XMH Holdings (SGX:BQF) Earnings Growth Strengthens Bullish Narratives Despite Softer Margins

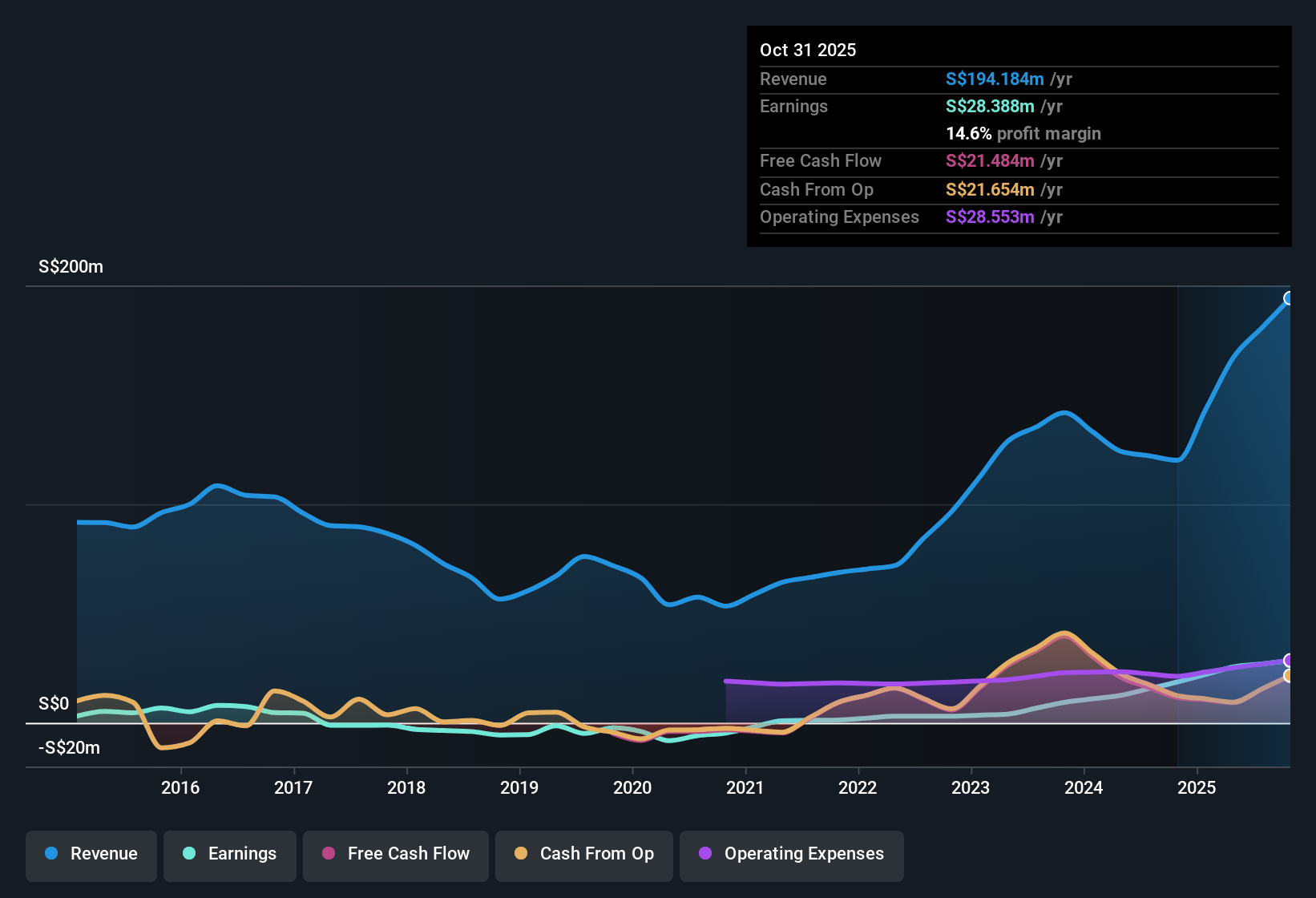

XMH Holdings (SGX:BQF) has put up another busy half, with H1 2026 revenue of about SGD 94 million and net income of SGD 15.4 million translating into basic EPS of SGD 0.1409, setting the tone for how investors will read the latest move in margins. The company has seen revenue move from SGD 66.9 million in H1 2025 to SGD 100.2 million in H2 2025 and then to SGD 93.9 million in H1 2026, while EPS has tracked from SGD 0.1149 to SGD 0.1180 and now SGD 0.1409. Trailing twelve month EPS has reached roughly SGD 0.259 alongside earnings growth of 52% over the last year. With net profit margin easing from 15.6% to 14.6%, the story this season is less about headline growth and more about how durable those margins look from here.

See our full analysis for XMH Holdings.With the numbers on the table, the next step is to see how this earnings profile lines up against the dominant narratives around XMH Holdings, highlighting where sentiment matches reality and where expectations may need a reset.

Curious how numbers become stories that shape markets? Explore Community Narratives

52 percent earnings growth versus softer margins

- Over the last 12 months, net income excluding extra items reached about SGD 28.4 million with earnings up 52 percent, even as net profit margin eased from 15.6 percent to 14.6 percent.

- What stands out in a generally bullish view is that strong multi year earnings expansion of 62.9 percent per year now has to coexist with a slightly thinner margin profile. This means investors need to decide whether they care more about the pace of profit growth or the direction of profitability per dollar of sales.

- On the growth side, H1 2026 net income of SGD 15.4 million already exceeds each of the last two half year periods, reinforcing the idea that profit levels are still moving higher.

- On the risk side, the move in net margin from 15.6 percent to 14.6 percent shows that higher profits are currently coming with a small squeeze on efficiency, which a cautious investor might flag as something to monitor rather than ignore.

6x P/E and price below DCF fair value

- The shares trade on a trailing P/E of 6 times compared to 14.3 times for the Asian Trade Distributors industry and 10.8 times for peers, while the SGD 1.56 share price sits below a DCF fair value of about SGD 1.69.

