3 European Dividend Stocks To Watch With Up To 6.3% Yield

As European markets navigate mixed performances, with Germany's DAX showing gains while France's CAC 40 and the UK's FTSE 100 face declines, investors are keenly observing potential shifts in monetary policy by the European Central Bank. In this context, dividend stocks can offer a measure of stability and income generation, making them appealing options for those looking to balance growth with reliable returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.23% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.61% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.50% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.10% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.80% | ★★★★★★ |

| Evolution (OM:EVO) | 4.85% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.13% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 9.73% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.51% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.36% | ★★★★★★ |

Click here to see the full list of 205 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

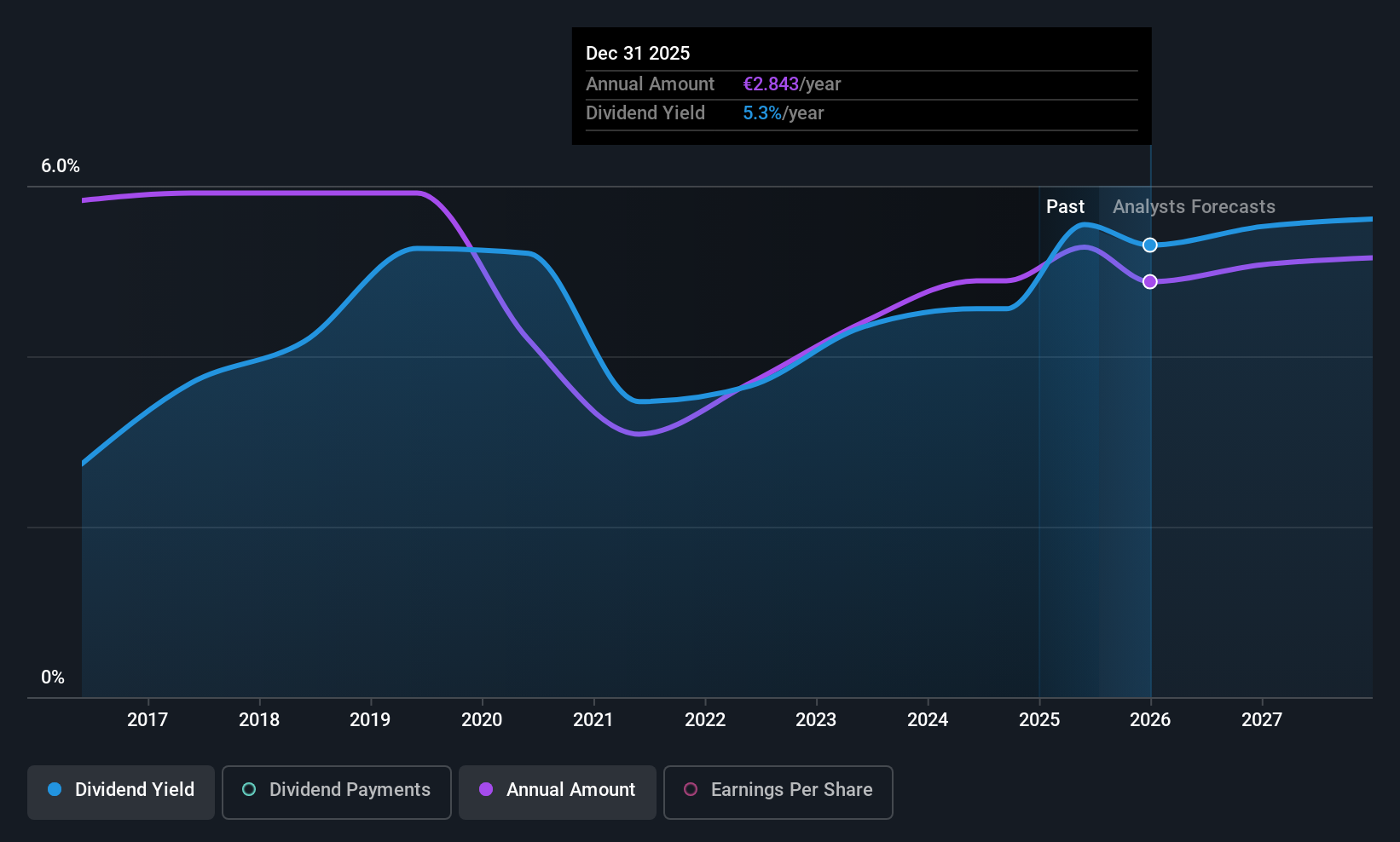

Société BIC (ENXTPA:BB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Société BIC SA is a global manufacturer and seller of stationery, lighters, shavers, and other products with a market capitalization of approximately €1.99 billion.

Operations: Société BIC's revenue is primarily derived from its segments: Human Expression (€768 million), Flame for Life (€762 million), and Blade Excellence (€574 million).

Dividend Yield: 6.4%

Société BIC offers a mixed picture for dividend investors. Despite its top-tier dividend yield in the French market, BIC's dividends have been volatile over the past decade, with an unstable track record. However, its dividends are covered by earnings and cash flows, indicating sustainability. Recent strategic moves include discontinuing underperforming operations and appointing a new CFO to drive financial growth. These changes could impact future dividend stability and company performance.

- Get an in-depth perspective on Société BIC's performance by reading our dividend report here.

- Our expertly prepared valuation report Société BIC implies its share price may be lower than expected.

