Asian Growth Stocks With High Insider Ownership For December 2025

As global markets navigate a period of mixed economic signals, with the U.S. Federal Reserve's rate cuts and concerns over technology valuations making headlines, Asian markets are also experiencing shifts influenced by these global trends. In this environment, growth companies with high insider ownership can offer unique insights into potential resilience and long-term commitment from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| WinWay Technology (TWSE:6515) | 21.7% | 30.3% |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

We'll examine a selection from our screener results.

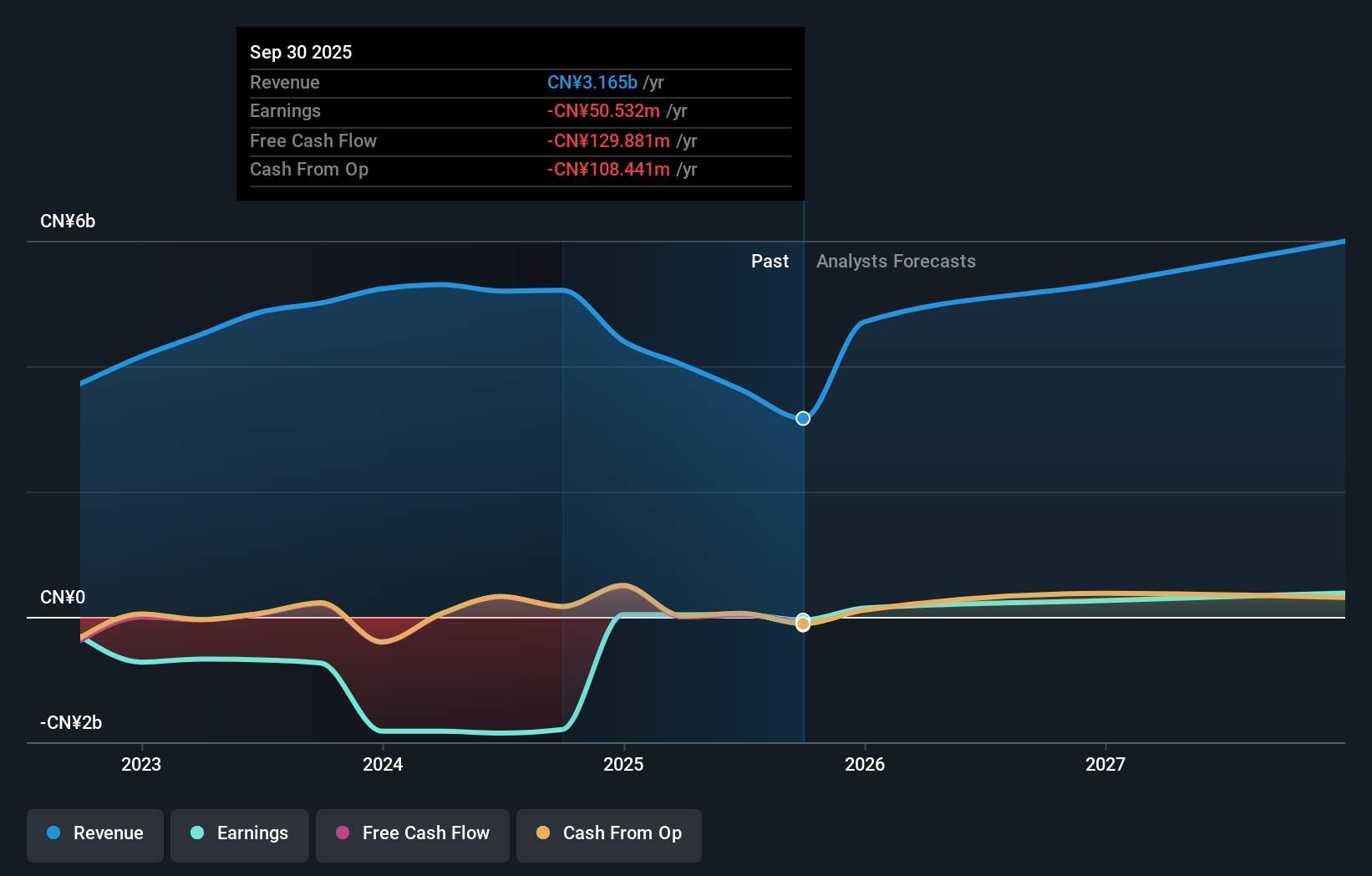

Montnets Cloud Technology Group (SZSE:002123)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Montnets Cloud Technology Group Co., Ltd. operates in the cloud communication services sector and has a market cap of CN¥10.12 billion.

