Assessing Corcept Therapeutics (CORT) Valuation After Bullish Analyst Views on Korlym and Relacorilant’s PDUFA Milestone

Corcept Therapeutics (CORT) is back in focus after fresh analyst commentary spotlighted growing Korlym sales and rising expectations for relacorilant ahead of its key PDUFA decision for Cushing’s syndrome.

See our latest analysis for Corcept Therapeutics.

The stock has been repricing that optimism fast, with a roughly 16 percent 1 month share price return, a 26 percent 3 month share price return, and a powerful 3 year total shareholder return of about 338 percent, pointing to clear, building momentum around Corcept’s growth story.

If Korlym and relacorilant have you rethinking what is possible in healthcare, it is worth scanning other promising names through healthcare stocks to see where similar momentum might be emerging.

Yet with Corcept trading at a steep discount to analyst targets despite rapid revenue and earnings growth, investors face a key question: is this still an underappreciated growth story, or are markets already pricing in the next leg higher?

Most Popular Narrative: 34.6% Undervalued

With Corcept Therapeutics last closing at $87.99 against a narrative fair value of $134.50, the storyline leans toward meaningful upside if assumptions hold.

The publication of the CATALYST study and the resulting increased awareness and screening for hypercortisolism among physicians are expanding the potential addressable patient pool, which is expected to drive significant acceleration in revenue growth over the next several years.

Curious what kind of revenue surge and margin reset would justify this higher value, and why a richer future earnings multiple sits at the core of it all? Explore the details to see which growth and profitability assumptions power this upside narrative.

Result: Fair Value of $134.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if Korlym faces faster pricing pressure or if relacorilant approvals slip, which would delay diversification just as competition intensifies.

Find out about the key risks to this Corcept Therapeutics narrative.

Another View: Rich On Earnings Today

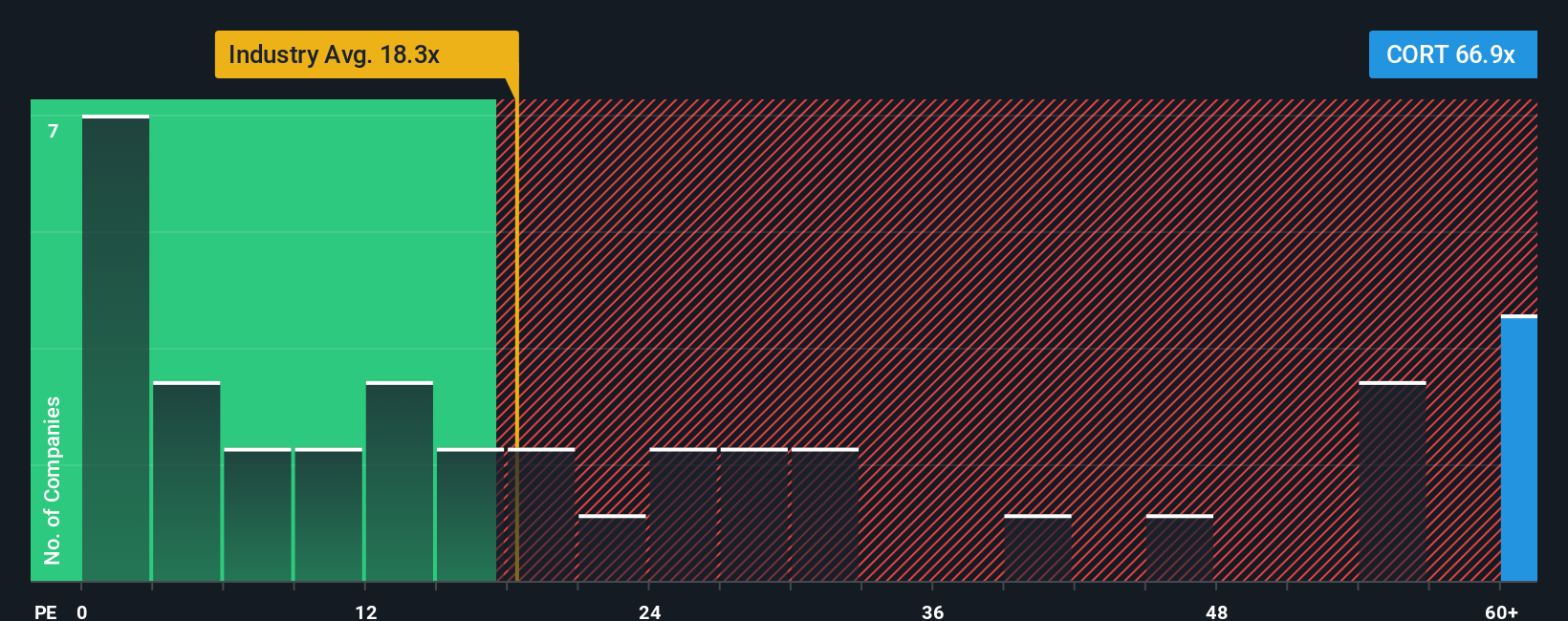

While narrative and analyst targets point to upside, the earnings lens sends a very different signal. Corcept trades on a steep 88.4 times earnings, more than double its fair ratio of 44.8 times and far above the US pharma average of 20 times and peer average of 36.7 times. That gap suggests meaningful valuation risk if growth or sentiment cool, so how comfortable are you paying up now for tomorrow’s story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corcept Therapeutics Narrative

If you see the numbers differently or simply want to test your own thesis, you can build a personalized narrative in minutes. Do it your way.

A great starting point for your Corcept Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next smart investing edge?

Do not stop with one compelling story. Use the Simply Wall St Screener to uncover fresh opportunities that match your strategy before the crowd catches on.

- Capture potential market mispricings by targeting companies trading below their estimated cash flow value with these 904 undervalued stocks based on cash flows.

- Capitalize on transformative tech tailwinds by scanning these 26 AI penny stocks that could benefit most from the AI boom.

- Strengthen your income stream by filtering for reliable payers through these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com