Does NVIDIA’s Soaring AI Growth Justify Its Current 2025 Valuation?

- If you are wondering whether NVIDIA is still worth buying after its massive run, you are not alone. In this article, we are going to unpack what the current price really implies about future growth.

- Even after slipping about 4.1% over the past week and 9.7% over the last month, the stock is still up 26.5% year to date and roughly 30.4% over the last year, on top of a staggering 957.2% 3 year and 1222.4% 5 year return that keeps expectations sky high.

- Recent moves have been shaped by ongoing excitement around AI infrastructure demand, as NVIDIA continues to cement its position at the center of data center build outs and next generation computing platforms. At the same time, regulators and competitors are paying closer attention to its market dominance, which feeds into how investors think about long term risk and the durability of its margins.

- On our framework, NVIDIA scores just 2 out of 6 on undervaluation checks. Next, we will walk through what the key valuation methods say about that price tag and, toward the end of the article, explore a more holistic way to judge whether the current valuation really makes sense.

NVIDIA scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NVIDIA Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes the cash a company is expected to generate in the future, then discounts those projections back to today to estimate what the business is worth now. For NVIDIA, the model uses a 2 stage Free Cash Flow to Equity approach built on analyst forecasts and longer term extrapolations.

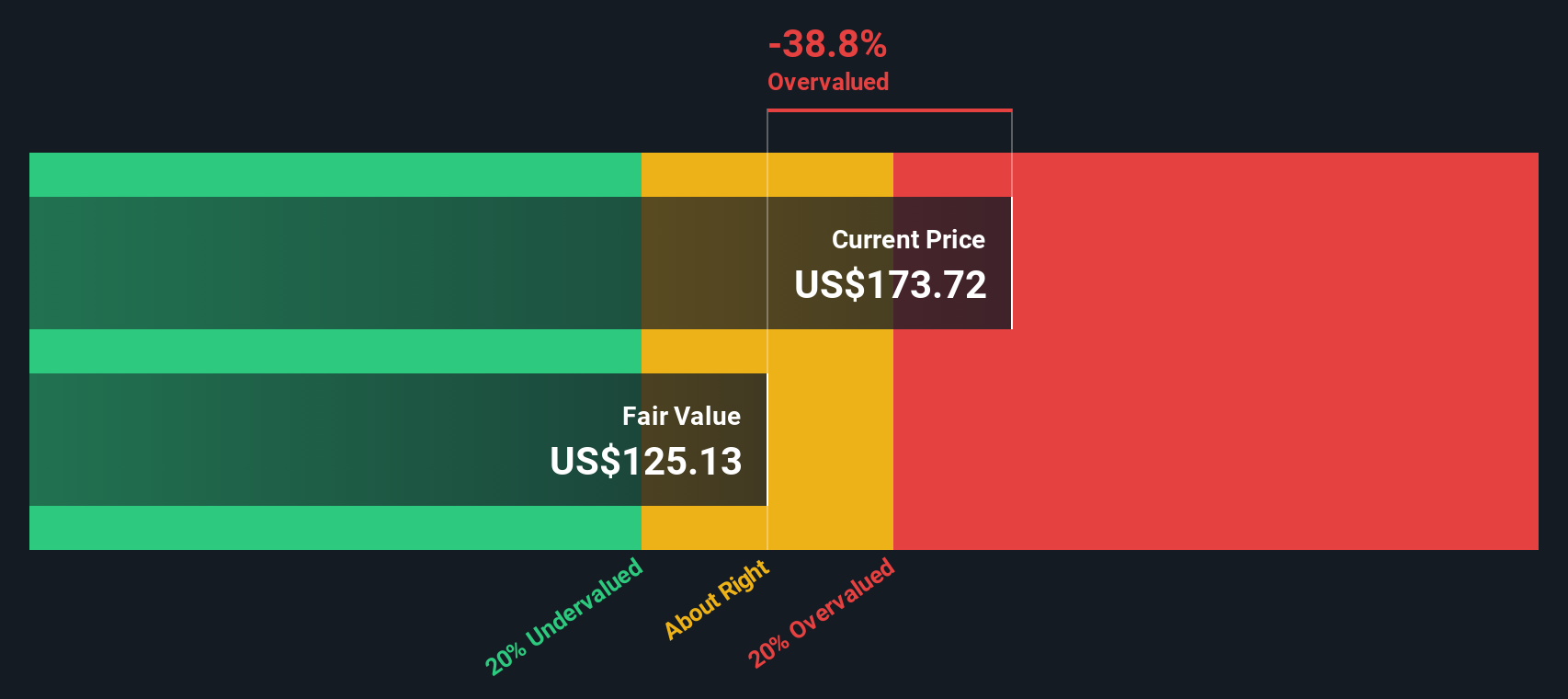

NVIDIA generated roughly $77.96 billion in free cash flow over the last twelve months. Analysts and extrapolated estimates see this rising to about $287.49 billion by 2030, with ten year projections continuing to climb beyond that as AI infrastructure spending expands. Simply Wall St discounts each of these future cash flows back to today in dollars, then sums them to arrive at an intrinsic value of $165.32 per share.

Compared with the current share price, this implies the stock is about 5.9% overvalued. In valuation terms, that is a relatively small premium and suggests the market is broadly aligned with the cash flow outlook but leaning slightly optimistic.

