Global Growth Stocks With Significant Insider Ownership

As global markets navigate a complex landscape marked by interest rate adjustments and economic uncertainties, investors are increasingly attentive to the performance of various indices. Amidst these shifts, growth companies with high insider ownership have garnered attention for their potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| CD Projekt (WSE:CDR) | 29.7% | 51.8% |

Here's a peek at a few of the choices from the screener.

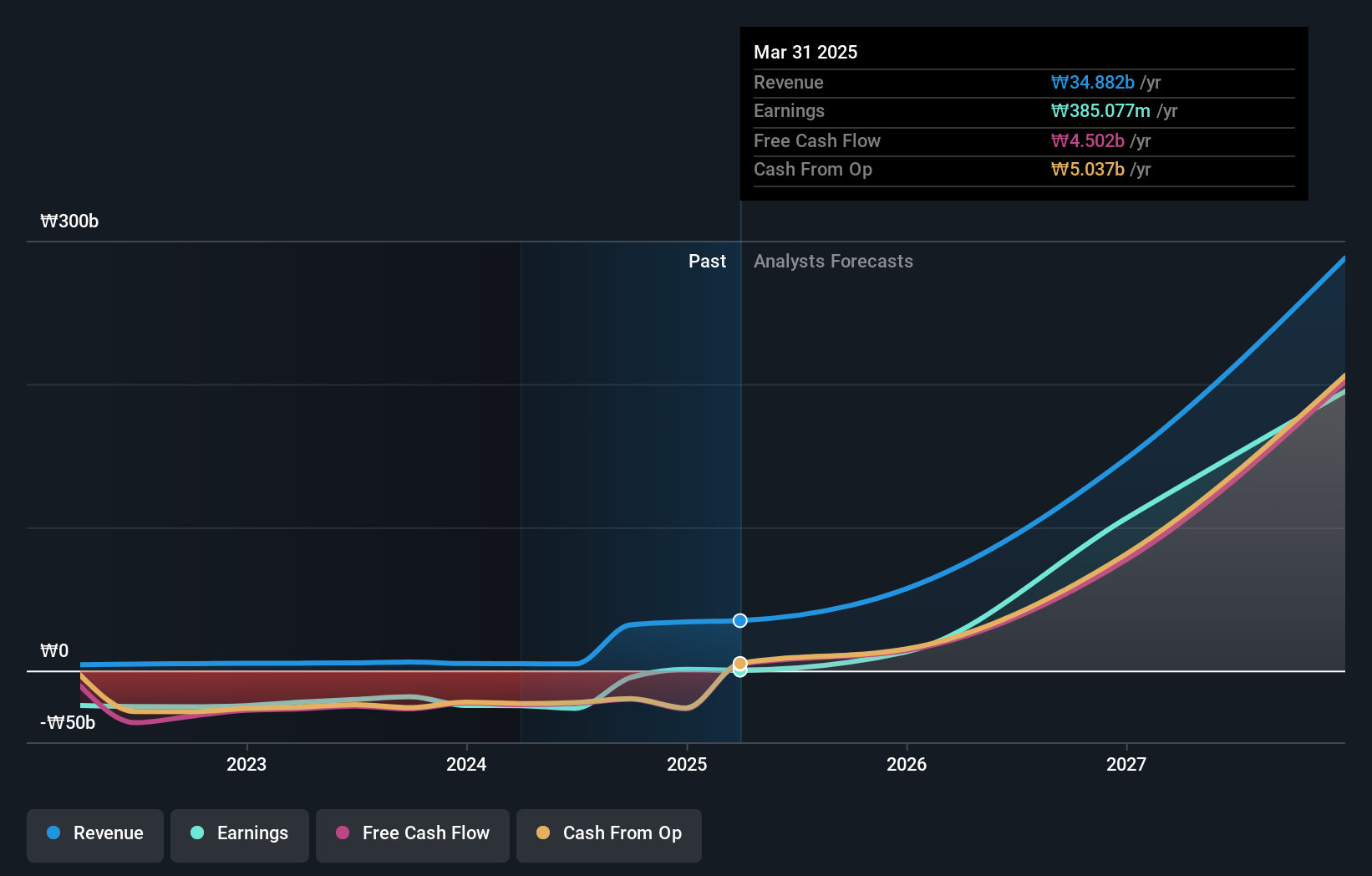

Oscotec (KOSDAQ:A039200)

Simply Wall St Growth Rating: ★★★★★★

Overview: Oscotec Inc. is a biotechnology company involved in drug development, functional materials, and dental bone graft materials, with a market cap of approximately ₩2.30 trillion.