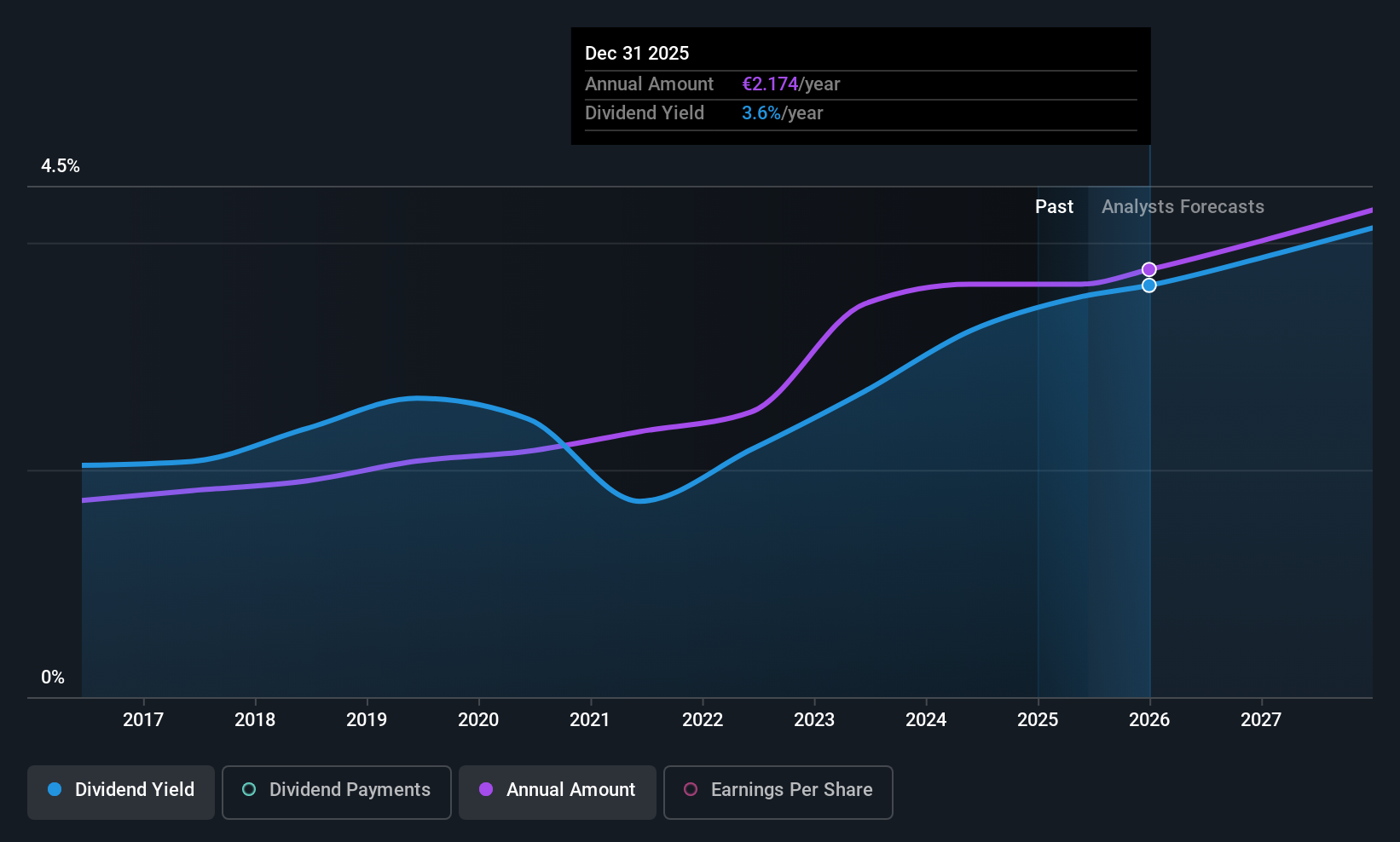

Brenntag (XTRA:BNR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brenntag SE is involved in the distribution of chemicals and ingredients across various countries including Germany, the United States, and China, with a market cap of €7.29 billion.

Operations: Brenntag SE's revenue is segmented as follows: Brenntag Essentials - North America (€4.87 billion), Europe, Middle East & Africa (EMEA) (€3.68 billion), Latin America (€944.40 million), Asia Pacific (APAC) (€914 million), and Transregional (€287.80 million); and Brenntag Specialties - Life Science (€3.30 billion), Material Science (€1.61 billion), and Specialties Other (€45.90 million).

Dividend Yield: 4.2%

Brenntag's dividend profile is supported by a sustainable payout ratio of 72.5% from earnings and 45.2% from cash flows, indicating strong coverage. Despite a dividend yield of 4.16%, slightly below the top tier in Germany, its dividends have been stable and reliable over the past decade. However, recent earnings showed a decline in both sales and net income compared to last year, highlighting potential challenges ahead for maintaining its financial position amidst high debt levels.

- Delve into the full analysis dividend report here for a deeper understanding of Brenntag.

- The analysis detailed in our Brenntag valuation report hints at an deflated share price compared to its estimated value.