Result: ABOUT RIGHT

NVIDIA is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

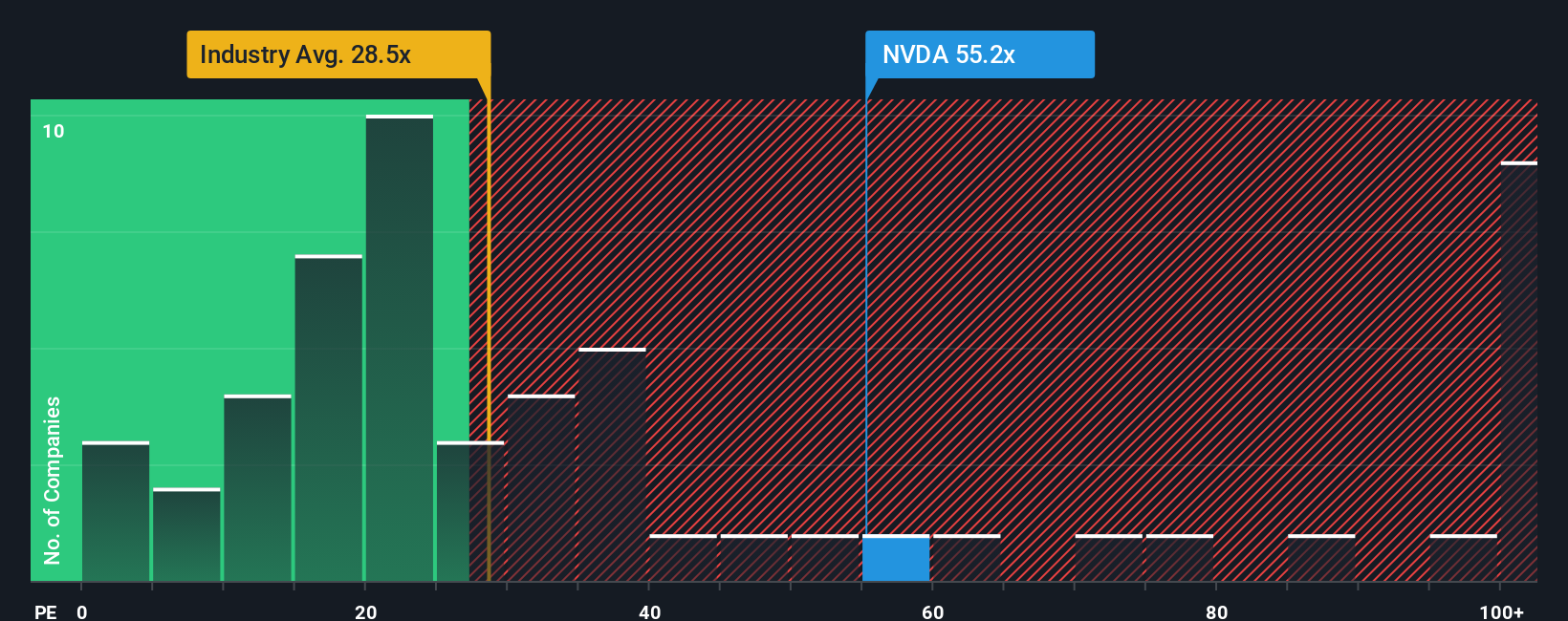

Approach 2: NVIDIA Price vs Earnings

For profitable companies like NVIDIA, the price to earnings ratio is often the cleanest way to see how much investors are willing to pay for each dollar of profit. In general, faster and more predictable earnings growth can justify a higher PE, while cyclical or risky earnings usually deserve a lower multiple.

NVIDIA currently trades on about 42.87x earnings, which is above the broader semiconductor industry average of roughly 37.03x but below the 62.27x average of its high growth peers. Simply Wall St also estimates a Fair Ratio of 58.23x for NVIDIA, a proprietary view of what its PE could be once you factor in its earnings growth outlook, margins, industry dynamics, market cap and risk profile.

This Fair Ratio may be more informative than a simple comparison with peers or the industry, because it adjusts for NVIDIA specific strengths and vulnerabilities instead of assuming all chipmakers deserve the same multiple. With the actual PE sitting meaningfully below the 58.23x Fair Ratio, the stock appears undervalued on this framework.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NVIDIA Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of NVIDIA’s story with the numbers you think are realistic for its future revenue, earnings, margins and ultimately fair value. A Narrative on Simply Wall St’s Community page is your personal storyline for the company, where you spell out how you think AI demand, competition and profitability will play out, and the platform then turns that story into a full financial forecast and a fair value estimate you can compare with today’s share price to help inform a buy, hold or sell decision. Because Narratives on the platform are updated dynamically as new information like earnings, news or regulations emerge, your fair value view