Operations: The company's revenue is primarily derived from its New Drug Business Division at ₩19.91 billion, Medical Business Sector at ₩1.84 billion, Functional Materials at ₩407.81 million, and Food Business at ₩1.08 billion.

Insider Ownership: 12.7%

Oscotec is expected to experience significant growth, with revenue forecasted to grow 84.5% annually, surpassing the Korean market average of 10.6%. Despite a volatile share price and recent financial losses (net loss of KRW 489.33 million for Q3), the company is projected to become profitable over the next three years with a high return on equity anticipated at 51.6%. Recent discussions focused on R&D progress and management outlooks highlight ongoing strategic efforts.

- Take a closer look at Oscotec's potential here in our earnings growth report.

- Our valuation report here indicates Oscotec may be overvalued.

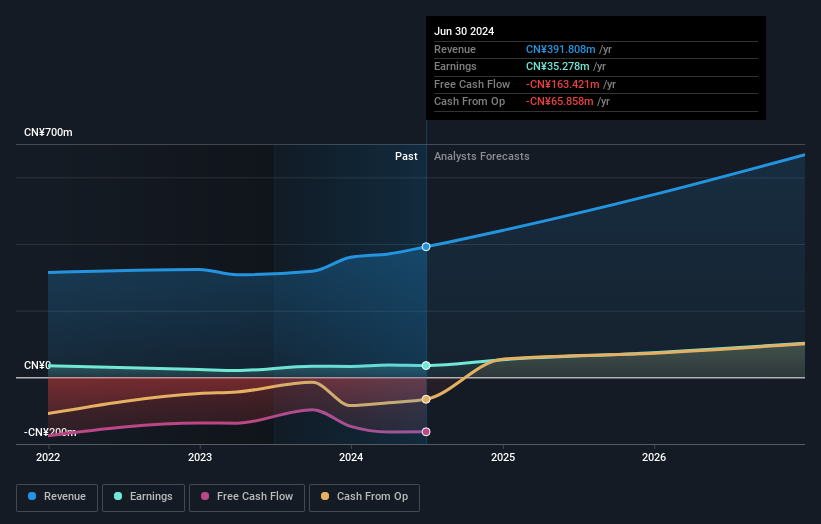

Jiangsu Aisen Semiconductor MaterialLtd (SHSE:688720)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Aisen Semiconductor Material Co., Ltd. (SHSE:688720) operates in the semiconductor materials industry and has a market capitalization of CN¥4.87 billion.

Operations: I'm sorry, but the provided Business operations text does not include any specific revenue segment information for Jiangsu Aisen Semiconductor Material Co., Ltd.

Insider Ownership: 33.2%

Jiangsu Aisen Semiconductor Material Ltd. is poised for substantial growth, with revenue expected to increase by 24% annually, outpacing the Chinese market's 14.6%. Earnings are forecasted to grow significantly at 41.18% per year, exceeding market averages. Despite a volatile share price recently, the company reported strong earnings for the first nine months of 2025 with net income rising from CNY 23.83 million to CNY 34.48 million year-over-year and completed a share buyback plan worth CNY 50.21 million.

- Click to explore a detailed breakdown of our findings in Jiangsu Aisen Semiconductor MaterialLtd's earnings growth report.

- According our valuation report, there's an indication that Jiangsu Aisen Semiconductor MaterialLtd's share price might be on the expensive side.

