The data storm is here! The bond market debates the script for the Federal Reserve's 2026 interest rate cut

The Zhitong Finance App learned that the US Treasury bond market is heating up with the upcoming release of a series of key economic data due to the intense debate over the extent of the Federal Reserve's future interest rate cuts.

This week's data will largely fill the information gap caused by the US government shutdown. Monthly employment and inflation data, which was previously delayed, will soon be released, and more key employment data will be released in early January next year. These reports will help answer the core question facing the market in 2026: after cutting interest rates three times in a row, is the Fed's easing cycle nearing its end, or whether more aggressive action is needed.

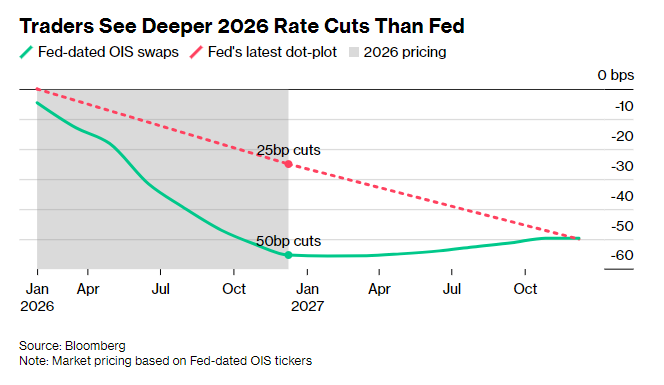

This is a big deal for bond traders. Although inflation remains high, traders are still betting that the Federal Reserve will cut interest rates twice next year to support the job market and economic growth prospects. This expectation is one more time than the number of interest rate cuts currently implied by the Federal Reserve — if the market's judgment is correct, it will pave the way for a new round of steady growth in US bonds, which this year is heading towards the best performing year since 2020.

“For next year's trends, the single most important data is probably the employment data released on Tuesday,” said George Catrambone, head of the fixed income department at DWS Americas. “This is the only indicator I'm concerned about. The trend of the labor market will determine interest rate trends.”

Catrambone is in the camp where the Federal Reserve is expected to cut interest rates drastically — judging from weak labor indicators before this week's data was released, the rate cut may be quite large. When treasury yields soared to multi-month highs last week, he had already increased his treasury bond holdings.

At the beginning of the week, policy-sensitive two-year Treasury yields were around 3.5%, and 10-year Treasury yields were around 4.2%. The Federal Reserve cut the benchmark interest rate by 25 basis points to the 3.5%-3.75% range last week. Chairman Powell emphasized concerns about weak recruitment at a press conference on Wednesday. Since then, yields have declined from recent peaks.

In this context, traders are establishing options positions to profit when market sentiment shifts to anticipate interest rate cuts in the first quarter. Looking at it now, the market has yet to fully absorb the expectations for the next rate cut before mid-next year; the second rate cut is expected in October.

Mainly data

All of this has heightened the market's focus on the upcoming data — which will cover the November situation and part of the October data. According to the median forecast of a survey, the number of non-farm payrolls in the US is likely to increase by 50,000 in November. According to data delayed release last month, the number of people employed in non-farm payrolls increased by 119,000 in September. Although it exceeded expectations, the unemployment rate rose to 4.4%, the highest level since 2021.

For WisdomTree's Kevin Flanagan, the employment report released this week is probably less weighty because the government shutdown complicates data collection, which makes him turn his attention to the report to be released at the beginning of next month, before the Federal Reserve's January 28 policy decision.

“The threshold for the Federal Reserve to cut interest rates at the next meeting in January has been raised,” said Flanagan, the firm's head of fixed income strategy. “We need to see clear signs of cooling in employment reports.”

Strategist Ed Harrison said, “If we want to continue the upward trend in bonds, the December 16 employment report will be the next data hurdle. Given that the market's general expectation of an increase in non-farm payrolls is 50,000, a decline in employment may help continue the rise and advance the first fully priced interest rate cut forecast from June to April.”

Flanagan said that if the November data were close to September levels, it could trigger a sell-off and push the 10-year treasury yield to 4.25%. He also believes that the Fed's interest rate cut cycle is nearing its end. The reason is that research shows that 3.5% is the so-called neutral interest rate, that is, the interest rate that neither stimulates nor limits the economy.

This view echoes Powell's comments last week. He said that the Federal Reserve's benchmark interest rate is now within the “broad estimation range” of neutral interest rates, which emphasizes to some extent that there is limited room for further policy relaxation. According to an indicator from the swap market, traders expect the Federal Reserve to cut interest rates to around 3.2% at the end of the current interest rate cut cycle.

If the Federal Reserve remains largely on hold while inflation remains high, the treasury bond market may not experience a bullish market that can bring impressive total returns in 2026, but will instead show a pattern of range-bound fluctuations. Most of the returns will come from about 4% coupon payments.

The new chairman effect

Federal Reserve officials are also divided on the policy path. Like investors, they are waiting for data to indicate the direction. Chicago Federal Reserve Chairman Goulsby, who voted against last week, said on Friday that he voted against cutting interest rates because he wanted to see more inflation data.

Another major event is imminent: Powell's term ends in May next year. Against the backdrop of strong pressure from President Trump to cut interest rates drastically, investors' attention may soon shift from economic data to Powell's successor. Currently, Trump's selection process is nearing completion.

“Whether the economy is slightly overheated or not, the new chairman will mean that the Fed is more dovish,” said Janet Rilling, head of the Plus fixed income team at Allspring Global Investments.

“The job market may be an excuse to cut interest rates,” she said. “We don't expect the unemployment rate to rise sharply, but even if the job market weakens slightly, it may be a reason to cut interest rates.”