Reassessing Cheniere Energy Partners (CQP) Valuation After B of A’s Renewed Underperform Call and Lower Price Target

B of A Securities just reiterated its Underperform call on Cheniere Energy Partners (NYSE:CQP) while trimming expectations further. This move lines up with broader caution across LNG names facing tighter profit margins.

See our latest analysis for Cheniere Energy Partners.

The cautious call comes as CQP trades near $52.94, with recent share price returns soft and sector wide LNG pressure keeping sentiment muted. Even so, its five year total shareholder return above 100 percent indicates that the long term story has still rewarded patient holders.

If this latest downgrade has you rethinking your energy exposure, it could be a good moment to scan the broader space and uncover interesting ideas among aerospace and defense stocks.

With CQP now trading only a few dollars below a cautious Wall Street target and sporting a modest earnings multiple, investors face a key question: is this quietly undervalued or already pricing in most of its future growth?

Price-to-Earnings of 13.8x: Is it justified?

On a simple snapshot, Cheniere Energy Partners trades at a 13.8x price to earnings multiple, modestly cheaper than the broader US market but a touch richer than its Oil and Gas peers.

The price to earnings ratio compares what investors pay today for each dollar of current earnings. This makes it a core yardstick for mature, profit generating energy infrastructure names like CQP.

Against the wider US market, where the average multiple sits closer to 19.1x, CQP screens as relatively inexpensive. This hints that the market is not assigning a premium for its earnings power. Yet versus the US Oil and Gas industry, where peers change hands at roughly 13.3x earnings, CQP is fractionally more expensive, even though its net profit margins have slipped from 25 percent to 18 percent and growth expectations are only mid single digit.

Looking through the lens of a fair price to earnings ratio, however, the picture shifts further in CQP's favor. An estimated fair multiple of 18.3x sits well above its current 13.8x level, which suggests room for the market to re rate if forecasts are met.

Explore the SWS fair ratio for Cheniere Energy Partners

Result: Price-to-Earnings of 13.8x (ABOUT RIGHT)

However, investors still face risks from narrowing LNG margins and slower revenue growth, which could limit multiple expansion if demand or contract economics weaken.

Find out about the key risks to this Cheniere Energy Partners narrative.

Another View on Value

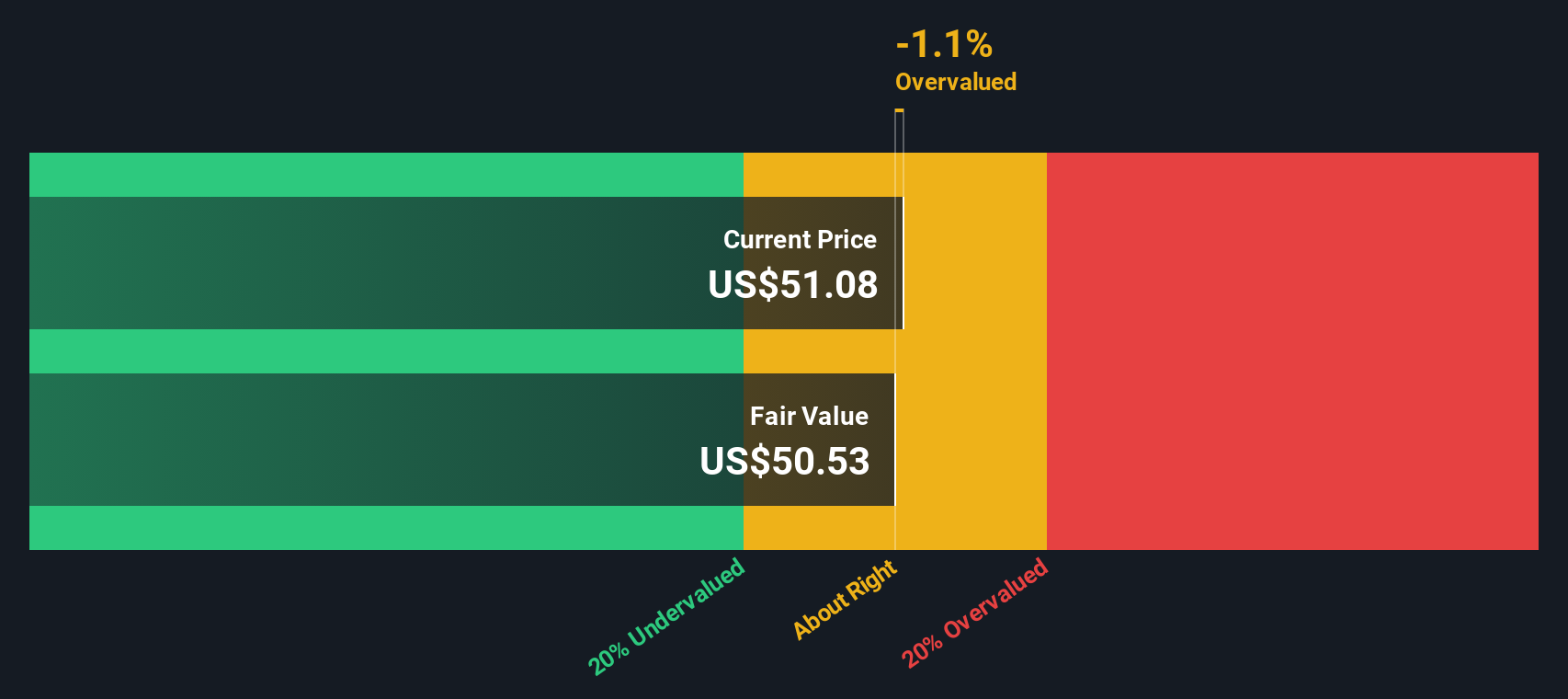

Our DCF model points the other way, suggesting CQP is slightly overvalued at $52.94 versus an estimated fair value around $50.30. That is not a big gap, but it hints the market may already be baking in a lot of its steady growth story, so what changes the narrative from here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cheniere Energy Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cheniere Energy Partners Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly build a personalized view in just minutes: Do it your way.

A great starting point for your Cheniere Energy Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next opportunities with targeted screens on Simply Wall Street so you are not relying on CQP alone.

- Capture potential mispricings by reviewing these 908 undervalued stocks based on cash flows that stand out on cash flow strength and valuation support.

- Tap into the next wave of innovation by scanning these 26 AI penny stocks that marry real revenue growth with compelling AI exposure.

- Boost your income strategy by focusing on these 13 dividend stocks with yields > 3% that pair meaningful yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com