3 High Growth Tech Stocks To Watch In The US Market

As the U.S. market grapples with fluctuating indices and AI bubble concerns, the Dow Jones Industrial Average recently hit an all-time high before retreating, while tech-heavy stocks like those in the Nasdaq face pressure amid broader economic uncertainties. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience and adaptability to market shifts, particularly those that can navigate technological advancements and investor sentiment effectively.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.12% | 23.48% | ★★★★★☆ |

| Marker Therapeutics | 75.24% | 59.07% | ★★★★★★ |

| Palantir Technologies | 27.16% | 29.97% | ★★★★★★ |

| Workday | 11.17% | 32.18% | ★★★★★☆ |

| Circle Internet Group | 23.14% | 84.30% | ★★★★★☆ |

| Atlassian | 14.86% | 53.82% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Zscaler | 15.85% | 46.09% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

| Procore Technologies | 11.76% | 116.48% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Annexon (ANNX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Annexon, Inc. is a clinical-stage biopharmaceutical company focused on discovering and developing medicines for inflammatory-related diseases, with a market cap of $740.81 million.

Operations: Annexon, Inc. specializes in the discovery and development of treatments for inflammatory-related diseases without current revenue streams, as it remains in the clinical-stage phase.

Annexon, despite its current unprofitability, is navigating through a transformative phase with significant capital influx and strategic R&D investments aimed at reversing its financial trajectory. Recently raising nearly $75 million through equity offerings, the company is bolstering its war chest to fuel research endeavors and potential market expansions. This strategic move aligns with their impressive projected annual revenue growth rate of 75.1%, starkly outpacing the broader U.S. market's growth expectation of 10.6%. Furthermore, Annexon's commitment to innovation is evident as they anticipate transitioning from losses to profitability within the next three years—a testament to their potential in harnessing cutting-edge technologies for substantial growth amidst a highly competitive sector.

Savara (SVRA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Savara Inc. is a clinical-stage biopharmaceutical company concentrating on rare respiratory diseases, with a market cap of $1.67 billion.

Operations: Savara Inc. is engaged in developing therapies for rare respiratory diseases, with no reported revenue streams currently available. The company operates as a clinical-stage entity, focusing on advancing its pipeline rather than generating immediate sales revenue.

Savara, amid a flurry of activity including recent patent approvals and conference presentations, exemplifies resilience in the high-growth tech sector. The company's strategic R&D investments are evident with its latest innovations in treatments for rare lung diseases, notably MOLBREEVI which has received multiple designations from health authorities globally. Despite a challenging financial performance with a net loss widening to $86.6 million over nine months, Savara's commitment to advancing healthcare through technology is underscored by an aggressive conference presence and significant equity offerings totaling approximately $130 million. This approach not only fuels their research but also positions them favorably within the biotech landscape for potential future growth as they navigate towards profitability.

- Delve into the full analysis health report here for a deeper understanding of Savara.

Review our historical performance report to gain insights into Savara's's past performance.

MNTN (MNTN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MNTN, Inc. operates a technology platform focused on performance marketing for Connected TV and has a market cap of $929.94 million.

