Assessing 4DMedical (ASX:4DX) Valuation After Expanded Philips CT:VQ Distribution Deal

4DMedical (ASX:4DX) just announced a significant expansion of its distribution agreement with Koninklijke Philips for its FDA cleared CT:VQ non contrast lung imaging solution, sharpening investor focus on how widely this technology could scale.

See our latest analysis for 4DMedical.

The expanded Philips deal lands on top of a sharp run, with 4DMedical delivering a 51.02% 1 month share price return and a 377.42% 1 year total shareholder return. This suggests momentum is still building despite a modestly negative 5 year total shareholder return.

If this kind of healthcare innovation has your attention, it might be worth scanning the broader universe of promising healthcare stocks that could be next in line for a rerating.

With revenues accelerating but losses still steep and the share price now sitting just below analyst targets, the key question is whether 4DMedical is still trading below its potential or whether the market is already pricing in future growth.

Most Popular Narrative Narrative: 4% Undervalued

With the narrative fair value sitting just above 4DMedical's last close of A$2.22, the story assumes investors will keep rewarding long term earnings power.

The analysts have a consensus price target of A$0.725 for 4DMedical based on their expectations of its future earnings growth, profit margins and other risk factors. In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$48.5 million, earnings will come to A$17.4 million, and it would be trading on a PE ratio of 24.1x, assuming you use a discount rate of 7.5%.

Curious how a loss making small cap earns a premium future multiple and a rich earnings profile, all from fast climbing revenues and margin upgrades? The full narrative unpacks the precise growth runway, profitability shift, and valuation bridge that have to line up almost perfectly. Want to see the exact assumptions behind that bold trajectory?

Result: Fair Value of $2.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cash burn and limited funding runway mean that any slip in execution or delayed contracts could quickly undermine this upbeat valuation story.

Find out about the key risks to this 4DMedical narrative.

Another Angle on Valuation

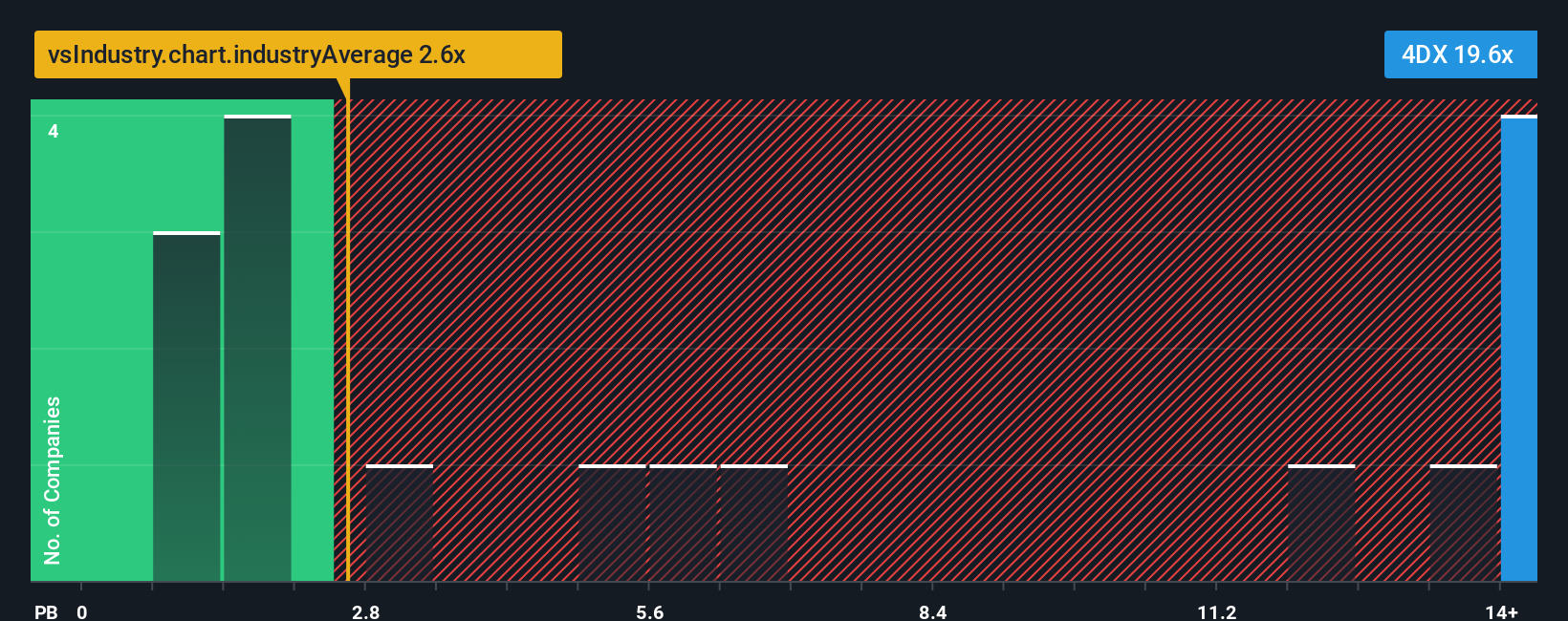

While the narrative fair value leans on long term earnings power, a simpler lens looks at today’s price compared with book value. On that score, 4DMedical trades at 17.8 times book versus 2.6 times for the global Healthcare Services group, a steep premium for a business that is still loss making and capital hungry. Is the market already paying tomorrow’s price for today’s progress?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own 4DMedical Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom view in just minutes: Do it your way.

A great starting point for your 4DMedical research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

If you stop with just one opportunity, you could miss the next market winner. Use the Simply Wall St Screener to pinpoint your next move with confidence.

- Unlock income potential by scanning these 13 dividend stocks with yields > 3% that can strengthen your portfolio with cash flow.

- Look for potentially mispriced opportunities by targeting these 908 undervalued stocks based on cash flows that the market has yet to fully recognize.

- Explore the next wave of digital disruption by zeroing in on these 80 cryptocurrency and blockchain stocks shaping the future of blockchain and decentralized finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com