Operations: Montnets Cloud Technology Group Co., Ltd. focuses on cloud communication services and has a market capitalization of CN¥10.12 billion.

Insider Ownership: 14.1%

Revenue Growth Forecast: 21.9% p.a.

Montnets Cloud Technology Group is experiencing significant challenges, with recent earnings showing a net loss of CNY 58.27 million for the first nine months of 2025, a reversal from last year's profit. Despite this, its revenue is forecast to grow at 21.9% annually, outpacing the broader Chinese market's growth rate. While expected to become profitable within three years, insider trading activity has been minimal recently. The company trades at good value compared to peers and industry standards.

- Click here to discover the nuances of Montnets Cloud Technology Group with our detailed analytical future growth report.

- Our valuation report here indicates Montnets Cloud Technology Group may be undervalued.

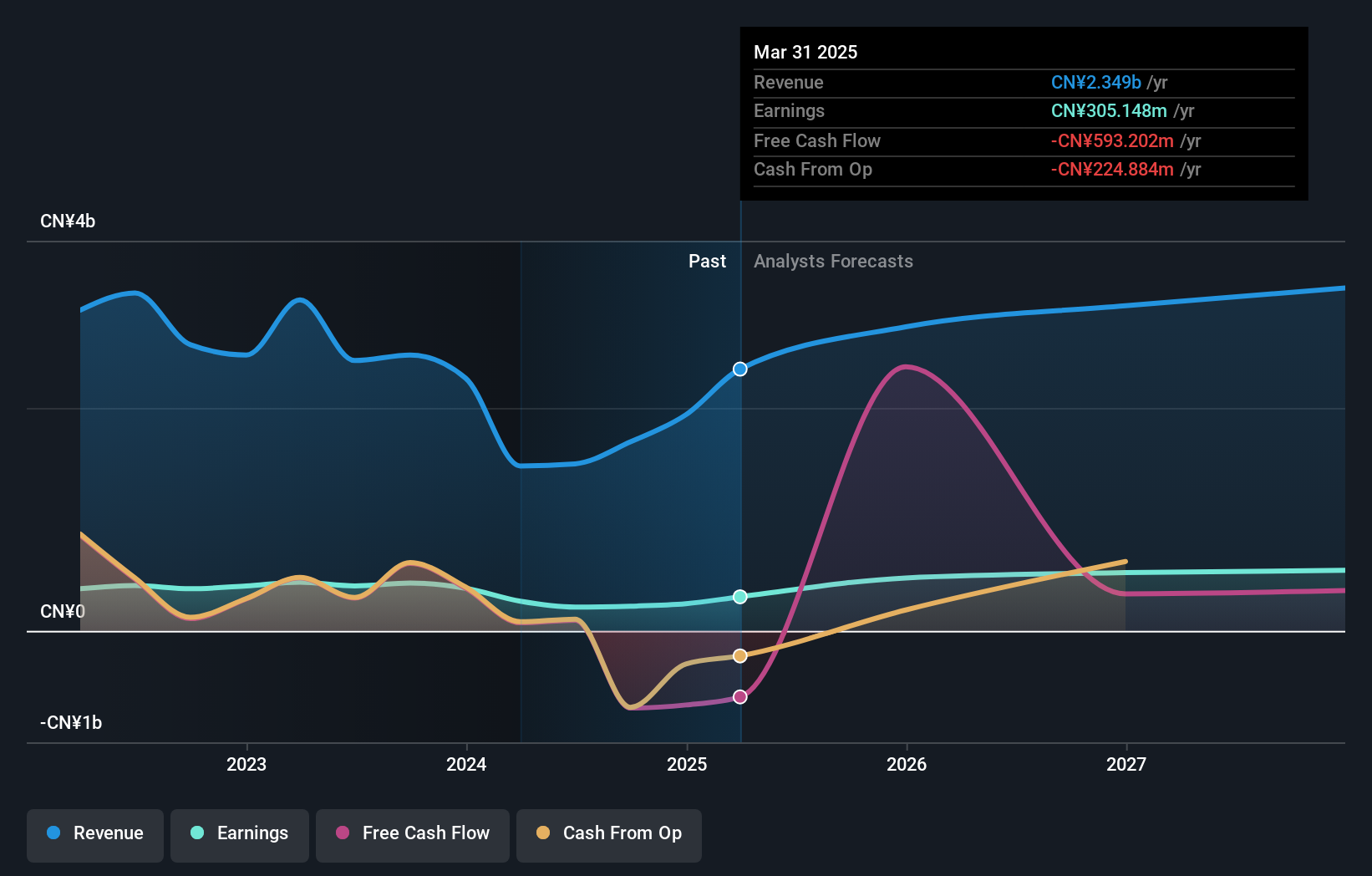

Zhejiang Huace Film & TV (SZSE:300133)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Huace Film & TV Co., Ltd. is involved in the production, distribution, and derivative of film and television dramas both in China and internationally, with a market cap of CN¥15.03 billion.

Operations: Zhejiang Huace Film & TV Co., Ltd. generates revenue through its activities in film and television drama production, distribution, and derivative products across domestic and international markets.

Insider Ownership: 17.4%

Revenue Growth Forecast: 20.8% p.a.

Zhejiang Huace Film & TV demonstrates robust growth prospects, with earnings projected to rise significantly over the next three years, outpacing the Chinese market. Recent M&A activity saw a 3.55% stake acquisition by multiple funds for approximately CNY 500 million, reflecting strong institutional interest. Despite high insider ownership changes, revenue and net income have shown steady increases year-over-year. However, its forecasted Return on Equity remains low at 7.2%, which could be a concern for some investors.

