New Army Corps Contract Could Be A Game Changer For Tutor Perini’s Backlog Story (TPC)

- Tutor Perini Corporation, through its subsidiary Perini Management Services, was awarded a US$35.8 million U.S. Army Corps of Engineers contract to build a 56,000-square-foot Tool and Die Facility at the Iowa Army Ammunition Plant, with work that began in November 2025 and substantial completion targeted for June 2027 now included in its backlog.

- This win expands Tutor Perini’s federal defense footprint while adding environmentally focused, LEED Silver–targeted work that complements its broader civil and infrastructure portfolio.

- We’ll now explore how this new US$35.8 million Army Corps contract influences Tutor Perini’s backlog-led investment narrative and risk profile.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Tutor Perini Investment Narrative Recap

To own Tutor Perini, you need to believe that its record US$21.1 billion backlog will convert into steadier earnings while legacy project and litigation issues remain contained. The new US$35.8 million Army Corps contract modestly reinforces the backlog-led story and federal work mix, but it is not large enough on its own to change the near term earnings trajectory or overshadow the key risk around execution on major projects and fixed price work.

The recent decision to initiate a quarterly dividend of US$0.06 per share and authorize up to US$200 million in buybacks is more directly relevant for near term catalysts, as it signals a shift toward returning cash to shareholders after a period of uneven profitability. Against that backdrop, incremental defense and infrastructure awards like the Iowa Army Ammunition Plant facility help support the case that a healthier backlog can underpin future cash generation to sustain these capital return plans.

Yet while the backlog is growing and capital returns are starting, investors still need to be aware of the ongoing risk that large, complex contracts...

Read the full narrative on Tutor Perini (it's free!)

Tutor Perini's narrative projects $7.1 billion revenue and $515.9 million earnings by 2028.

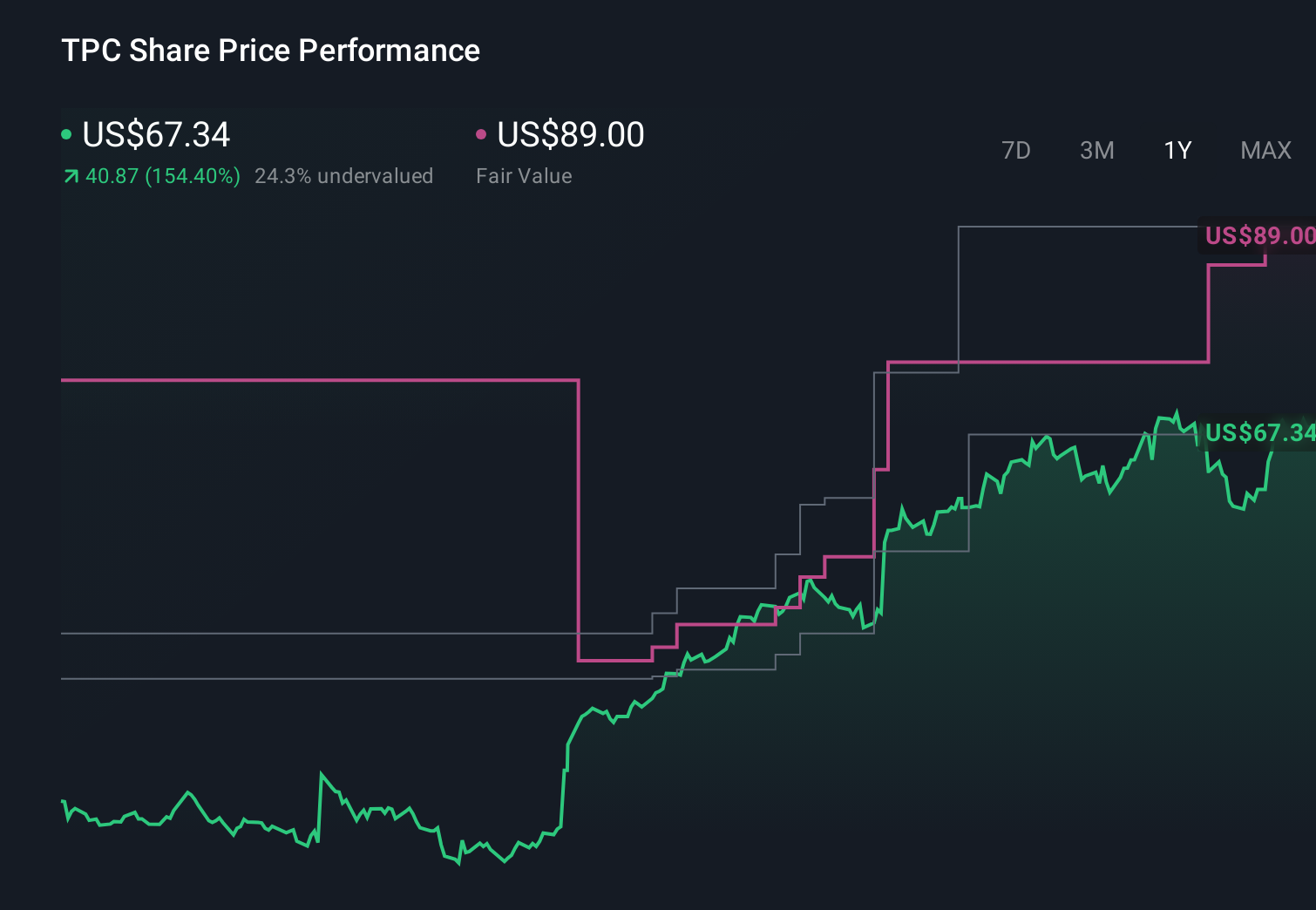

Uncover how Tutor Perini's forecasts yield a $89.00 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span about US$67 to US$89 per share, showing how widely opinions can differ. You can set those views against the backlog driven thesis and the lingering execution and litigation risks that could still influence how much of that backlog turns into durable earnings.

Explore 4 other fair value estimates on Tutor Perini - why the stock might be worth as much as 32% more than the current price!

Build Your Own Tutor Perini Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tutor Perini research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tutor Perini research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tutor Perini's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com