Hexagon (OM:HEXA B): Reassessing Valuation as Earnings Grow but Share Price Momentum Cools

Hexagon (OM:HEXA B) has been treading water lately, with the stock slipping over the past month despite steady revenue and faster growing net income. That disconnect naturally raises questions about valuation.

See our latest analysis for Hexagon.

Over the past year, Hexagon has delivered a modest positive total shareholder return while its recent 1 month and 1 week share price returns have slipped, suggesting momentum is cooling even as earnings trends remain supportive.

If Hexagon’s slower momentum has you reassessing tech exposure, it might be a good time to see what else is out there with high growth tech and AI stocks.

With earnings growing faster than sales, a slight discount to analyst targets and only a thin margin to intrinsic value estimates, is Hexagon a quietly mispriced compounder, or is the market already baking in the next leg of growth?

Most Popular Narrative: 10.5% Undervalued

Hexagon’s most followed narrative sees upside from today’s SEK108.5 close, arguing that modestly stronger long term growth and margins justify a higher fair value.

The company's growing base of recurring software and SaaS revenues (particularly in Asset Lifecycle Intelligence and SIG) continues to improve the quality and predictability of Hexagon's revenue streams, supporting gross margin expansion and providing a stabilizing influence on earnings.

Curious how steady software growth, rising margins, and a premium earnings multiple combine into this valuation story? The full narrative unpacks the exact growth runway, profitability lift, and future P E assumptions driving that upside case.

Result: Fair Value of $121.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and weaker construction demand in Europe and China could easily undermine this upside case and cap near term re rating potential.

Find out about the key risks to this Hexagon narrative.

Another Lens on Value

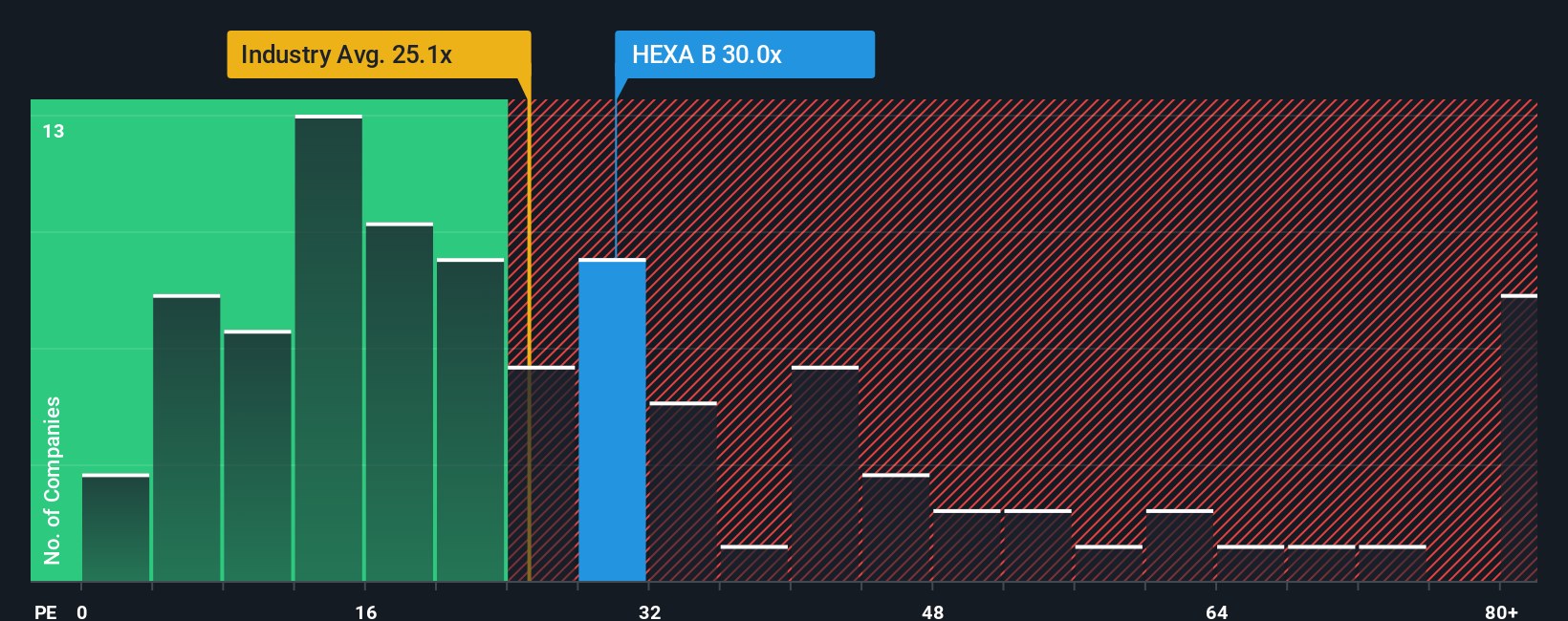

On earnings multiples, Hexagon looks anything but cheap. The shares trade at about 39.8 times earnings versus 25.6 times for peers and a fair ratio of 36.5 times. This points to a valuation that already assumes smooth execution and leaves less room for disappointment if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hexagon Narrative

If this view does not quite fit your own, or you prefer digging into the numbers yourself, you can build a custom story in minutes: Do it your way.

A great starting point for your Hexagon research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investment move?

Do not stop with one idea. Use the Simply Wall Street Screener to quickly surface fresh opportunities tailored to the way you like to invest.

- Capture potential multi baggers early by scanning these 3611 penny stocks with strong financials that already show financial strength, not just speculative hype.

- Position ahead of the next tech wave by targeting innovators among these 26 AI penny stocks transforming industries with real world AI solutions.

- Strengthen your long term core holdings by filtering for these 908 undervalued stocks based on cash flows that the market has not fully appreciated yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com