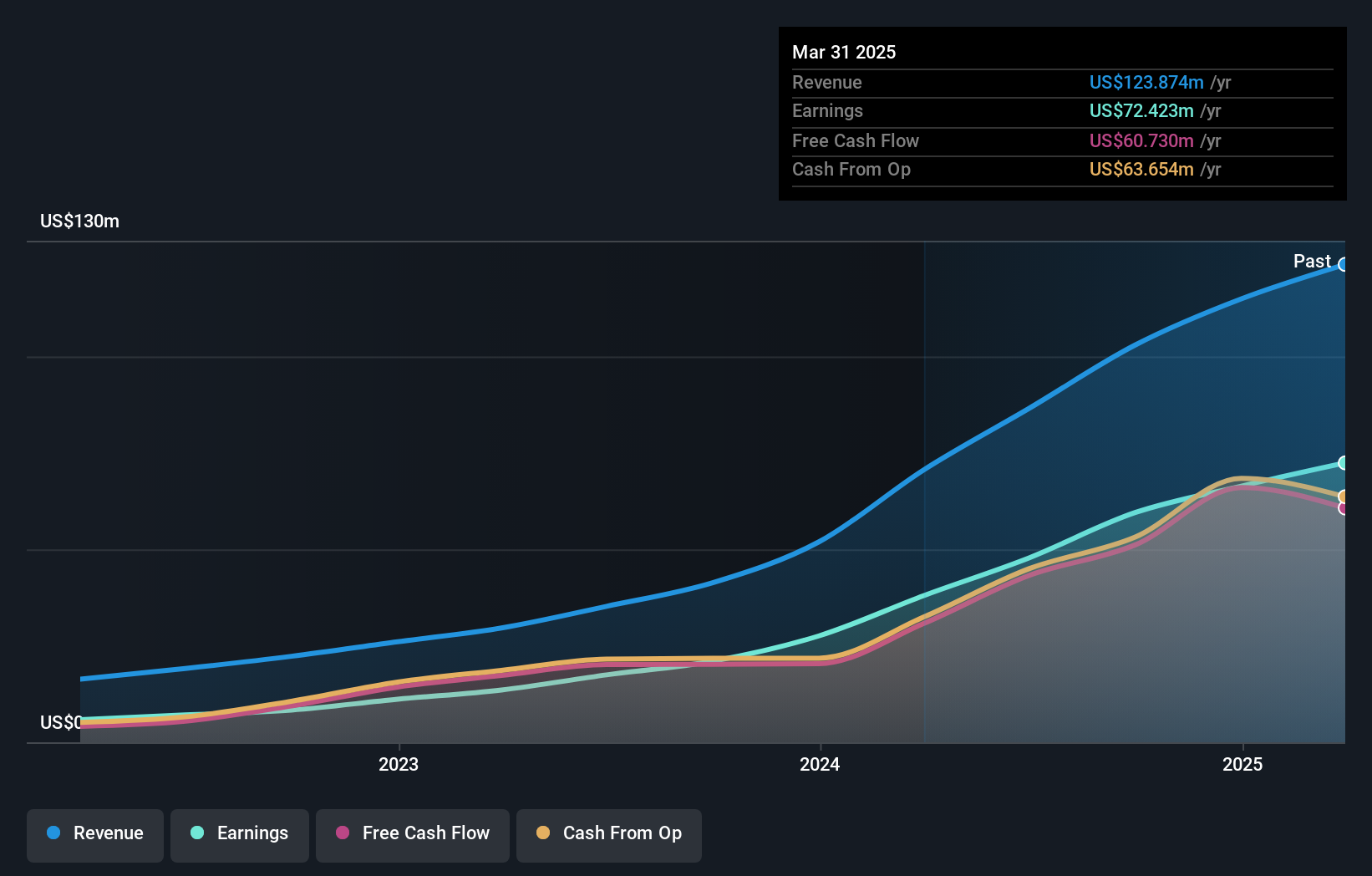

NextVision Stabilized Systems (TASE:NXSN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: NextVision Stabilized Systems, Ltd. develops, manufactures, and markets stabilized day and night photography solutions for ground and aerial vehicles in Israel and internationally, with a market cap of ₪13.79 billion.

Operations: NextVision Stabilized Systems generates its revenue primarily from the Electronic Security Devices segment, which reported $151.04 million.

Insider Ownership: 22.1%

NextVision Stabilized Systems is experiencing robust growth, with revenue projected to rise by 24.6% annually, surpassing the Israeli market average. Earnings are also expected to grow significantly at 26.9% per year. Recent earnings reports show strong performance, with third-quarter sales increasing from US$29.15 million to US$47.29 million and net income rising from US$18.02 million to US$28.17 million year-over-year. The company was added to the TA-35 Index and completed a follow-on equity offering worth ILS 1.39 billion.

- Unlock comprehensive insights into our analysis of NextVision Stabilized Systems stock in this growth report.

- Our comprehensive valuation report raises the possibility that NextVision Stabilized Systems is priced higher than what may be justified by its financials.

Taking Advantage

- Take a closer look at our Fast Growing Global Companies With High Insider Ownership list of 857 companies by clicking here.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com