US stock outlook | The three major stock index futures rose sharply, and CPI hit together this week, iRobot (IRBT.US) plummeted before the market

Pre-market market trends

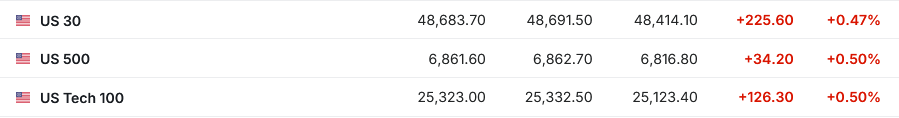

1. On December 15 (Monday), the futures of the three major US stock indexes rose sharply before the US stock market. As of press release, Dow futures were up 0.47%, S&P 500 futures were up 0.50%, and NASDAQ futures were up 0.50%.

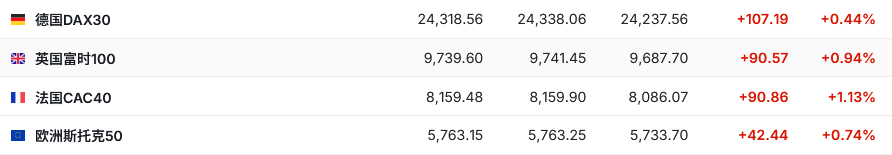

2. As of press release, the German DAX index rose 0.44%, the British FTSE 100 index rose 0.94%, the French CAC40 index rose 1.13%, and the European Stoxx 50 index rose 0.74%.

3. As of press release, WTI crude oil fell 0.42% to $57.00 per barrel. Brent crude fell 0.41% to $60.87 per barrel.

Market news

The candidate for the Federal Reserve chairman stirs up the bond market. The non-farm payrolls report and inflation data are coming this week. After the Federal Reserve cut interest rates by another 25 basis points last week, the market's focus may shift to a change in the candidate to succeed Powell as the next chairman of the Federal Reserve. US President Trump believes either Kevin Hassett or Kevin Walsh will be appointed. The bond market is also feeling the possibility of a dovish Federal Reserve more closely allied with the White House. This week's economic schedule will also continue to absorb the backlog of delayed data due to the government shutdown. Among them, the November employment report is scheduled to be released on Tuesday, and the November CPI data will be released on Thursday. In terms of financial reports, Micron Technology will announce quarterly results on Wednesday, while investors will welcome performance reports from Accenture, Nike, FedEx and Darden Restaurants (DRI.US) on Thursday. Furthermore, the United Kingdom, the European Central Bank, and the Bank of Japan will successively announce interest rate decisions this week.

The data storm is here! The bond market debated the script for the Federal Reserve's 2026 interest rate cut. The heated debate in the US bond market over the extent of the Fed's future interest rate cuts is entering a heated phase with the imminent release of a series of key economic data. This week's data will largely fill the information gap caused by the US government shutdown. Monthly employment and inflation data, which was previously delayed, will soon be released, and more key employment data will be released in early January next year. These reports will help answer the core question facing the market in 2026: after cutting interest rates three times in a row, is the Fed's easing cycle nearing its end, or whether more aggressive action is needed. This is a big deal for bond traders. Although inflation remains high, traders are still betting that the Federal Reserve will cut interest rates twice next year to support the job market and economic growth prospects. This expectation is one more time than the number of interest rate cuts currently implied by the Federal Reserve — if the market's judgment is correct, it will pave the way for a new round of steady growth in US bonds, which this year is heading towards the best performing year since 2020.

Bank of America: Bull and bear indicators are close to triggering a “sell” signal, and capital rotation indicates that the economy is expected to “run hot” in 2026. Bank of America securities strategist Michael Harnett's latest capital flow report said that the revised inverse indicator, the Bank of America Bull and Bear Index, has risen to 7.8, bringing market positions “close to an extremely bullish” region. The indicator previously hit 8.9 in early October, a level that historically usually correlates with tactical market tops. Furthermore, the widespread rotation of capital in the US market towards the small-cap sector, the return of capital inflows from risk assets, and a jump in investor confidence indicators indicate that investors have a kind of “hot operation” expectations for the 2026 economic outlook.

Hassett responds to “special intervention”: the independence of the Federal Reserve is the bottom line, and policy decisions will be based on data. White House National Economic Commission Chairman Kevin Hassett said that if appointed to lead the Federal Reserve, he will consider Trump's policy opinions, but the central bank's interest rate decisions will remain independent. Hassett said that the president “has a very firm and well-founded opinion on the actions we should take”, “but in the end, the Federal Reserve's responsibility is to maintain independence and cooperate with members of the Federal Reserve Council and the Federal Open Market Committee to reach a collective consensus on what level interest rates should be at.”

