Does Norwegian Cruise Line’s Recent Rebound Signal a Mispriced Opportunity in 2025?

- Wondering if Norwegian Cruise Line Holdings is a bargain or a value trap at around $20.86 a share? You are not alone, and this breakdown will help you cut through the noise.

- Despite being down 19.5% year to date and 22.2% over the last year, the stock has bounced 10.3% in the last week and 14.1% over the past month, while still sitting on a 45.7% gain over three years.

- Those swings are happening against a backdrop of steady post pandemic cruising demand, ongoing capacity ramp ups across the fleet, and management leaning into higher yielding itineraries. At the same time, investors remain focused on debt reduction, pricing power, and how resilient demand will be if macro conditions soften.

- On our framework, Norwegian Cruise Line Holdings scores a 5/6 valuation check, suggesting it screens as undervalued on most measures. Next, we will dig into the usual valuation approaches, before finishing with a more holistic way to think about what the market is really pricing in.

Approach 1: Norwegian Cruise Line Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects a company’s future cash flows and then discounts them back to today’s dollars, aiming to estimate what the business is worth right now. For Norwegian Cruise Line Holdings, the latest twelve month Free Cash Flow is negative at roughly $449 million, reflecting ongoing investment and the tail end of the post pandemic recovery.

Analysts expect this to swing into positive territory over the next few years, with projected Free Cash Flow rising to about $1.97 billion by 2029. Beyond those analyst estimates, Simply Wall St extends the outlook using a two stage Free Cash Flow to Equity model, which smooths growth as the business matures.

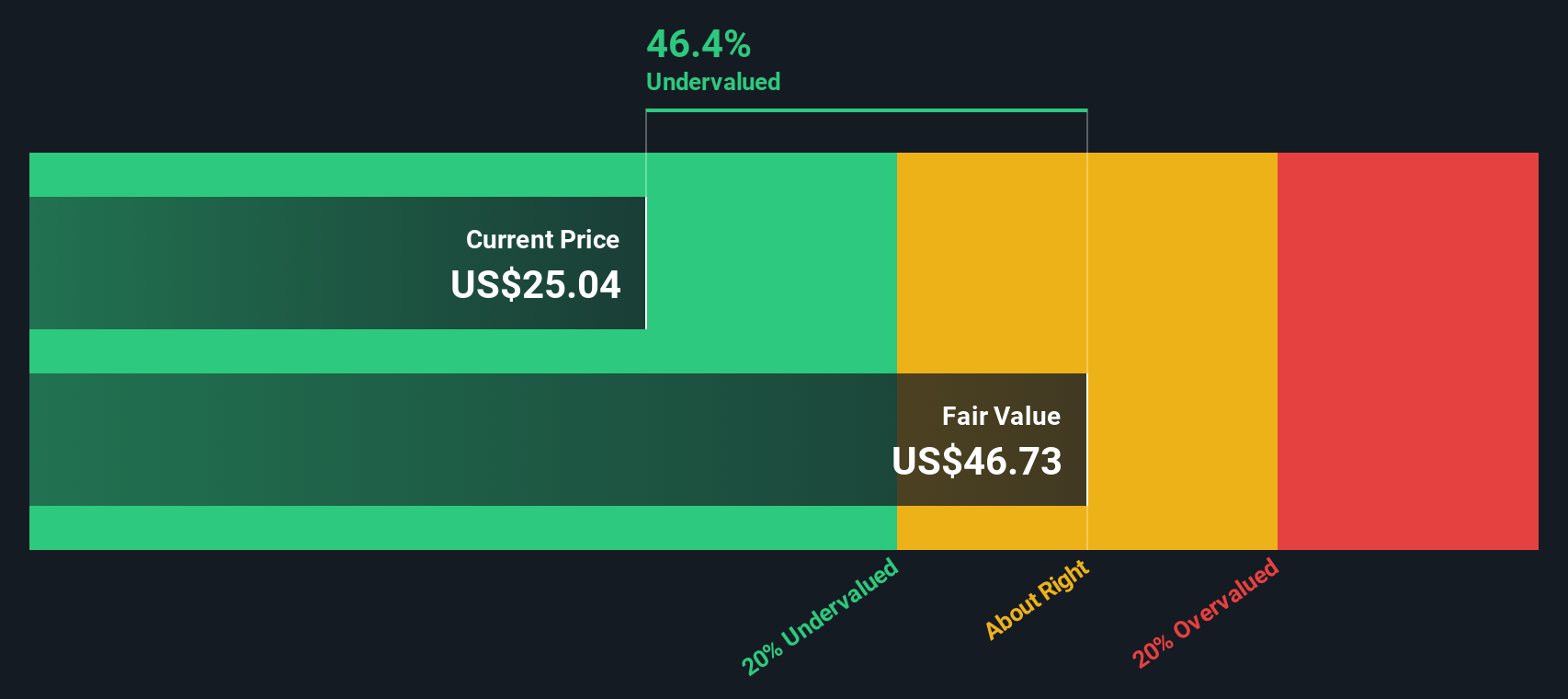

On this basis, the intrinsic value from the DCF model is about $45.06 per share, versus a recent share price around $20.86. That implies the stock trades at roughly a 53.7% discount to its estimated fair value, suggesting investors are still heavily discounting execution and macro risks.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Norwegian Cruise Line Holdings is undervalued by 53.7%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Norwegian Cruise Line Holdings Price vs Earnings