- Get an in-depth perspective on Zhejiang Huace Film & TV's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Zhejiang Huace Film & TV's share price might be on the expensive side.

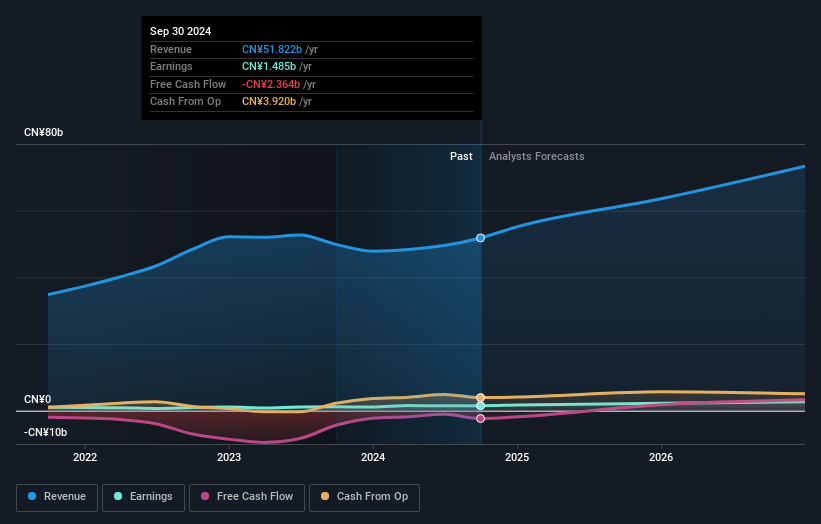

Sunwoda ElectronicLtd (SZSE:300207)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunwoda Electronic Co., Ltd, with a market cap of CN¥54.25 billion, is involved in the research, design, development, production, and sale of lithium-ion battery modules both in China and internationally.

Operations: Sunwoda Electronic Co., Ltd's revenue is primarily generated from its activities in the research, design, development, production, and sale of lithium-ion battery modules across domestic and international markets.

Insider Ownership: 28.2%

Revenue Growth Forecast: 19.3% p.a.

Sunwoda Electronic Ltd. shows promising growth potential, with earnings forecasted to grow at 33.6% annually, surpassing the Chinese market average. Recent financial results reveal a revenue increase to CNY 43.53 billion and net income of CNY 1.41 billion for the nine months ending September 2025, indicating strong performance despite volatile share prices and low forecasted Return on Equity at 11.3%. The stock trades significantly below estimated fair value, suggesting potential undervaluation opportunities for investors.

- Take a closer look at Sunwoda ElectronicLtd's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Sunwoda ElectronicLtd's share price might be too pessimistic.

Key Takeaways

- Get an in-depth perspective on all 633 Fast Growing Asian Companies With High Insider Ownership by using our screener here.

- Searching for a Fresh Perspective? Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com