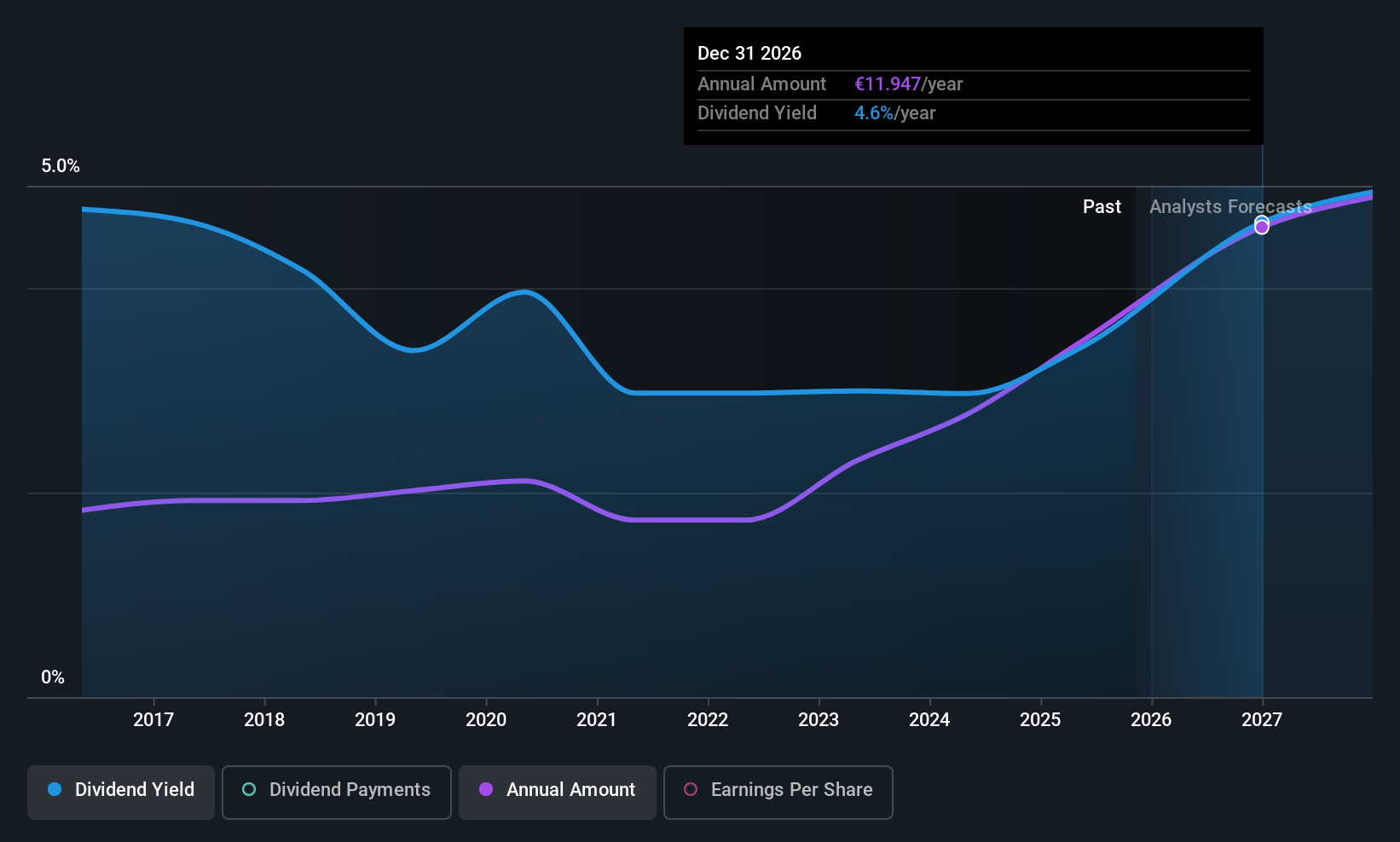

Hannover Rück (XTRA:HNR1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hannover Rück SE, with a market cap of €31.38 billion, offers reinsurance products and services across Germany, the UK, France, Europe, the US, Asia, Australia, Africa and globally through its subsidiaries.

Operations: Hannover Rück SE's revenue is primarily derived from Life and Health Reinsurance, which accounts for €7.94 billion, and Property & Casualty Reinsurance, contributing €19.24 billion.

Dividend Yield: 3.5%

Hannover Rück's dividend strategy is bolstered by a sustainable payout ratio of 34.2% from earnings and 20.5% from cash flows, ensuring robust coverage. The company recently increased its payout ratio to approximately 55%, reflecting strong capitalisation and commitment to long-term dividend growth. Despite a yield of 3.46%, below Germany's top tier, dividends have been stable and reliable over the past decade, with recent earnings guidance projecting continued profitability into 2026 at EUR 2.7 billion net income.

- Click here to discover the nuances of Hannover Rück with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Hannover Rück is trading behind its estimated value.

Summing It All Up

- Click through to start exploring the rest of the 202 Top European Dividend Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com