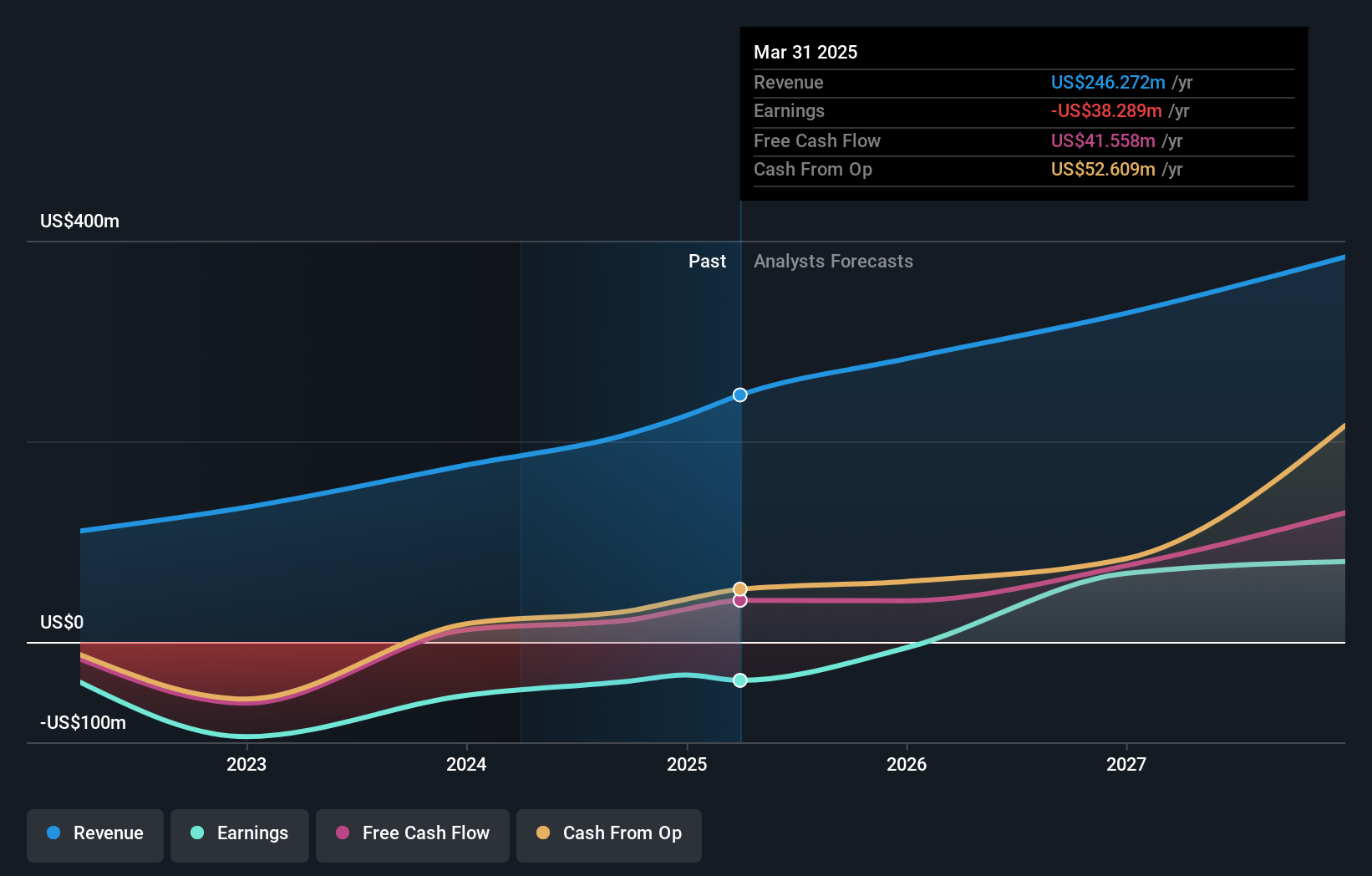

Operations: The company generates revenue primarily through its Internet Software & Services segment, totaling $272.81 million.

MNTN, Inc. is demonstrating robust growth in the tech sector, particularly through strategic integrations and innovations like its recent partnership with Northbeam. This collaboration enhances MNTN's Performance TV campaigns by integrating them with Northbeam's marketing measurement platform, which during its beta period showed a 1.8x marketing efficiency ratio and 90% new site visits, indicating strong performance metrics that could drive future growth. Additionally, MNTN's introduction of QuickFrame AI—an all-in-one video-production platform—underscores its commitment to leveraging cutting-edge technology to streamline content creation and distribution across various media channels, setting a new standard in advertising efficiency and effectiveness. With these advancements, MNTN is not only capitalizing on current trends but also positioning itself for sustained influence in the evolving landscape of Connected TV and digital advertising.

- Take a closer look at MNTN's potential here in our health report.

Explore historical data to track MNTN's performance over time in our Past section.

Summing It All Up

- Click through to start exploring the rest of the 72 US High Growth Tech and AI Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com