Has Alexandria Real Estate Equities Fallen Too Far After Its 52% Slide in 2025?

- If you are wondering whether Alexandria Real Estate Equities is a beaten down bargain or a value trap, you are in the right place to unpack what the current share price is really telling us.

- The stock has inched up 2.6% over the last week even after falling 10.8% over the past month and sliding around 52% year to date, so something has clearly shifted in how the market is reassessing its risk and reward profile.

- Recent headlines have focused on how life sciences office demand is evolving and what that means for specialized REITs like Alexandria, alongside ongoing discussion about interest rate expectations and how they impact property valuations. Together, these themes help explain why the share price was punished over the last few years but has started to see pockets of renewed interest as sentiment slowly stabilizes.

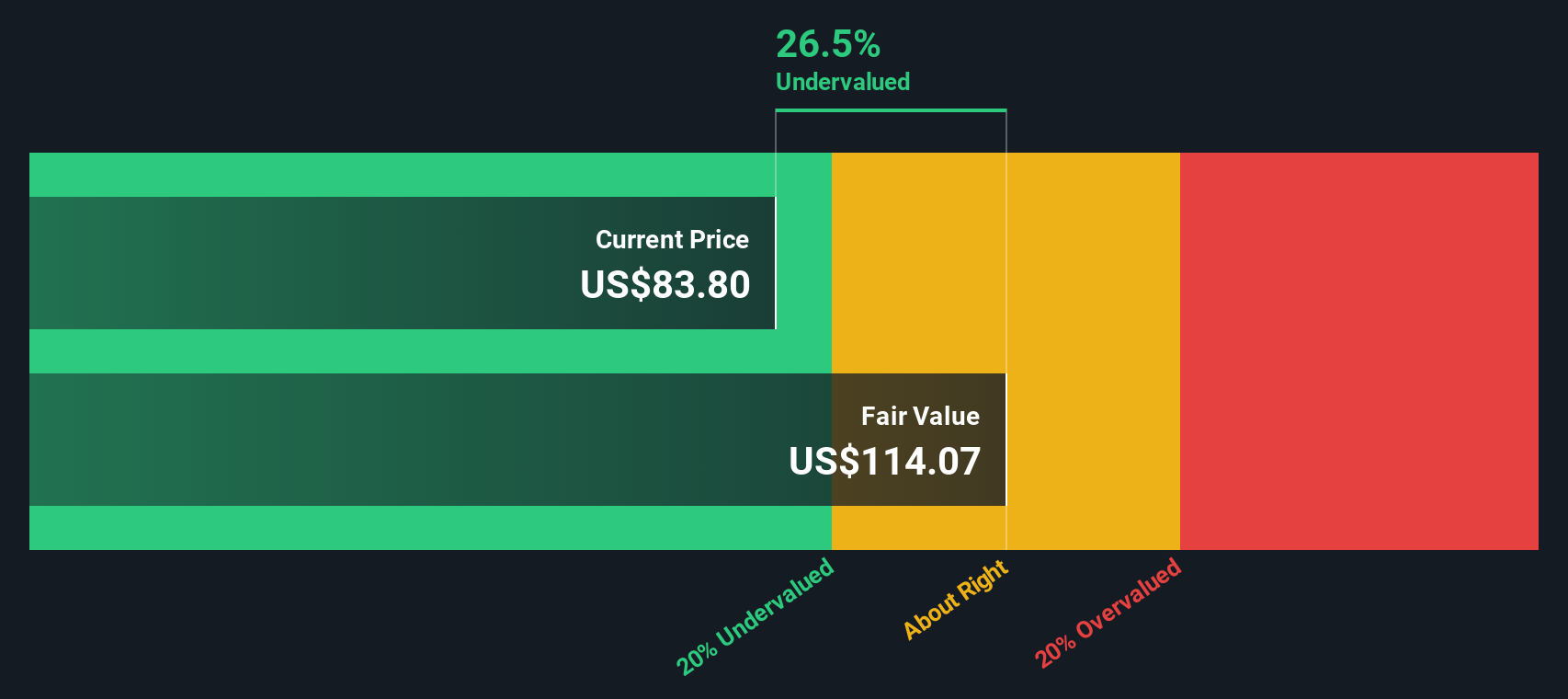

- Right now, Alexandria scores a solid 5/6 on our valuation checks. This suggests the market may be underestimating its intrinsic value and sets us up to walk through discounted cash flow, multiples, and asset based approaches, before finishing with an even more intuitive way to think about what this stock is really worth.

Approach 1: Alexandria Real Estate Equities Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what Alexandria Real Estate Equities is worth today by projecting its adjusted funds from operations into the future and discounting those cash flows back to a present value.

Alexandria currently generates about $1.63 billion in free cash flow, and analysts expect this to remain robust, with projections such as $858.36 million in 2026 and $938.85 million in 2028. Beyond the analyst horizon, Simply Wall St extrapolates further, with free cash flow rising to around $1.21 billion by 2035, reflecting steady but moderating growth as the portfolio matures.

Using a 2 stage Free Cash Flow to Equity model based on these projections, the intrinsic value for Alexandria comes out at roughly $79.61 per share. The current market price implies the stock is trading at a 41.4% discount, which indicates that investors may be pricing in substantially more risk or weaker growth than the cash flow outlook suggests.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alexandria Real Estate Equities is undervalued by 41.4%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Alexandria Real Estate Equities Price vs Sales

For many profitable, mature REITs, the price to sales ratio is a useful cross check on valuation because it compares what investors pay for each dollar of revenue with the scale and stability of those revenues. In general, companies with stronger growth prospects and lower perceived risk can justify a higher multiple, while slower growth or higher uncertainty usually call for a lower, more conservative range.

Alexandria currently trades on a price to sales ratio of 2.64x, which is well below both the Health Care REITs industry average of 6.53x and the peer group average of 7.36x. Simply Wall St also calculates a proprietary “Fair Ratio” of 4.10x for Alexandria, which represents the price to sales multiple the company would typically warrant once its growth profile, risk factors, margins, industry position and market cap are all accounted for. This makes it more tailored than a simple comparison with peers, which can miss nuances like different risk levels or profitability.

With the current 2.64x multiple sitting meaningfully below the 4.10x Fair Ratio, the price to sales lens also points to Alexandria being undervalued at today’s levels.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alexandria Real Estate Equities Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is a simple framework on Simply Wall St’s Community page where you connect your view of Alexandria’s story to a set of financial assumptions, project how revenue, earnings and margins might evolve, translate that into a Fair Value, and then compare it to today’s share price to decide whether to buy, hold or sell. The Narrative automatically updates as fresh news or earnings arrive. For example, one investor might build a bullish Alexandria Narrative around premium innovation-cluster assets, long leases and a recovery in biotech funding that supports a Fair Value closer to the top of recent analyst targets near $144 per share. Another might instead focus on weak leasing, dividend cuts and higher cap rates and land nearer the low end around $63. In both cases, investors can clearly see how their beliefs flow through to forecasts, valuation, and ultimately, their investment decision.

Do you think there's more to the story for Alexandria Real Estate Equities? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com