- From a generally bullish angle, this combination of a large P/E discount and a modest 7.6 percent gap to DCF fair value suggests the market is pricing XMH more cautiously than its recent 52 percent earnings growth might imply. This creates a clear tension between the low valuation multiples and the strength of the underlying profit trend.

- Supporters of the bullish case can point to trailing 12 month EPS of roughly SGD 0.259 against the 6 times P/E as evidence that investors are paying relatively little for each dollar of earnings compared with the wider group.

- More skeptical investors might counter that the small discount to the DCF fair value of SGD 1.69 does not leave a huge margin of safety if margins were to keep drifting down from the current 14.6 percent level.

Revenue base nearly doubles in two years

- Looking at the half year snapshots, total revenue moved from about SGD 66.9 million in H1 2025 to SGD 93.9 million in H1 2026, while trailing 12 month revenue rose from roughly SGD 120.0 million to SGD 194.2 million over the same general timeframe.

- For investors leaning bullish, this rapid expansion in the revenue base strengthens the argument that XMH is building a larger platform for future profits. At the same time, the drift in net margin from 15.6 percent to 14.6 percent means they also need to be comfortable with the idea that scaling up the business has so far come with slightly lower profitability per dollar of sales.

- Those focusing on growth can highlight that H1 2026 net income of SGD 15.4 million is being generated off a much larger revenue pool than in early 2025, indicating that absolute profits are rising alongside the top line.

- Investors prioritizing quality may instead focus on whether the company can stabilise or improve that 14.6 percent margin as the business matures, given that a weaker margin track record would make the high historical earnings growth harder to extrapolate.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on XMH Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite rapid earnings growth, XMH Holdings is facing gently eroding profit margins and only a modest discount to fair value, which limits its margin of safety.

If that combination makes you uneasy, use our pre filtered these 903 undervalued stocks based on cash flows to quickly focus on businesses where pricing and fundamentals line up more convincingly right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com