Cohen & Steers (CNS): Valuation Check as New Infrastructure and Short Duration Income ETFs Launch

Cohen & Steers (CNS) just rolled out two new actively managed ETFs, one targeting infrastructure opportunities and another short duration preferred income, extending its real assets franchise and giving investors fresh tools for yield and diversification.

See our latest analysis for Cohen & Steers.

The new ETF launches come at a time when Cohen & Steers’ share price has slipped, with a 90 day share price return of minus 11.09 percent and a year to date share price return of minus 31.55 percent. However, its three year total shareholder return of 7.38 percent suggests the longer term story is less bleak than the recent sell off implies.

If this expansion into new income strategies has caught your attention, it could be a good moment to explore other ideas in financials and beyond through fast growing stocks with high insider ownership.

With the share price sharply lower, yet earnings and revenue still growing, investors face a key question: is Cohen & Steers now trading below its true value, or is the market already discounting any future growth?

Most Popular Narrative Narrative: 12.7% Undervalued

With Cohen & Steers last closing at 62.54 dollars against a narrative fair value of 71.67 dollars, the valuation gap hinges on ambitious profit expansion.

Analysts are assuming Cohen & Steers's revenue will grow by 9.0% annually over the next 3 years.

Analysts assume that profit margins will increase from 29.8% today to 45.2% in 3 years time.

Want to see how steady revenue growth, sharply higher margins, and a lower future earnings multiple still add up to a richer valuation story? Dive in.

Result: Fair Value of $71.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering client outflows and rising expenses from global expansion and new products could pressure margins and undermine the bullish valuation narrative.

Find out about the key risks to this Cohen & Steers narrative.

Another Lens on Value

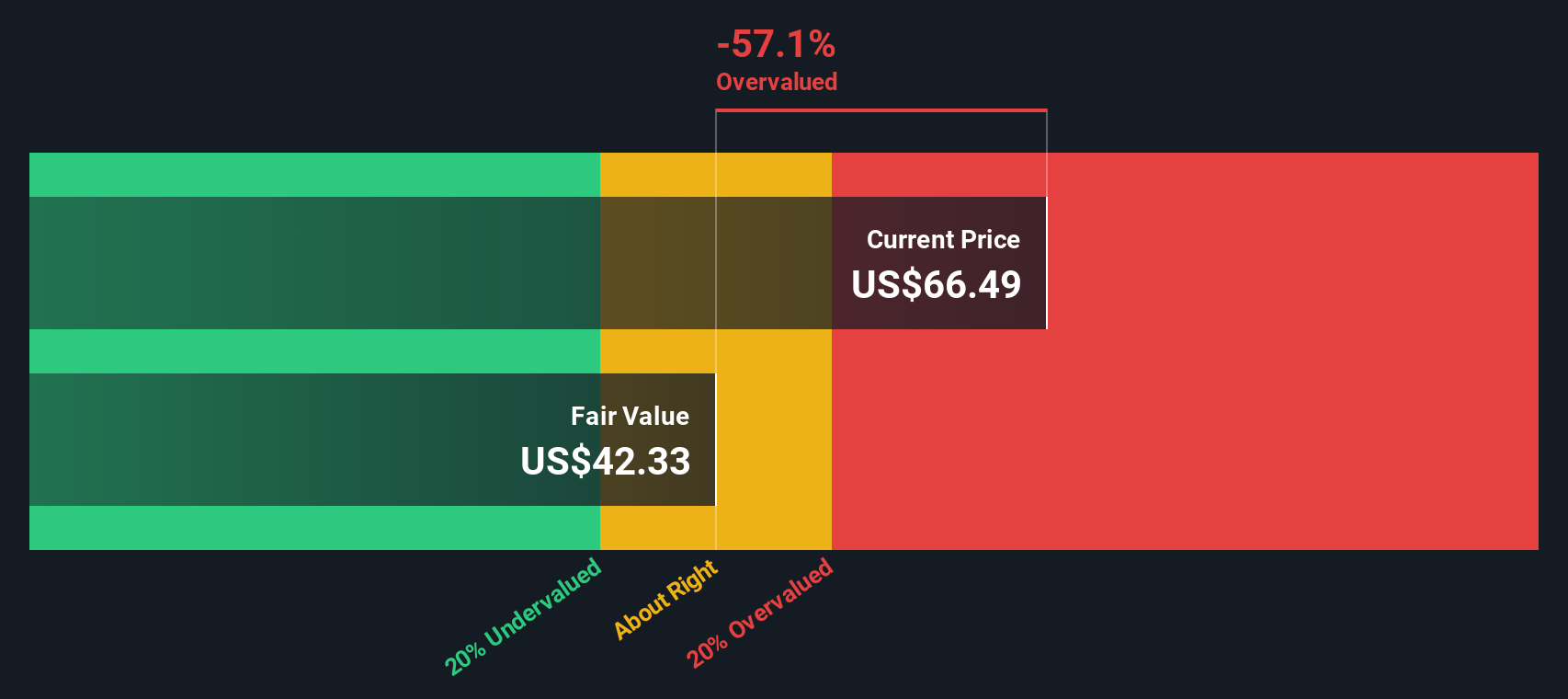

Our DCF model tells a different story, pointing to a fair value of about 42.55 dollars per share, meaning Cohen & Steers looks overvalued at current prices, not undervalued. If the cash flow math is right, the recent weakness could be the beginning of a longer trend.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cohen & Steers for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cohen & Steers Narrative

If you see the opportunity differently or prefer to dig into the numbers yourself, you can craft a custom view in minutes with Do it your way.

A great starting point for your Cohen & Steers research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready to uncover more compelling opportunities?

Before the market moves on without you, put Simply Wall St’s Screener to work and line up your next wave of high conviction investment ideas today.

- Capture powerful income potential by targeting companies in these 13 dividend stocks with yields > 3% that offer attractive yields backed by solid underlying businesses.

- Position yourself ahead of disruptive innovation by focusing on these 26 AI penny stocks at the center of intelligent software, automation, and data driven platforms.

- Strengthen your portfolio’s value core with these 908 undervalued stocks based on cash flows that trade below their estimated cash flow potential yet still show resilient fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com