evolves with the facts instead of staying frozen in time. For NVIDIA, some investors currently run very cautious Narratives that yield fair values near $70 to $100 per share, while others have far more optimistic Narratives pointing to fair values around $340 to $400. Seeing that range of well structured perspectives can help you locate where your own view really sits and whether the current market price matches it.

For NVIDIA however we will make it really easy for you with previews of two leading NVIDIA Narratives:

Fair value: $250.39 per share

Implied undervaluation vs latest close: approximately 30.1%

Revenue growth assumption: 30.75%

- Assumes surging AI adoption and multi year data center investment keep NVIDIA at the center of global compute infrastructure, supporting strong top line and earnings growth.

- Expects NVIDIA’s full stack platform, from GPUs and networking to CUDA software, to deepen customer lock in, sustain high margins and preserve pricing power despite rising scale.

- Sees geopolitical, regulatory and competitive risks as manageable, with consensus analyst targets implying upside from today’s price if current growth and margin trends continue.

Fair value: $90.15 per share

Implied overvaluation vs latest close: approximately 94.1%

Revenue growth assumption: 15.93%

- Argues NVIDIA is priced for perfection, with current valuation assuming its AI dominance and very high margins persist despite growing competitive and regulatory pressure.

- Highlights rising threats from alternative hardware, in house chips at hyperscalers and more efficient AI software that could weaken NVIDIA’s pricing power and market share.

- Builds a more conservative DCF path where revenue growth slows, margins normalize and a much lower future PE multiple leads to a fair value well below the current share price.

Do you think there's more to the story for NVIDIA? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com