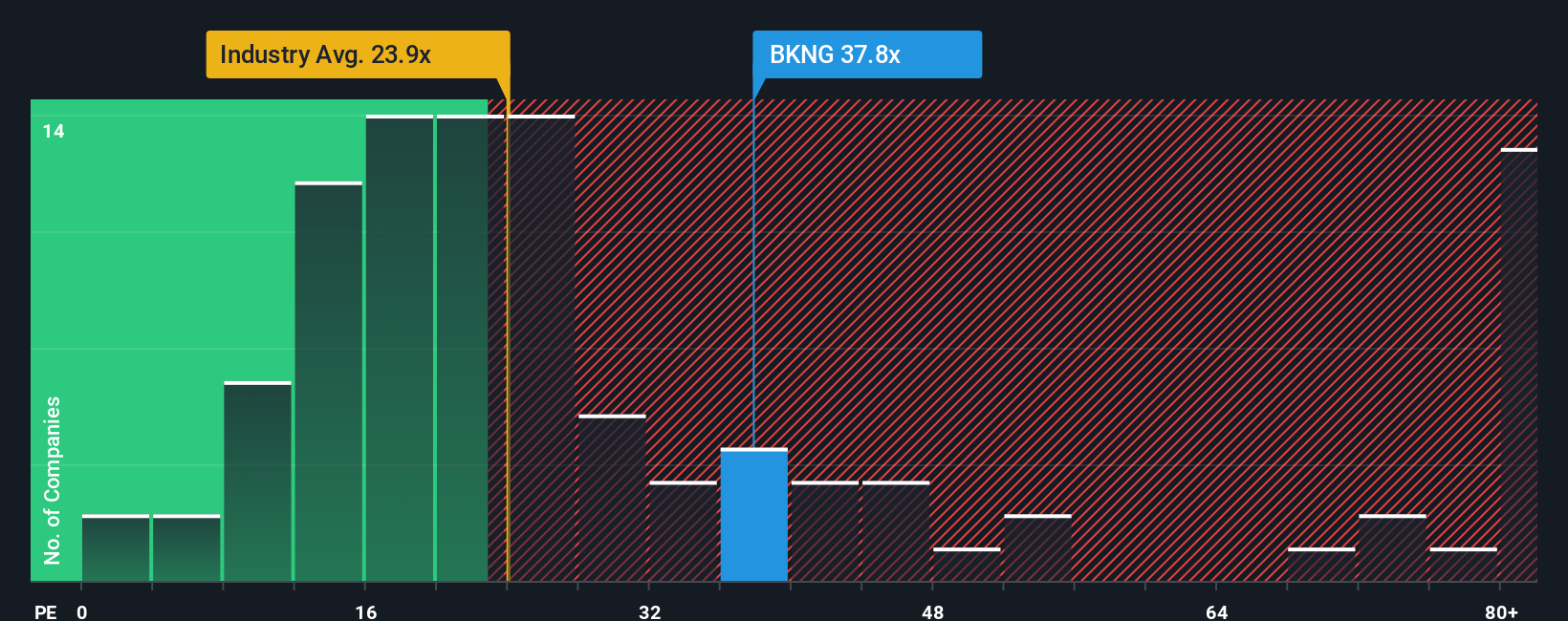

Approach 2: Booking Holdings Price vs Earnings

For profitable, established businesses like Booking Holdings, the Price to Earnings ratio is often the go to valuation yardstick because it directly links what investors pay for each share to the company’s current profits. The higher the expected growth and the lower the perceived risk, the more investors are usually willing to pay, which translates into a higher normal or fair PE multiple.

