Is EDP’s Italian Solar Sale Quietly Redefining Its Capital Allocation Priorities (ENXTLS:EDP)?

- EDP has recently completed the sale of a 207-MW solar portfolio in Italy, as part of its ongoing renewable asset optimization efforts, and earlier this month it also presented at the Energy LIVE Conference 2025 in Houston through Stephan Blasilli, Head of Business Excellence.

- This portfolio sale highlights how EDP is actively reshaping its renewables mix and freeing up capital that can be reallocated across its wider growth priorities.

- We’ll now examine how the Italian solar portfolio sale could influence EDP’s investment narrative and future capital allocation choices.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

EDP Investment Narrative Recap

To own EDP, you need to believe in its ability to compound value in regulated networks and renewables while managing policy, tax and earnings volatility. The Italian 207 MW solar sale fits its asset rotation approach but does not appear to change the key short term focus on stabilizing profitability and reducing reliance on asset rotation gains, nor does it materially alter the main risks around regulation and extraordinary taxation in core markets.

The recent Q3 2025 results, which showed higher year on year revenue but lower net income, feel particularly relevant here, as they underline how asset mix, rotation activity and one off items can influence earnings quality. Against that backdrop, the Italian solar sale looks incremental to EDP’s existing optimization efforts rather than a reset of its growth or risk profile in the near term.

But while asset sales may support capital recycling, investors should be aware that...

Read the full narrative on EDP (it's free!)

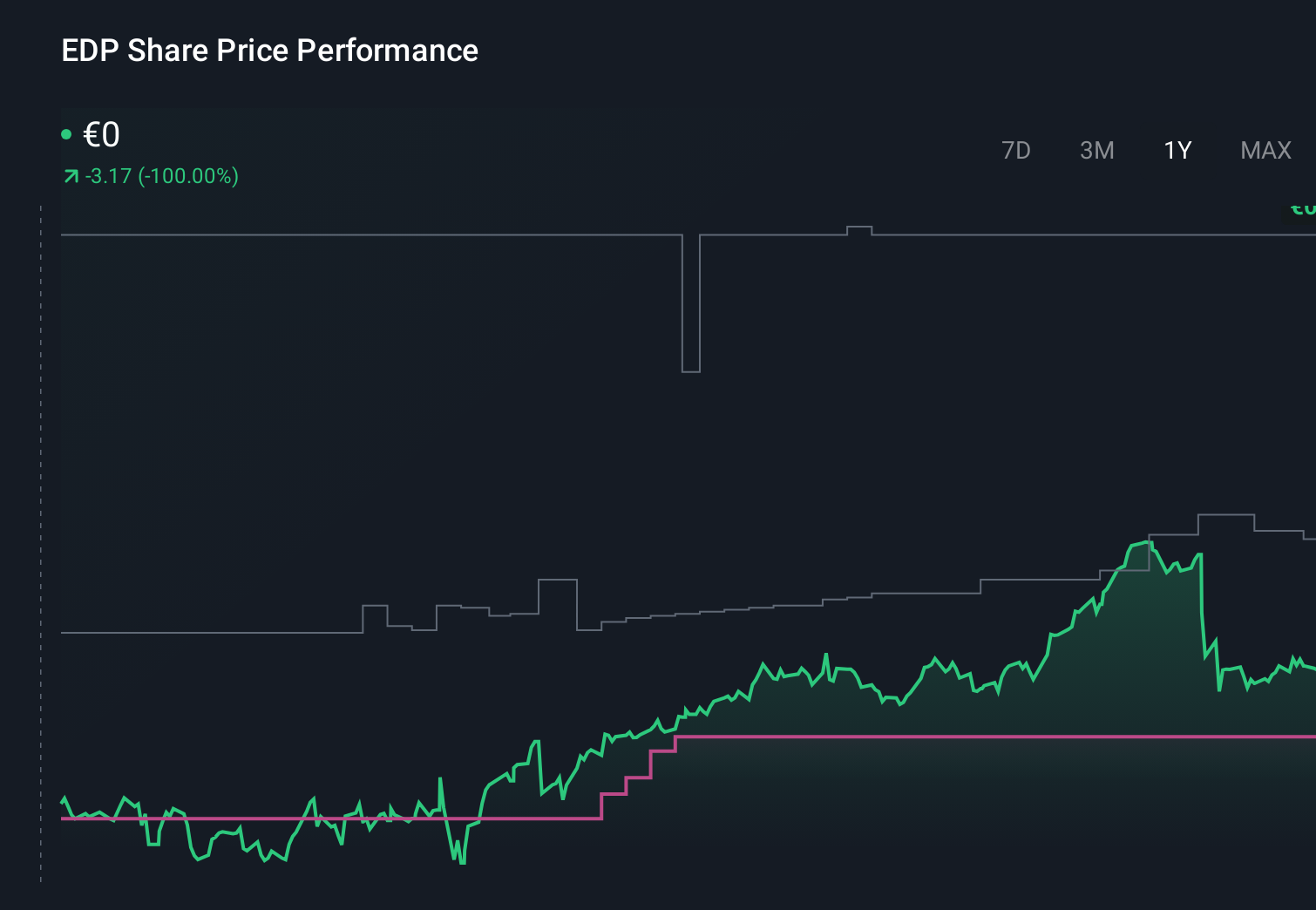

EDP’s narrative projects €15.0 billion revenue and €1.3 billion earnings by 2028. This requires a 0.9% yearly revenue decline and about a €552 million earnings increase from €747.7 million today.

Uncover how EDP's forecasts yield a €4.46 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly €1.78 to €5.28 per share, showing how widely views on EDP can differ. You can weigh those opinions against the risk that earnings remain sensitive to asset rotation gains and regulatory outcomes in key regions, which could influence how the market judges EDP’s progress over time.

Explore 8 other fair value estimates on EDP - why the stock might be worth as much as 41% more than the current price!

Build Your Own EDP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EDP research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free EDP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EDP's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com