Santos (ASX:STO): Reassessing Valuation After Barossa Setbacks, Regulatory Risks and a New Dividend Payout Plan

Santos (ASX:STO) is back in focus after fresh updates on its Barossa LNG startup issues, looming east coast gas market reforms, and a revamped dividend policy that will lift free cash flow payouts from 2026.

See our latest analysis for Santos.

Those Barossa setbacks and regulatory jitters help explain why the 90 day share price return sits at a weak negative 17.52 percent. Even so, the five year total shareholder return of 22.35 percent shows the longer term story is still intact and suggests momentum has cooled rather than collapsed.

If Santos has you reassessing energy risk and reward, this could be a smart moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

With Barossa delays clouding near term earnings, yet analysts still seeing around 20 percent upside to the share price, is Santos quietly undervalued today or is the market already baking in its next leg of growth?

Most Popular Narrative: 17% Undervalued

With Santos last closing at A$6.26 versus a narrative fair value of A$7.53, the current price embeds a sizable discount to projected cash generation.

Company-wide focus on operational efficiency, project self-execution, and continued cost reductions (targeting sub $7/boe unit costs) is likely to improve free cash flow generation and net margins as new projects come online and CapEx cycles moderate.

Curious how modestly faster growth, fatter margins and a lower future earnings multiple can still add up to a double digit discount to value? The full narrative spells out the playbook behind that gap.

Result: Fair Value of $7.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent Barossa and Pikka execution risks, coupled with volatile LNG prices, could quickly erode that perceived discount if timelines or returns disappoint.

Find out about the key risks to this Santos narrative.

Another View: Multiple Based Valuation

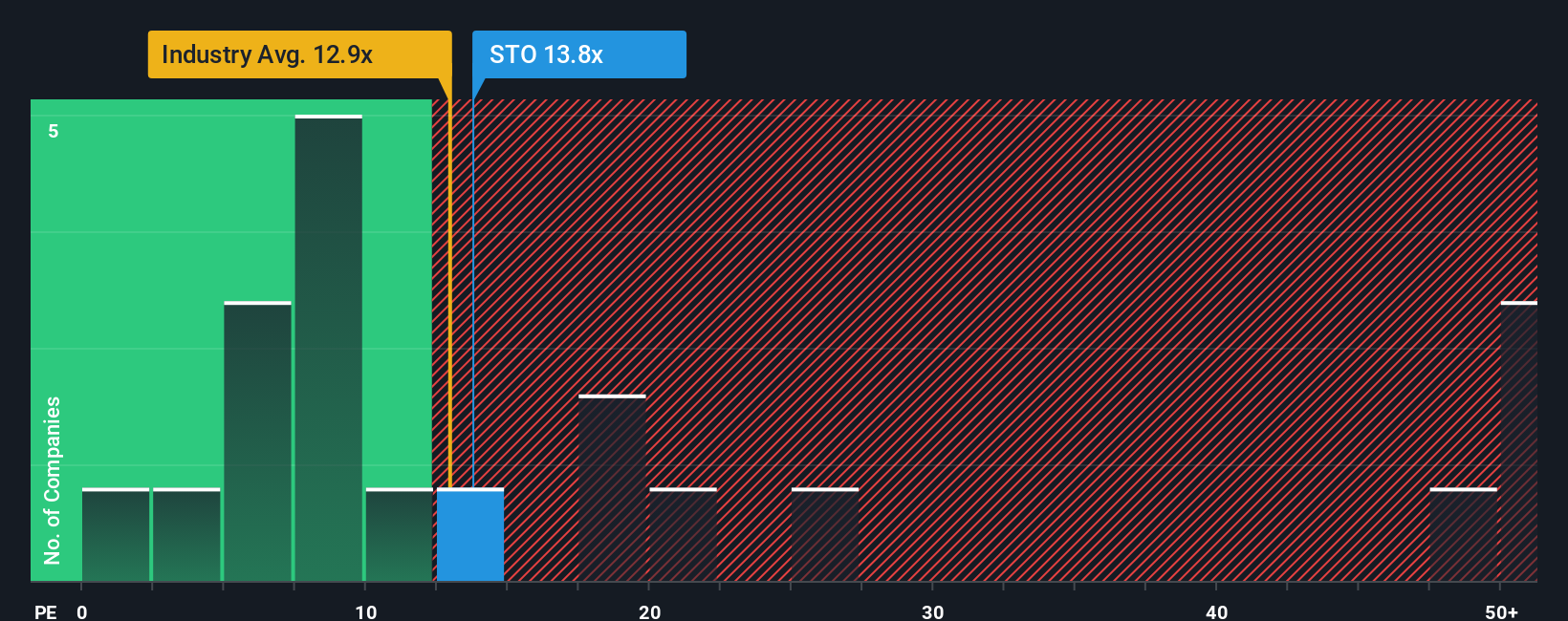

Step away from narratives and Santos still looks intriguing on plain earnings math. It trades on 13.1 times earnings versus 15.5 times for the wider Oceanic oil and gas group and a fair ratio of 15.8 times, hinting at upside if sentiment simply reverts. Or is that discount a warning, not a gift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Santos Narrative

If this perspective on Santos does not fully match your view, review the numbers yourself and build a custom thesis in minutes, Do it your way.

A great starting point for your Santos research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas beyond Santos?

If you are serious about sharpening your edge, do not stop at one stock. Use the Simply Wall Street Screener to uncover fresh, data backed opportunities today.

- Capture potential breakout names by targeting early stage opportunities through these 3612 penny stocks with strong financials before the wider market catches on.

- Ride long term structural trends by zeroing in on innovation leaders using these 26 AI penny stocks shaping the future of intelligent technology.

- Strengthen your core portfolio with cash generative candidates by filtering the market for compelling value via these 908 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com