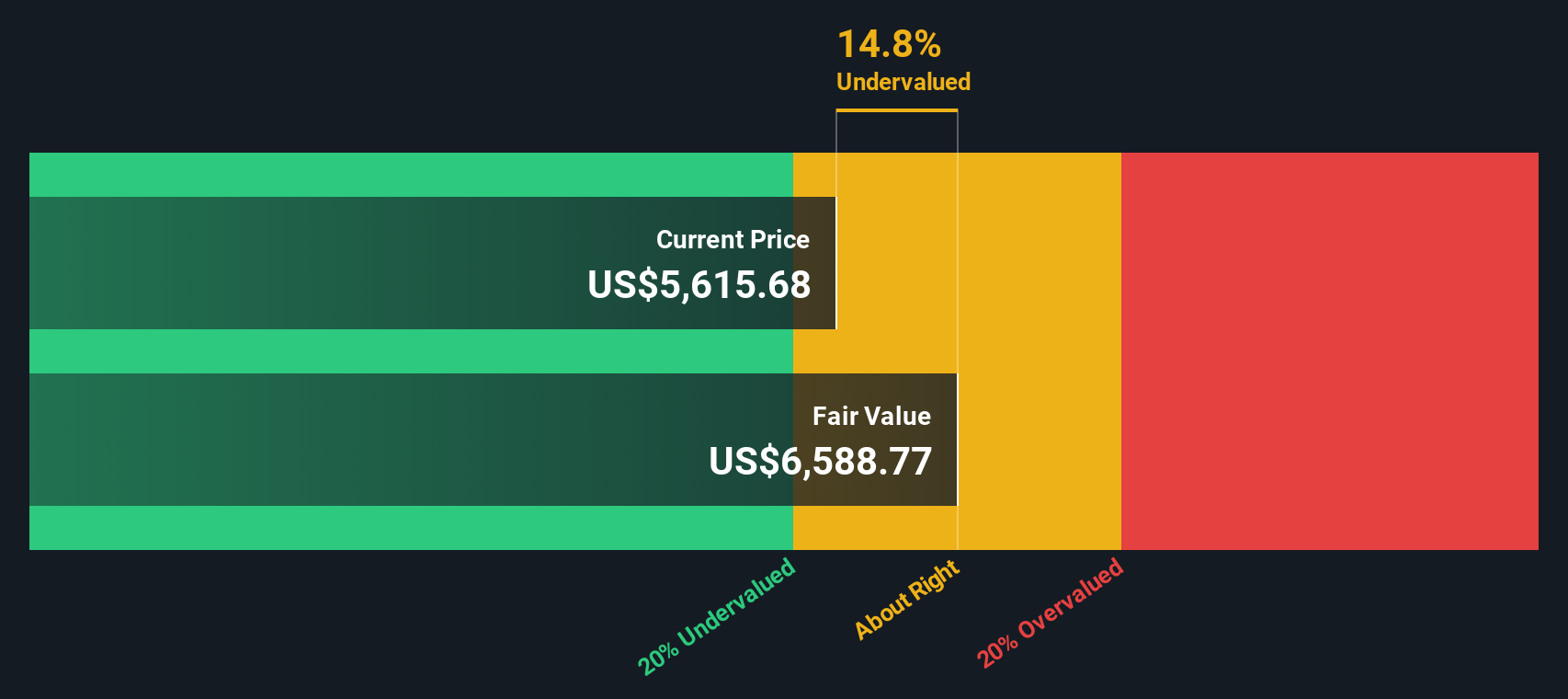

Booking currently trades on a PE of about 33.88x, which is a premium to both the Hospitality industry average of roughly 24.61x and the peer average of around 29.53x. At first glance, that suggests the market is already pricing in stronger growth and quality than the typical competitor. However, Simply Wall St’s Fair Ratio framework, which estimates what a reasonable PE should be after factoring in earnings growth, profitability, industry, market cap and company specific risks, points to a fair PE of about 39.31x for Booking.

Because this Fair Ratio of 39.31x sits meaningfully above the current 33.88x multiple, the stock screens as undervalued on a PE basis despite its headline premium to peers.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Booking Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you connect your view of Booking Holdings’ story to a concrete forecast for its future revenue, earnings and margins, and then to a fair value you can directly compare with today’s share price to decide whether to buy, hold or sell, while the system keeps that Narrative dynamically updated as new news or earnings arrive so different investors can see, for example, why one user’s bullish view might justify a fair value near the top end of recent targets around $7,218 per share while another more cautious investor might anchor closer to the lower end near $5,200, even though both are looking at the same company.

Do you think there's more to the story for Booking Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com