The price of copper is soaring to close to 12,000 US dollars! AI data centers have sparked a battle for “red metal”, and the supply chain has sounded the alarm. Copper prices are approaching the $12,000 per ton mark due to a combination of surging demand for data centers required for artificial intelligence and tight supply, combined with shortages outside the US. With mining disruptions and US hoarding, copper prices have risen 35% so far this year, and are moving towards their biggest increase since 2009. “The bullish sentiment is being driven by a supply tight narrative and supported by macro news flows,” Macquarie analysts said.

Individual stock news

Under increased competition and heavy tariff pressure, there is no way to save oneself! iRobot (IRBT.US), the original robot vacuum cleaner, filed for bankruptcy and plummeted before the market. iRobot, the manufacturer of Roomba robot vacuum cleaners, filed a Chapter 11 bankruptcy protection application in the US Delaware court last Sunday and said it would privatize it after being acquired by its main manufacturer Picea Robotics. iRobot anticipates that if the court finally approves the Chapter 11 bankruptcy and restructuring plan, existing common shareholders will not be able to obtain any shares in the company after the restructuring. All issued and distributed shares of the company will be cancelled, and common shareholders will face full losses on their investments and will not be able to receive any payment. As of press release, iRobot's US stocks plummeted by nearly 78% before the market on Monday.

Over 5 billion Starlink chips are expected to be delivered in the next two years! Commercial aerospace or IC semiconductors (STM.US) are growing new engines. An ST executive revealed to the media that since the two sides began working together around 2015, the company has delivered more than 5 billion RF antenna chips to Elon Musk's SpaceX for the Starlink (Starlink) satellite network. According to the partnership between the two parties, this number could double by 2027, which means ST could deliver 5 billion chips within the next two years, which is comparable to the number delivered in the past decade. Currently, the aerospace industry is shifting from government-led projects to a rapidly growing commercial market. This boom is generating demand for professional chips that can handle high data rates and survive in the harsh environment of space.

The FDA deferred superposition trial failed, and the Sanofi (SNY.US) multiple sclerosis drug was doubly attacked. The French pharmaceutical company said the US Food and Drug Administration (FDA) approval decision for its drug tolebrutinib to treat advanced multiple sclerosis may be delayed, and regulators will provide further guidance at the end of the first quarter. To make matters worse, Sanofi said that in a late-stage trial for primary progressive multiple sclerosis, tolebrutinib failed to delay the progression of patients' disability. Analysts say this double blow could threaten the drug's annual sales peak of up to $1.7 billion. As of press release, Sanofi's US stocks fell nearly 2% before the market on Monday.

Star drugs have suffered a severe setback! Argenx (ARGX.US) terminates thyroid eye disease drug trials. Belgian biotech company Argenx SE said the drug Efgartigimod (brand name Vyvgart), which is being evaluated in adult patients with moderate to severe thyroid eye disease, will stop testing based on the recommendations of an independent data monitoring committee. The end of this trial impacted the company's goal of treating 50,000 patients by 2030. Argenx expects to announce the results of four other late-stage clinical trials for various autoimmune diseases next year, three of which involve Vyvgart. The company's stock price once fell 9.7% in the Brussels stock market, the biggest drop since May 8. As of press release, Argenx's US stocks fell more than 5% before the market on Monday.

Rocket Lab (RKLB.US) has carried out its first exclusive launch mission for JAXA. Rocket Lab announced that it has carried out its first exclusive launch mission for the Japan Aerospace Exploration Agency (JAXA). This marks a milestone in the role of its Electron rocket in providing reliable access to space services around the world, and also reflects the increasing integration of commercial space companies into domestic and foreign national space programs. The company also plans to carry out an exclusive Electron rocket launch mission for the European Space Agency (ESA) in the new year, further highlighting the international demand for “Electron rockets. As of press release, Rocket Lab's US stock rose more than 2% before the market on Monday.

Key economic data and event forecasts

At 21:30 Beijing time, the US New York Federal Reserve Manufacturing Index for December

At 22:30 Beijing time, Federal Reserve Governor Milan delivered a speech

At 23:30 Beijing time, FOMC Permanent Voting Committee and New York Federal Reserve Chairman Williams delivered speeches on economic prospects