PeptiDream (TSE:4587) Valuation Reassessed After 2025 Guidance Cut and Delayed Partnership Milestones

PeptiDream (TSE:4587) just shocked the market by slashing its 2025 guidance, shifting from an expected profit to a projected loss as key partnering milestones slip into 2026.

See our latest analysis for PeptiDream.

The lowered guidance has arrived after a choppy year, with a recent 7 day share price return of 7.5 percent offering only a brief rebound against a deeply negative year to date share price return and a weak 1 year total shareholder return, suggesting momentum is still fragile.

If this reset has you reassessing your biotech exposure, it could be a good moment to explore other healthcare stocks that pair drug development potential with more balanced risk profiles.

With shares still down sharply over one and five years, but trading at a sizable discount to analyst targets, the real question now is whether PeptiDream is a bargain on delayed milestones or if the market already anticipates its next leg of growth.

Most Popular Narrative: 46.9% Undervalued

With PeptiDream last closing at ¥1,737.5 against a narrative fair value near double that level, the valuation hinges on aggressive profitability and growth assumptions.

Analysts expect earnings to reach ¥16.1 billion (and earnings per share of ¥123.96) by about September 2028, up from ¥-5.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥21.7 billion in earnings, and the most bearish expecting ¥5.7 billion.

Curious how a loss making biotech ends up with a near double upside case? The secret mix, hypercharged revenue growth, surging margins, and a future multiple that rivals market darlings. Want to see exactly how those moving parts stack up to justify this punchy fair value? Dive in to unpack the full playbook behind the projection.

Result: Fair Value of ¥3,271.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering governance concerns and ongoing operating losses could derail partnership momentum and delay the transition from milestone-driven income to sustainable profitability.

Find out about the key risks to this PeptiDream narrative.

Another Angle on Valuation

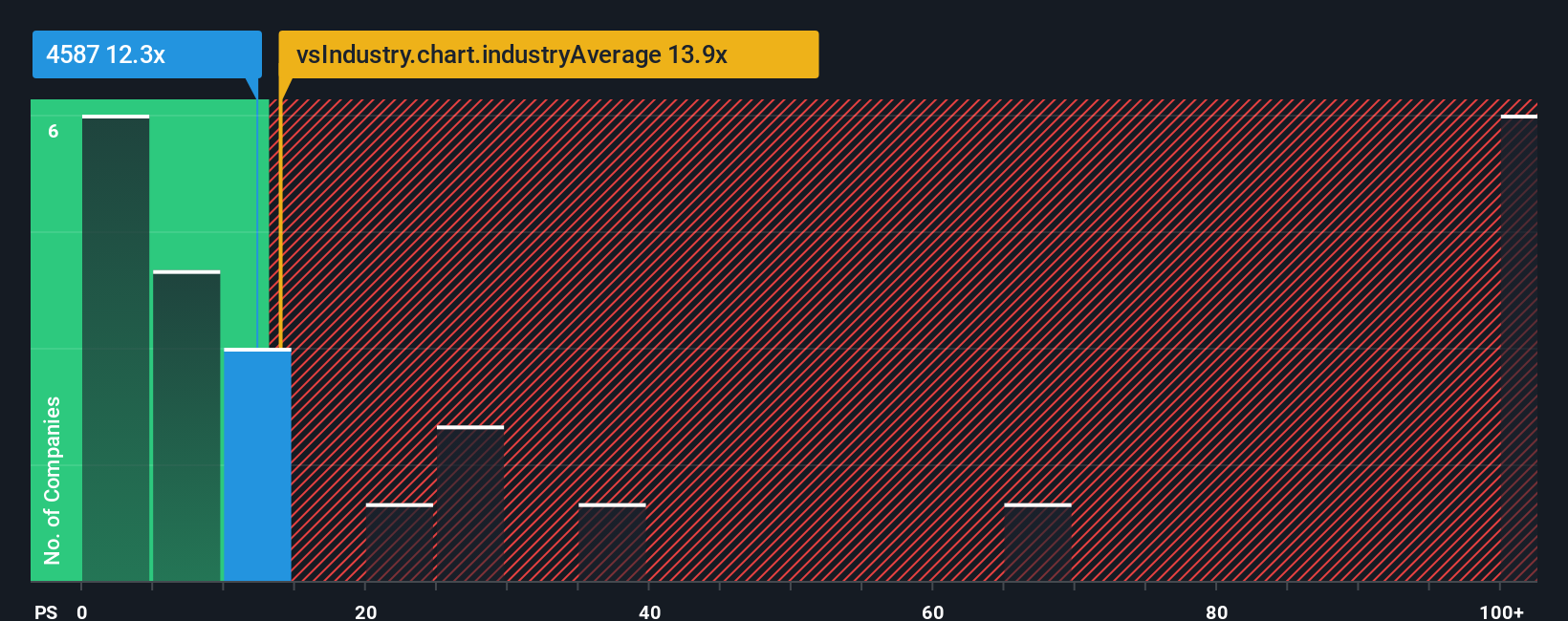

On ratios, the story is less generous. PeptiDream trades on a 12.5x price to sales versus an industry 14.6x but far above peer average at 8.6x and a fair ratio of just 2.8x, raising the question: is the discount really upside or simply less downside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PeptiDream Narrative

If you see the story unfolding differently or want to stress test the numbers yourself, you can build a fresh narrative in just a few minutes: Do it your way.

A great starting point for your PeptiDream research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investment move?

Before you decide what to do with PeptiDream, lock in a broader watchlist by using targeted screeners that surface high conviction ideas you might otherwise miss.

- Capture early stage upside by scanning these 3613 penny stocks with strong financials that pair speculative potential with healthier fundamentals than the usual small cap crowd.

- Ride structural growth by targeting these 13 dividend stocks with yields > 3% that can stack reliable income on top of your long term capital gains ambitions.

- Position ahead of the next adoption wave by filtering for these 80 cryptocurrency and blockchain stocks where real businesses are building durable models around blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com