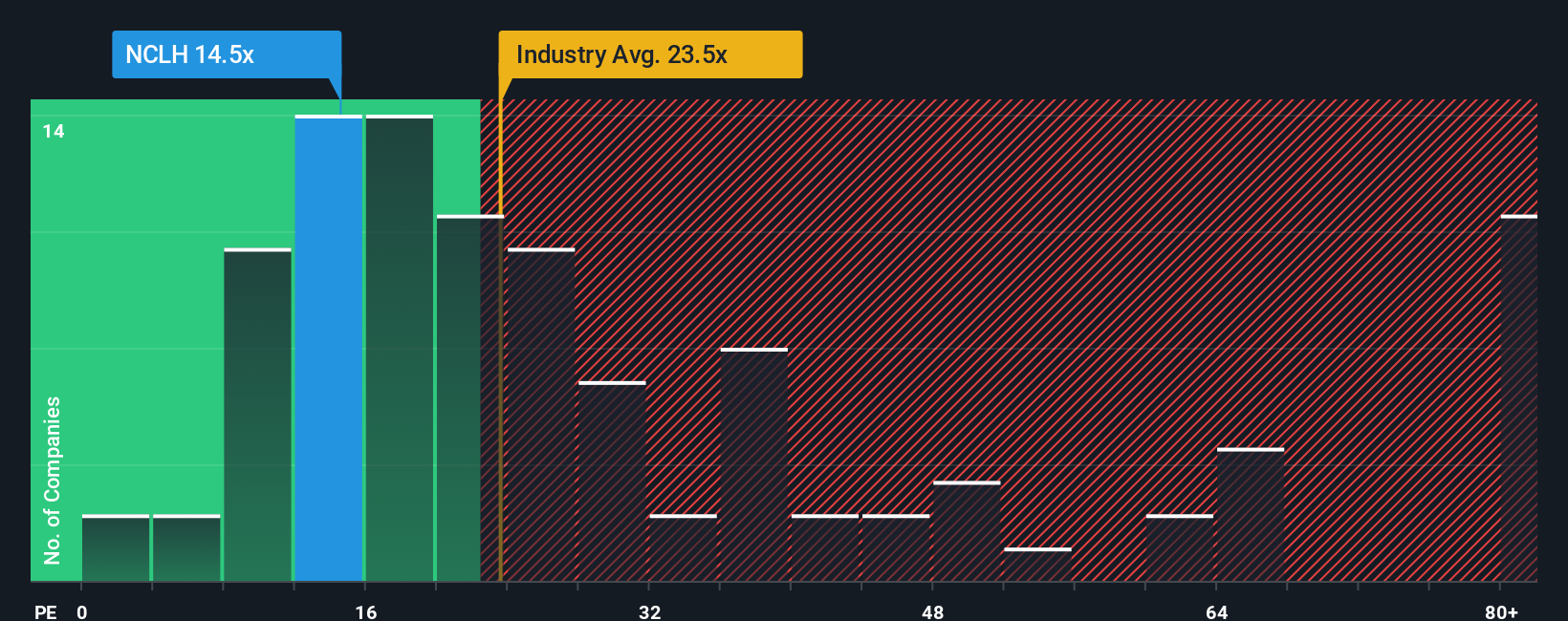

For profitable companies, the Price to Earnings, or P E, ratio is a straightforward way to see how much investors are willing to pay today for each dollar of current earnings. This makes it a natural cross check on the DCF work above. In general, higher expected growth and lower perceived risk justify a higher P E, while slower growth or elevated risk typically warrant a lower, more conservative multiple.

Norwegian Cruise Line Holdings currently trades on a P E of about 14.31x, well below the Hospitality industry average of roughly 24.61x and the broader peer group average of around 43.60x. To go a step further, Simply Wall St calculates a Fair Ratio of about 42.92x. This is the P E you would reasonably expect once you factor in the company’s earnings growth outlook, industry context, profit margins, market cap and key risks. This Fair Ratio is more tailored than a simple peer or industry comparison because it adjusts for those company specific drivers rather than assuming one size fits all.

With the current 14.31x P E sitting far below the 42.92x Fair Ratio, the multiple based view also points to the shares looking materially undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Norwegian Cruise Line Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives. These are simple stories you create about Norwegian Cruise Line Holdings that tie your view of its future revenue, earnings and margins to a financial forecast, a fair value estimate, and ultimately a buy or sell decision. All of this happens within the Narratives tool on Simply Wall St’s Community page, which millions of investors use to compare their own fair value to today’s share price, see those fair values update automatically when fresh news or earnings land, and observe how one bullish investor might build a Narrative around premium destinations, fleet upgrades and margin expansion that supports a fair value toward the top of the current analyst range near $40. A more cautious investor may instead focus on debt, rising capacity and yield risk and land closer to the low end around $23, illustrating how different yet structured perspectives can guide your timing and conviction.

Do you think there's more to the story for Norwegian Cruise Line Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com