What Ulta Beauty (ULTA)'s Upgraded 2025 Outlook and Loyalty Momentum Means For Shareholders

- Earlier in December 2025, Ulta Beauty reported third-quarter results showing sales rising to US$2,857.62 million while net income softened slightly, raised full-year 2025 guidance to around US$12.30 billion in net sales with a 12.3%–12.4% operating margin and US$25.20–US$25.50 EPS, and confirmed fourth-quarter EPS guidance of US$7.61–US$7.90 with operating margin of 12%–12.3%.

- Management linked this upgraded outlook to strong sales growth, record loyalty engagement and exclusive brand launches, while also continuing meaningful share repurchases, which together suggest growing confidence in the company’s operating model.

- We’ll now look at how Ulta’s upgraded 2025 guidance and loyalty-driven momentum shape its existing investment narrative and risk balance.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Ulta Beauty Investment Narrative Recap

To own Ulta, you need to believe its loyalty engine, differentiated assortment and omnichannel model can offset rising costs and intensifying competition. The upgraded 2025 guidance reinforces that story in the near term, while also shining a light on the biggest current swing factor: whether Ulta can defend margins as investments in stores, technology and international growth push SG&A higher. For now, the new outlook lifts expectations but does not remove the long term cost and format risks.

The most relevant update here is Ulta’s higher 2025 guidance to about US$12.30 billion in net sales, a 12.3% to 12.4% operating margin and US$25.20 to US$25.50 EPS. That guidance, tied to strong loyalty engagement and exclusive brand launches, directly links the near term catalyst of membership driven sales growth with the ongoing risk that rising store, wage and benefit costs could still pressure profitability if revenue momentum slows.

But even with upgraded guidance, investors should be aware that rising wage, benefits and in store experience costs could eventually...

Read the full narrative on Ulta Beauty (it's free!)

Ulta Beauty’s narrative projects $13.8 billion revenue and $1.3 billion earnings by 2028. This requires 5.9% yearly revenue growth and an earnings increase of about $0.1 billion from $1.2 billion today.

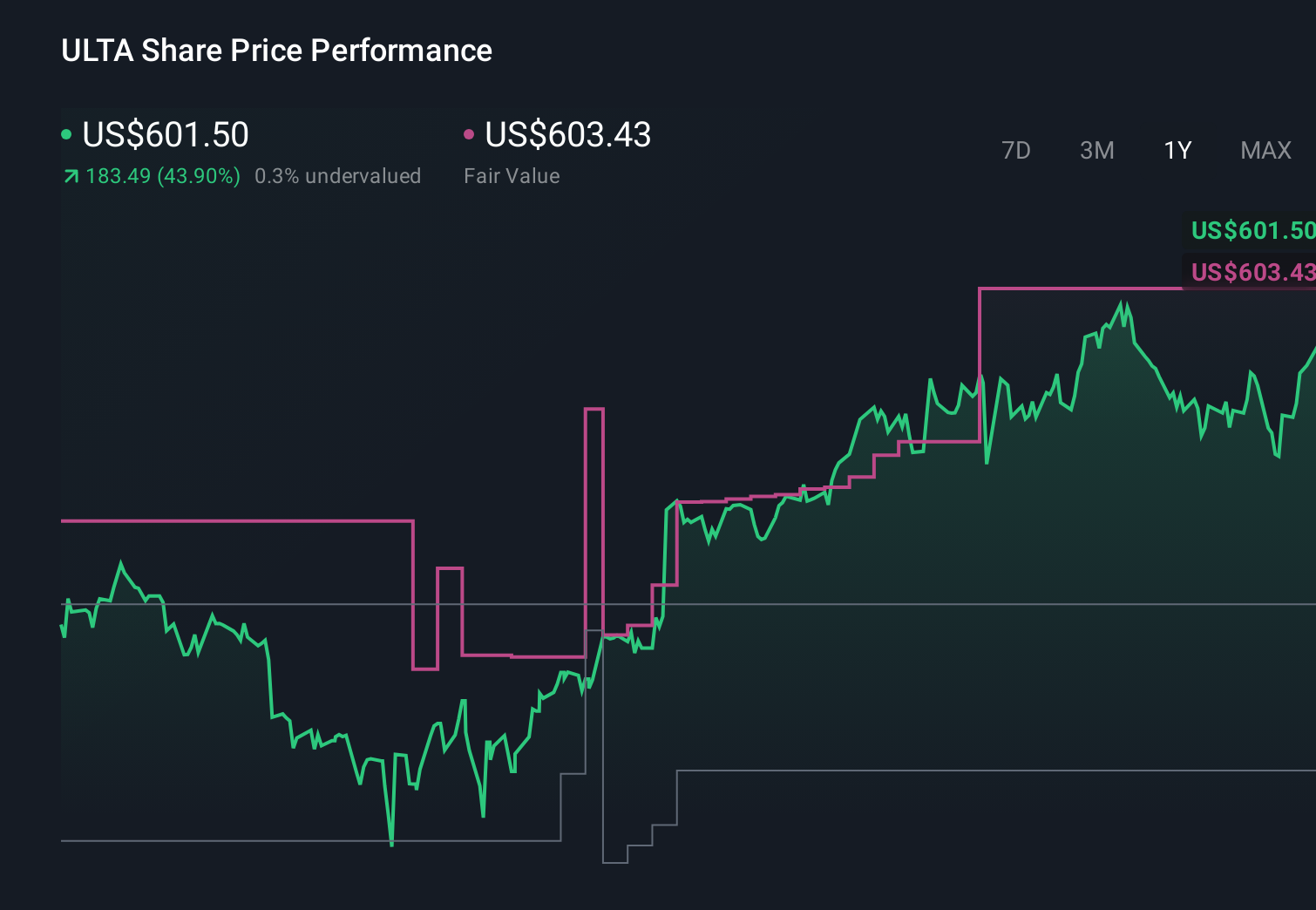

Uncover how Ulta Beauty's forecasts yield a $603.43 fair value, in line with its current price.

Exploring Other Perspectives

Nine Simply Wall St Community fair value estimates for Ulta range from about US$380.74 to US$603.43 per share, underscoring how far opinions can diverge. As you weigh those views against Ulta’s loyalty powered growth catalyst, consider how sustained margin pressure from higher store and labor costs might affect the company over time.

Explore 9 other fair value estimates on Ulta Beauty - why the stock might be worth 37% less than the current price!

Build Your Own Ulta Beauty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ulta Beauty research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Ulta Beauty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ulta Beauty's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com